Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5-1A (Static) Calculate the amount of revenue to recognize (LO5-1) Assume the following scenarios. Scenario 1: During 2024, IBM provides consulting services on its

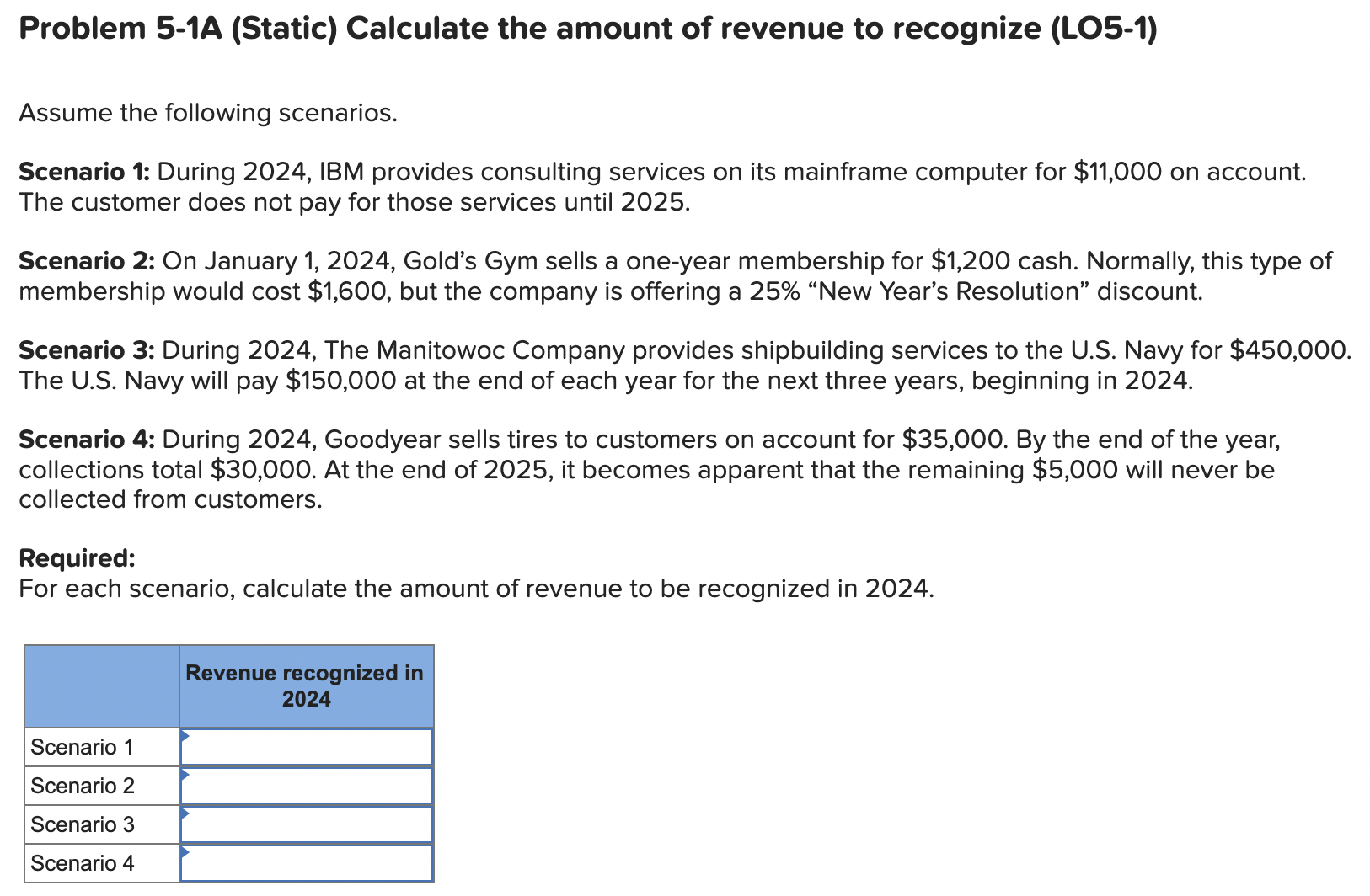

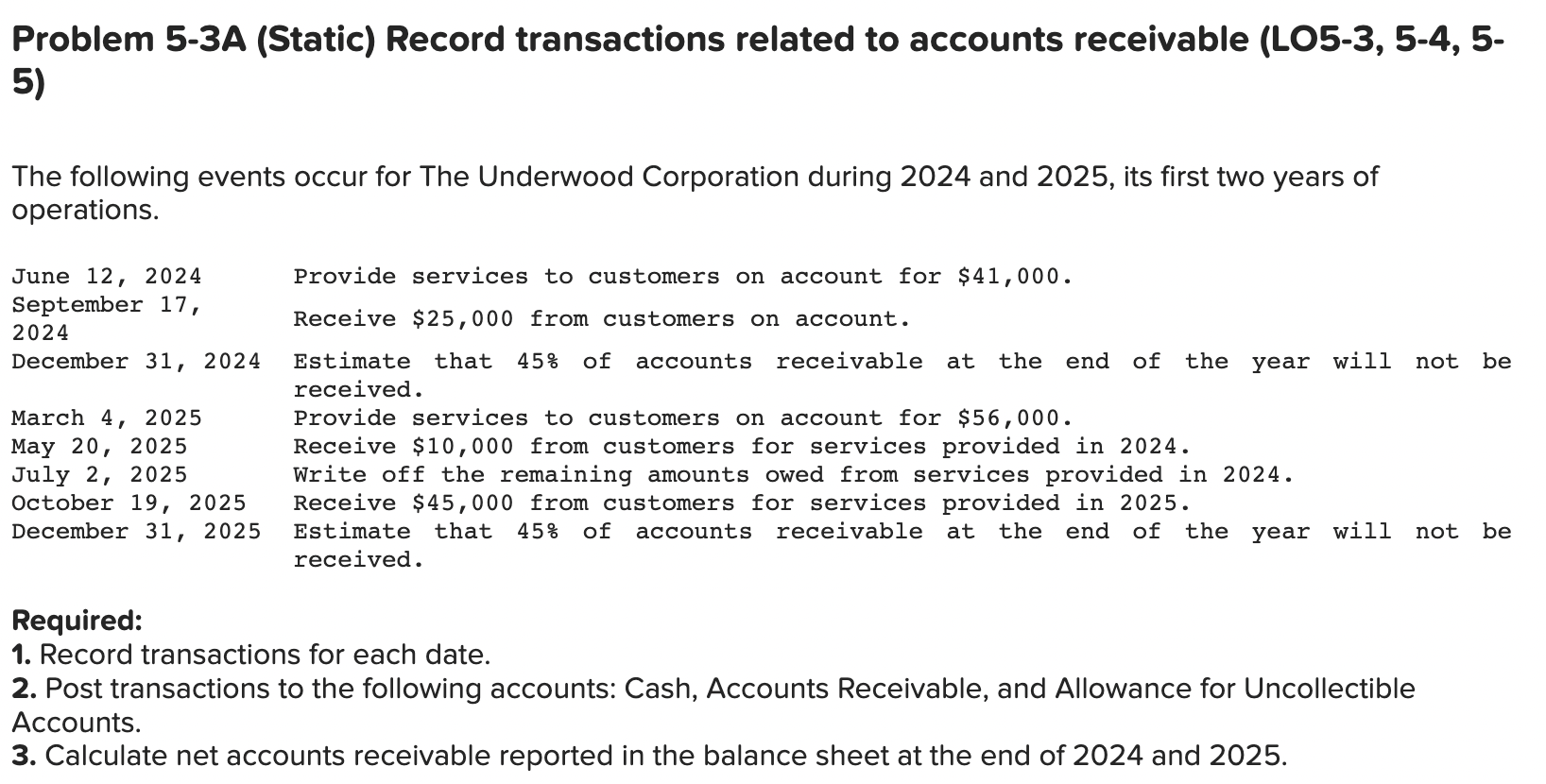

Problem 5-1A (Static) Calculate the amount of revenue to recognize (LO5-1) Assume the following scenarios. Scenario 1: During 2024, IBM provides consulting services on its mainframe computer for $11,000 on account. The customer does not pay for those services until 2025. Scenario 2: On January 1, 2024, Gold's Gym sells a one-year membership for $1,200 cash. Normally, this type of membership would cost \$1,600, but the company is offering a 25\% "New Year's Resolution" discount. Scenario 3: During 2024, The Manitowoc Company provides shipbuilding services to the U.S. Navy for $450,000 The U.S. Navy will pay $150,000 at the end of each year for the next three years, beginning in 2024 . Scenario 4: During 2024, Goodyear sells tires to customers on account for $35,000. By the end of the year, collections total $30,000. At the end of 2025 , it becomes apparent that the remaining $5,000 will never be collected from customers. Required: For each scenario, calculate the amount of revenue to be recognized in 2024 . 5) The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations. June 12, 2024 Provide services to customers on account for $41,000. September 17, Receive $25,000 from customers on account. 2024 December 31, 2024 Estimate that 45% of accounts receivable at the end of the year will not be March 4, 2025 Provide services to customers on account for $56,000. May 20, 2025 Receive $10,000 from customers for services provided in 2024 . July 2, 2025 Write off the remaining amounts owed from services provided in 2024. October 19,2025 Receive \$45,000 from customers for services provided in 2025. December 31, 2025 Estimate that 45\% of accounts receivable at the end of the year will not be received. Required: 1. Record transactions for each date. 2. Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncollectible Accounts. 3. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025

Problem 5-1A (Static) Calculate the amount of revenue to recognize (LO5-1) Assume the following scenarios. Scenario 1: During 2024, IBM provides consulting services on its mainframe computer for $11,000 on account. The customer does not pay for those services until 2025. Scenario 2: On January 1, 2024, Gold's Gym sells a one-year membership for $1,200 cash. Normally, this type of membership would cost \$1,600, but the company is offering a 25\% "New Year's Resolution" discount. Scenario 3: During 2024, The Manitowoc Company provides shipbuilding services to the U.S. Navy for $450,000 The U.S. Navy will pay $150,000 at the end of each year for the next three years, beginning in 2024 . Scenario 4: During 2024, Goodyear sells tires to customers on account for $35,000. By the end of the year, collections total $30,000. At the end of 2025 , it becomes apparent that the remaining $5,000 will never be collected from customers. Required: For each scenario, calculate the amount of revenue to be recognized in 2024 . 5) The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations. June 12, 2024 Provide services to customers on account for $41,000. September 17, Receive $25,000 from customers on account. 2024 December 31, 2024 Estimate that 45% of accounts receivable at the end of the year will not be March 4, 2025 Provide services to customers on account for $56,000. May 20, 2025 Receive $10,000 from customers for services provided in 2024 . July 2, 2025 Write off the remaining amounts owed from services provided in 2024. October 19,2025 Receive \$45,000 from customers for services provided in 2025. December 31, 2025 Estimate that 45\% of accounts receivable at the end of the year will not be received. Required: 1. Record transactions for each date. 2. Post transactions to the following accounts: Cash, Accounts Receivable, and Allowance for Uncollectible Accounts. 3. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started