Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 5-17 AND PROBLEM 5-19 Problem 5-17 (IAA) Aye Company is authorized to issue P5,000,000 of 6%, 10-year bonds dated July 1, 2020 with interest

PROBLEM 5-17 AND PROBLEM 5-19

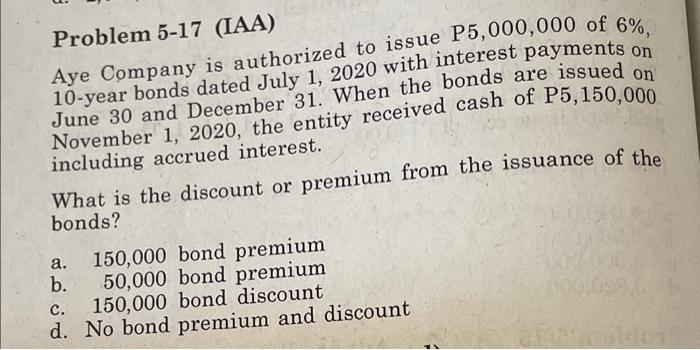

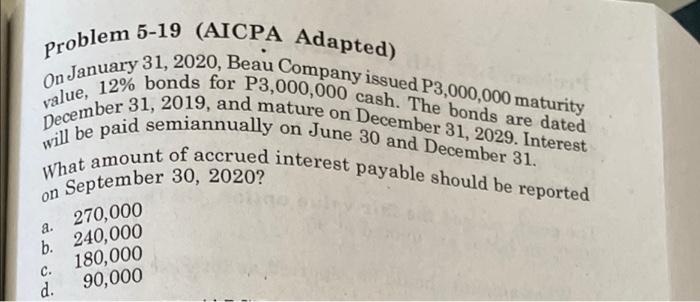

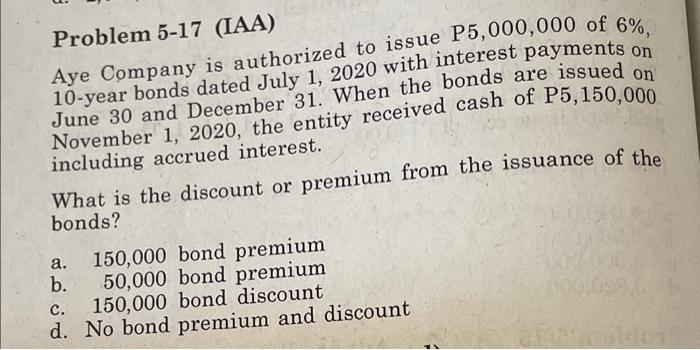

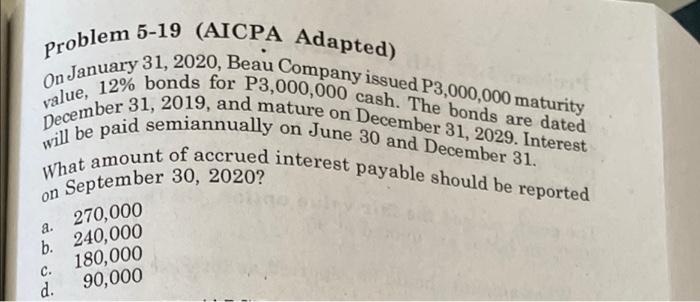

Problem 5-17 (IAA) Aye Company is authorized to issue P5,000,000 of 6%, 10-year bonds dated July 1, 2020 with interest payments on November 1, 2020, the entity received cash of P5,150,000 June 30 and December 31. When the bonds are issued on including accrued interest. What is the discount or premium from the issuance of the bonds? a. 150,000 bond premium b. 50,000 bond premium 150,000 bond discount d. No bond premium and discount c. Problem 5-19 (AICPA Adapted) value, 12% bonds for P3,000,000 cash. The bonds are dated On January 31, 2020, Beau Company issued P3,000,000 maturity December 31, 2019, and mature on December 31, 2029. Interest will be paid semiannually on June 30 and December 31. What amount of accrued interest payable should be reported September 30, 2020? on a. 270,000 b. 240,000 c. 180,000 d. 90,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started