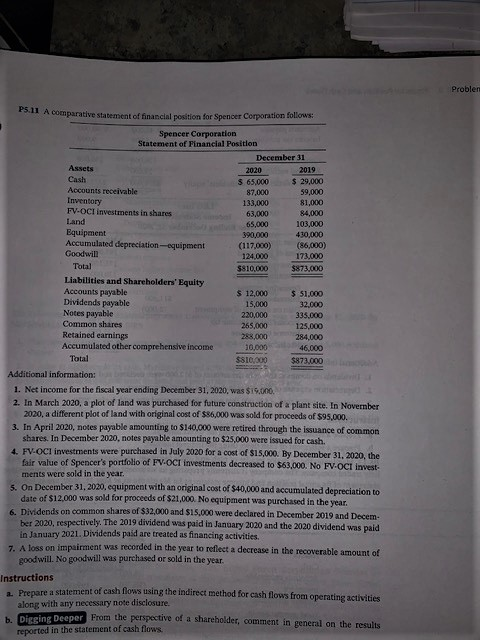

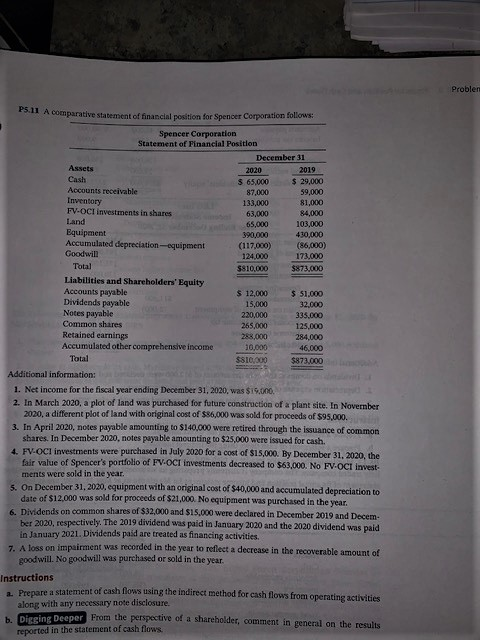

Problem 5.11 A comparative statement of financial position for Spencer Corporation follows: (117.000) Spencer Corporation Statement of Financial Position December 31 Assets 2020 S 65.000 $ 29,000 Accounts receivable 87,000 59,000 Inventory 133,000 81.000 FV-OCI investments in shares n Shares 63,000 84,000 Land 65,000 103.000 Equipment 390,000 430,000 Accumulated depreciation-equipment (86,000) Goodwill 124.000 173.000 Total SS10,000 $873.000 Liabilities and Shareholders' Equity Accounts payable $ 12,000 $ $1.000 Dividends payable 15.000 32.000 Notes payable 220,000 335.000 Common shares 265.000 125,000 Retained earnings 284,000 Accumulated other comprehensive income 10.000 46.000 Total $S100 $873.000 Additional information: 1. Net income for the fiscal year ending December 31, 2020. was $19.000 2. In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $86,000 was sold for proceeds of $95.000. 3. In April 2020, notes payable amounting to $140.000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $25,000 were issued for cash. 4 F OCI investments were purchased in July 2020 for a cost of $15,000. By December 31, 2020, the fair value of Spencer's portfolio of FV.OCT investments decreased to $63.000. No FV.OCI invest ments were sold in the year. On December 31, 2020, equipment with an original cost of $40,000 and accumulated depreciation to date of $12,000 was sold for proceeds of $21,000. No equipment was purchased in the year. 6. Dividends on common shares of $32,000 and $15.000 were declared in December 2019 and Decem- bet 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities. 7. A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year. Instructions Prepare a statement of cash flows using the indirect method for cash flows from operating activities along with any necessary note disclosure. Dieeing Deeper From the perspective of a shareholder, comment in general on the results reported in the statement of cash flows. Problem 5.11 A comparative statement of financial position for Spencer Corporation follows: (117.000) Spencer Corporation Statement of Financial Position December 31 Assets 2020 S 65.000 $ 29,000 Accounts receivable 87,000 59,000 Inventory 133,000 81.000 FV-OCI investments in shares n Shares 63,000 84,000 Land 65,000 103.000 Equipment 390,000 430,000 Accumulated depreciation-equipment (86,000) Goodwill 124.000 173.000 Total SS10,000 $873.000 Liabilities and Shareholders' Equity Accounts payable $ 12,000 $ $1.000 Dividends payable 15.000 32.000 Notes payable 220,000 335.000 Common shares 265.000 125,000 Retained earnings 284,000 Accumulated other comprehensive income 10.000 46.000 Total $S100 $873.000 Additional information: 1. Net income for the fiscal year ending December 31, 2020. was $19.000 2. In March 2020, a plot of land was purchased for future construction of a plant site. In November 2020, a different plot of land with original cost of $86,000 was sold for proceeds of $95.000. 3. In April 2020, notes payable amounting to $140.000 were retired through the issuance of common shares. In December 2020, notes payable amounting to $25,000 were issued for cash. 4 F OCI investments were purchased in July 2020 for a cost of $15,000. By December 31, 2020, the fair value of Spencer's portfolio of FV.OCT investments decreased to $63.000. No FV.OCI invest ments were sold in the year. On December 31, 2020, equipment with an original cost of $40,000 and accumulated depreciation to date of $12,000 was sold for proceeds of $21,000. No equipment was purchased in the year. 6. Dividends on common shares of $32,000 and $15.000 were declared in December 2019 and Decem- bet 2020, respectively. The 2019 dividend was paid in January 2020 and the 2020 dividend was paid in January 2021. Dividends paid are treated as financing activities. 7. A loss on impairment was recorded in the year to reflect a decrease in the recoverable amount of goodwill. No goodwill was purchased or sold in the year. Instructions Prepare a statement of cash flows using the indirect method for cash flows from operating activities along with any necessary note disclosure. Dieeing Deeper From the perspective of a shareholder, comment in general on the results reported in the statement of cash flows