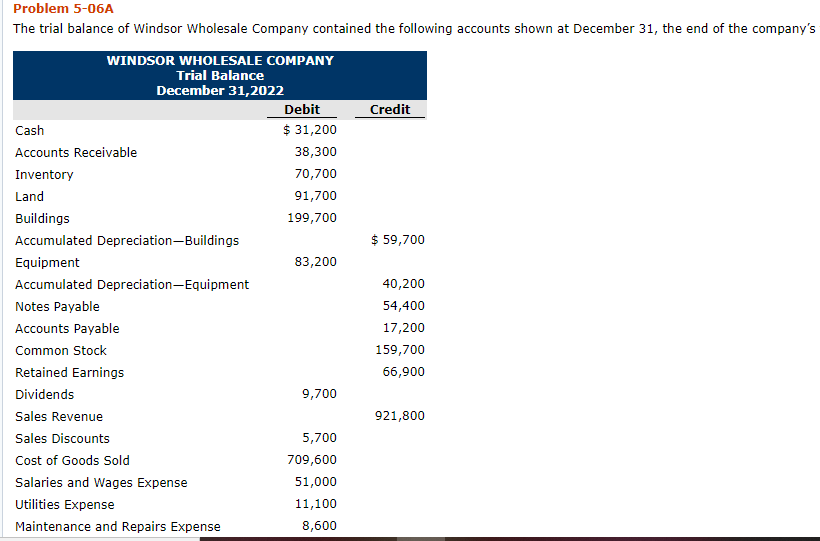

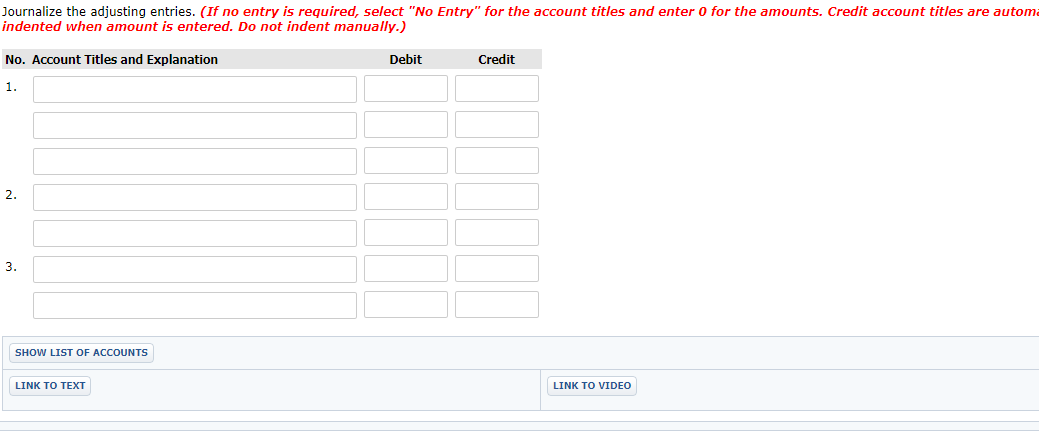

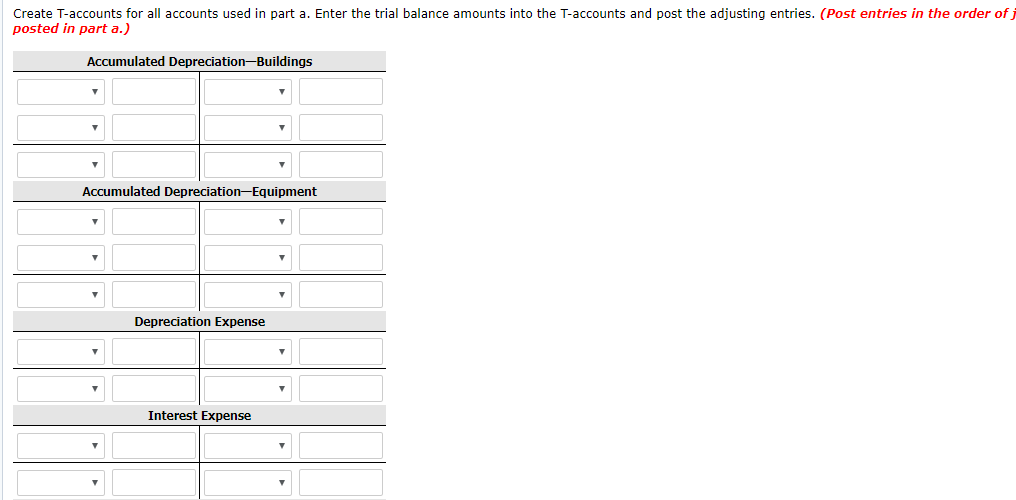

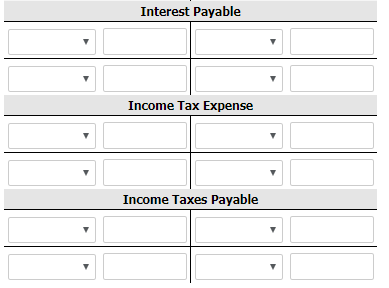

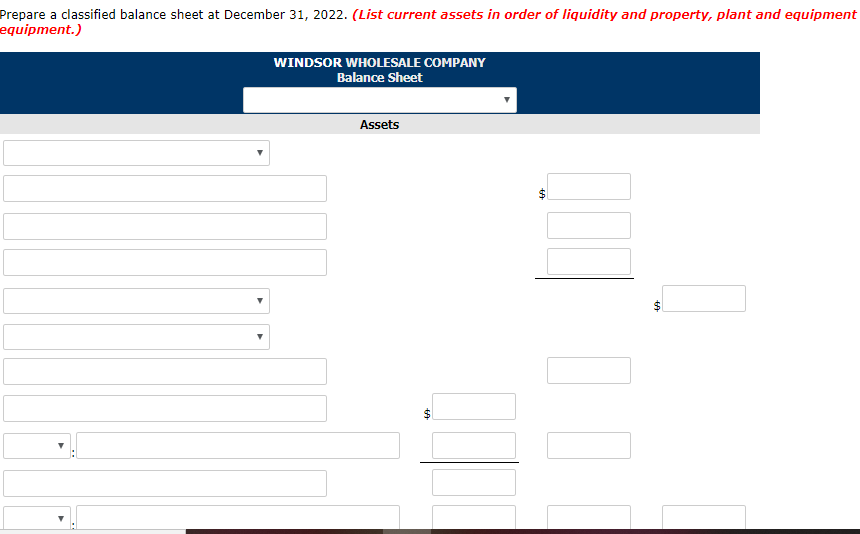

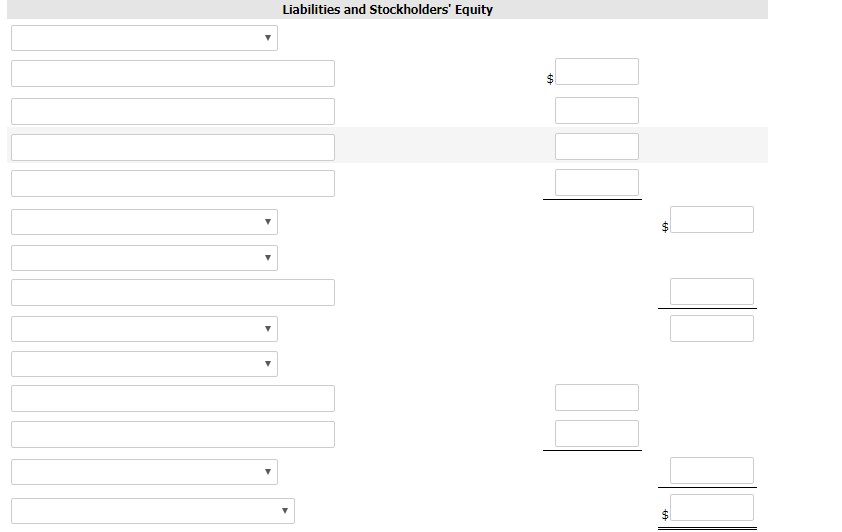

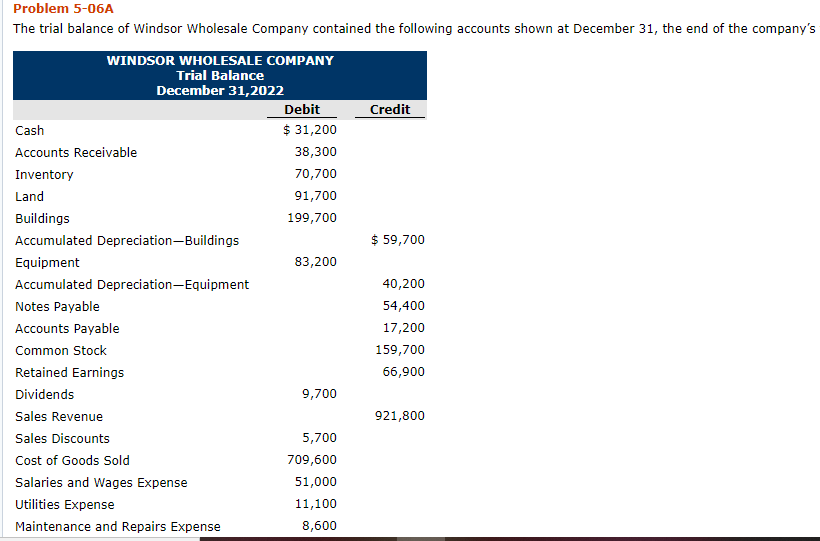

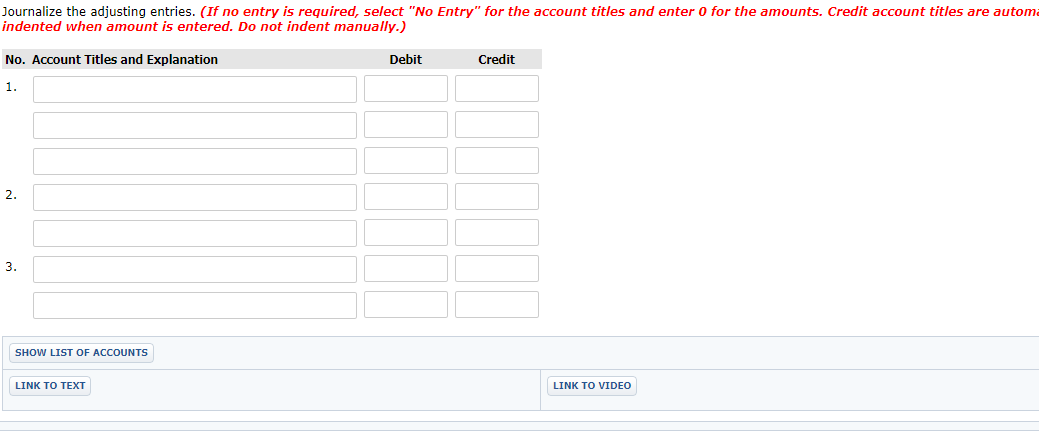

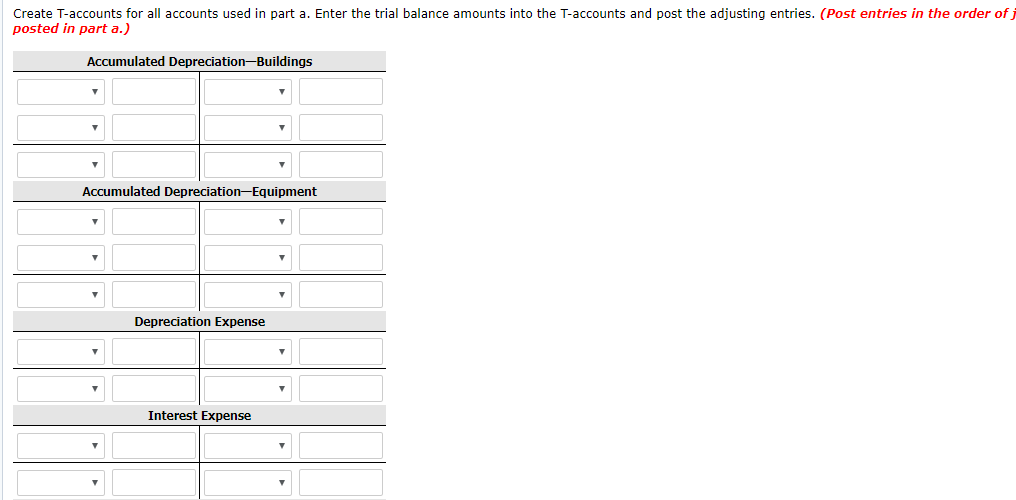

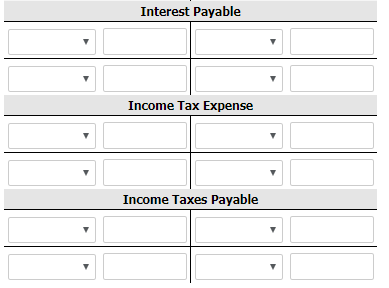

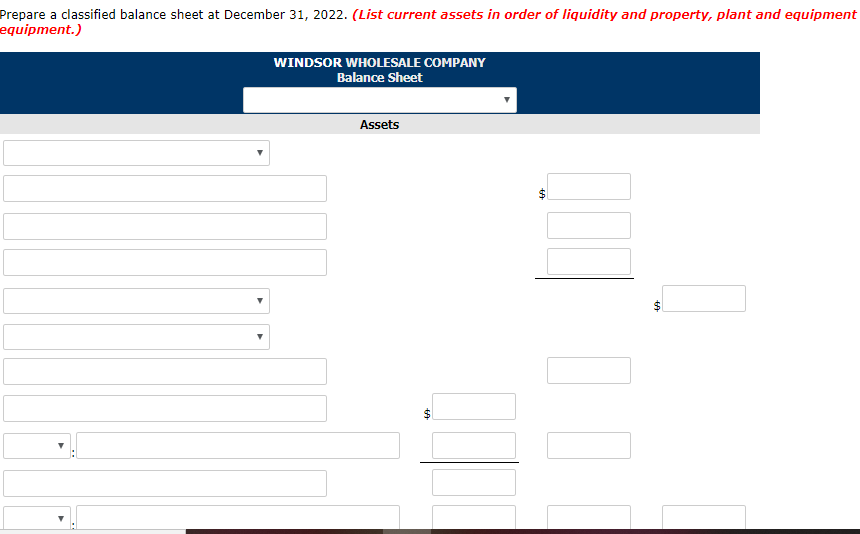

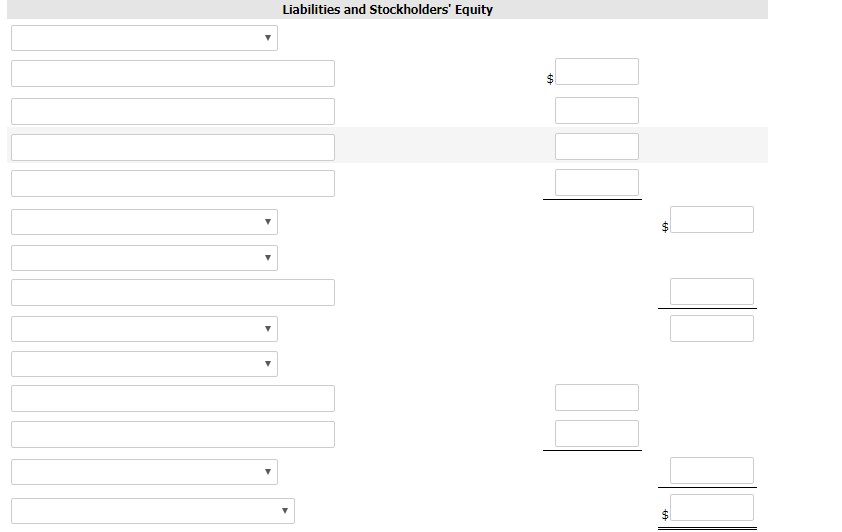

Problem 5-06A The trial balance of Windsor Wholesale Company contained the following accounts shown at December 31, the end of the company's Credit $ 59,700 WINDSOR WHOLESALE COMPANY Trial Balance December 31,2022 Debit Cash $ 31,200 Accounts Receivable 38,300 Inventory 70,700 Land 91,700 Buildings 199,700 Accumulated Depreciation-Buildings Equipment 83,200 Accumulated Depreciation-Equipment Notes Payable Accounts Payable Common Stock Retained Earnings Dividends 9,700 Sales Revenue Sales Discounts 5,700 Cost of Goods Sold 709,600 Salaries and Wages Expense 51,000 Utilities Expense 11,100 Maintenance and Repairs Expense 8,600 40,200 54,400 17,200 159,700 66,900 921,800 Journalize the adjusting entries. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automa indented when amount is entered. Do not indent manually.) Debit Credit No. Account Titles and Explanation 1. SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Create T-accounts for all accounts used in part a. Enter the trial balance amounts into the T-accounts and post the adjusting entries. (Post entries in the order of posted in part a.) Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Depreciation Expense Interest Expense Interest Payable Income Tax Expense Income Taxes Payable Prepare a classified balance sheet at December 31, 2022. (List current assets in order of liquidity and property, plant and equipment equipment.) WINDSOR WHOLESALE COMPANY Balance Sheet Assets Liabilities and Stockholders' Equity Problem 5-06A The trial balance of Windsor Wholesale Company contained the following accounts shown at December 31, the end of the company's Credit $ 59,700 WINDSOR WHOLESALE COMPANY Trial Balance December 31,2022 Debit Cash $ 31,200 Accounts Receivable 38,300 Inventory 70,700 Land 91,700 Buildings 199,700 Accumulated Depreciation-Buildings Equipment 83,200 Accumulated Depreciation-Equipment Notes Payable Accounts Payable Common Stock Retained Earnings Dividends 9,700 Sales Revenue Sales Discounts 5,700 Cost of Goods Sold 709,600 Salaries and Wages Expense 51,000 Utilities Expense 11,100 Maintenance and Repairs Expense 8,600 40,200 54,400 17,200 159,700 66,900 921,800 Journalize the adjusting entries. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automa indented when amount is entered. Do not indent manually.) Debit Credit No. Account Titles and Explanation 1. SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Create T-accounts for all accounts used in part a. Enter the trial balance amounts into the T-accounts and post the adjusting entries. (Post entries in the order of posted in part a.) Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Depreciation Expense Interest Expense Interest Payable Income Tax Expense Income Taxes Payable Prepare a classified balance sheet at December 31, 2022. (List current assets in order of liquidity and property, plant and equipment equipment.) WINDSOR WHOLESALE COMPANY Balance Sheet Assets Liabilities and Stockholders' Equity