Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required: 1. Assume F&S offers a deal whereby enrolling in a new membership for $1,400 provides a year of unlimited access to facilities and

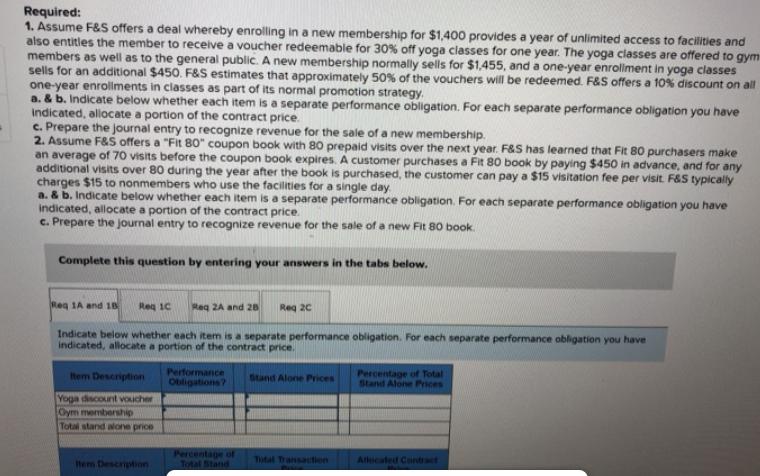

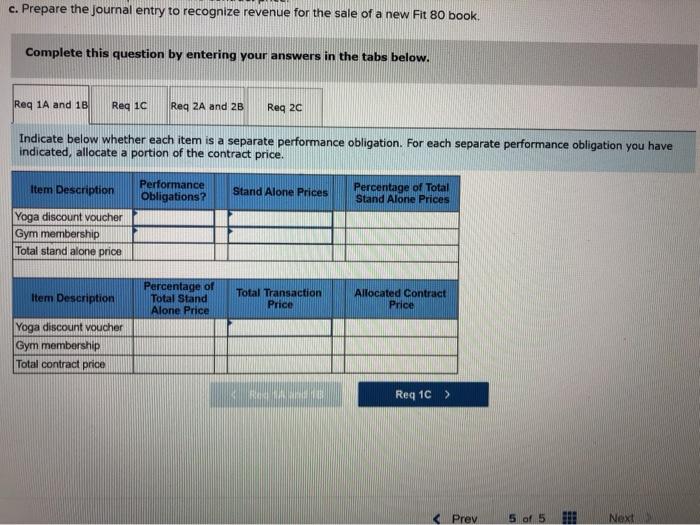

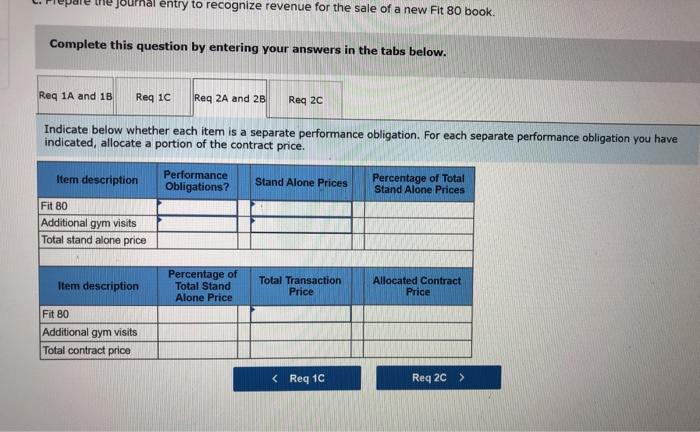

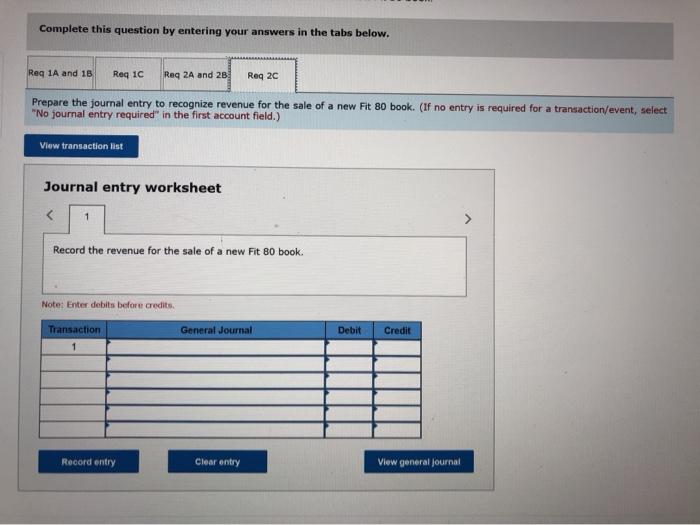

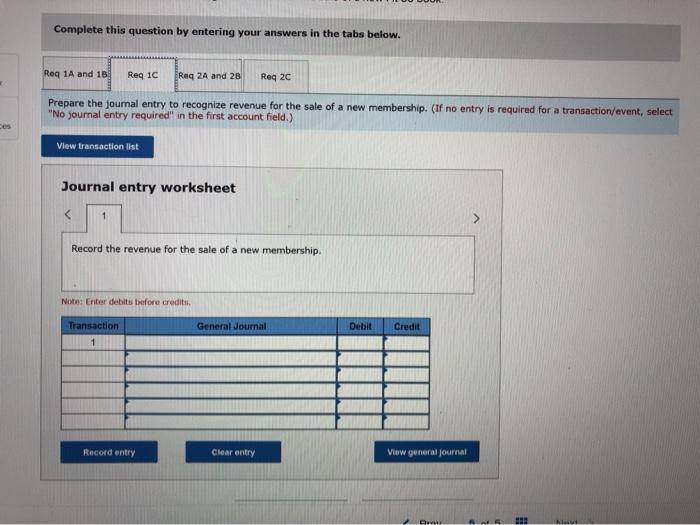

Required: 1. Assume F&S offers a deal whereby enrolling in a new membership for $1,400 provides a year of unlimited access to facilities and also entitles the member to receive a voucher redeemable for 30% off yoga classes for one year. The yoga classes are offered to gym members as well as to the general public. A new membership normally sells for $1,455, and a one-year enrollment in yoga classes sells for an additional $450. F&S estimates that approximately 50% of the vouchers will be redeemed. F&S offers a 10% discount on all one-year enrollments in classes as part of its normal promotion strategy. a. & b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have Indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new membership. 2. Assume F&S offers a "Fit 80" coupon book with 80 prepaid visits over the next year. F&S has learned that Fit 80 purchasers make an average of 70 visits before the coupon book expires. A customer purchases a Fit 80 book by paying $450 in advance, and for any additional visits over 80 during the year after the book is purchased, the customer can pay a $15 visitation fee per visit. F&S typically charges $15 to nonmembers who use the facilities for a single day a. & b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new Fit 80 book. Complete this question by entering your answers in the tabs below. Req 1A and 18 Req 1C Req 2A and 28 Req 2C Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. Item Description Yoga discount voucher Oym membership Total stand alone price Performance Obligations? Stand Alone Prices Percentage of Total Stand Alone Prices Item Description Percentage of Total Stand Total Transaction Alicated Contract c. Prepare the journal entry to recognize revenue for the sale of a new Fit 80 book. Complete this question by entering your answers in the tabs below. Req 1A and 1B Req 1C Req 2A and 2B Req 2C Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. Item Description Performance Obligations? Stand Alone Prices Percentage of Total Stand Alone Prices Yoga discount voucher Gym membership Total stand alone price Percentage of Item Description Total Stand Total Transaction Price Allocated Contract Price Alone Price Yoga discount voucher Gym membership Total contract price Req 1C > Prev 5 of 5 Next journal entry to recognize revenue for the sale of a new Fit 80 book. Complete this question by entering your answers in the tabs below. Req 1A and 1B Req 1C Req 2A and 2B Req 2C Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. Item description Performance Obligations? Stand Alone Prices Percentage of Total Stand Alone Prices Fit 80 Additional gym visits Total stand alone price Item description Fit 80 Additional gym visits Total contract price Percentage of Total Stand Alone Price Total Transaction Price Allocated Contract Price < Req 1C Req 2C > Complete this question by entering your answers in the tabs below. Req 1A and 1B Req 1C Req 2A and 2B Req 2C Prepare the journal entry to recognize revenue for the sale of a new Fit 80 book. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet < 1 Record the revenue for the sale of a new Fit 80 book. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Req 1A and 1B Req 1C Req 2A and 2B Req 2C Prepare the journal entry to recognize revenue for the sale of a new membership. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the revenue for the sale of a new membership. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal Drai

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided information and the tables in the images heres how you can structure the solut...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started