Answered step by step

Verified Expert Solution

Question

1 Approved Answer

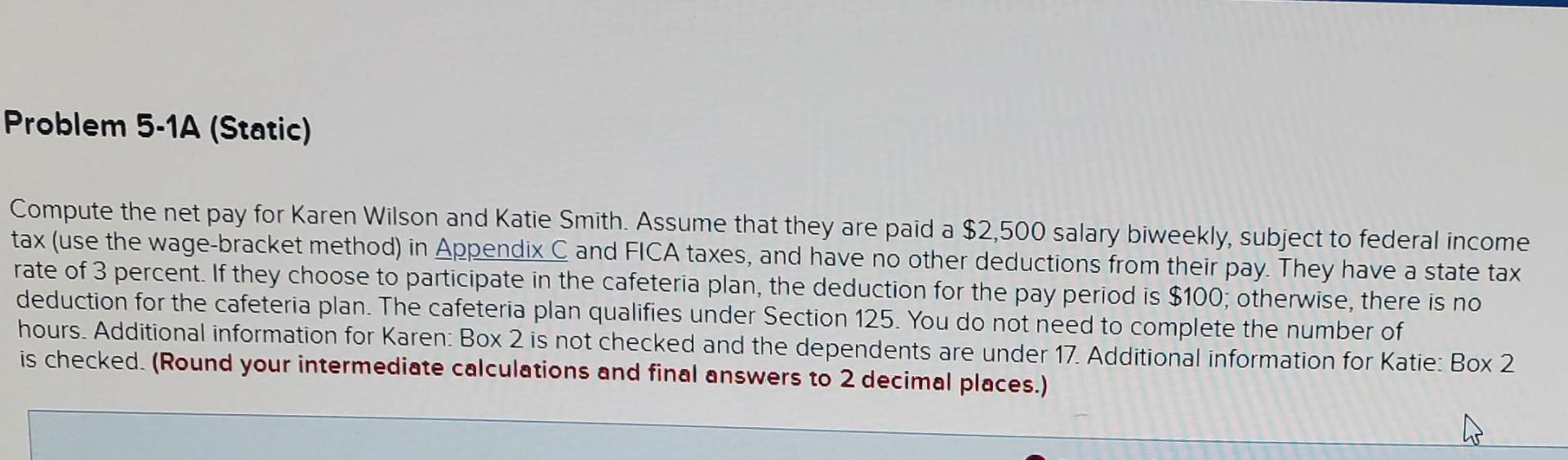

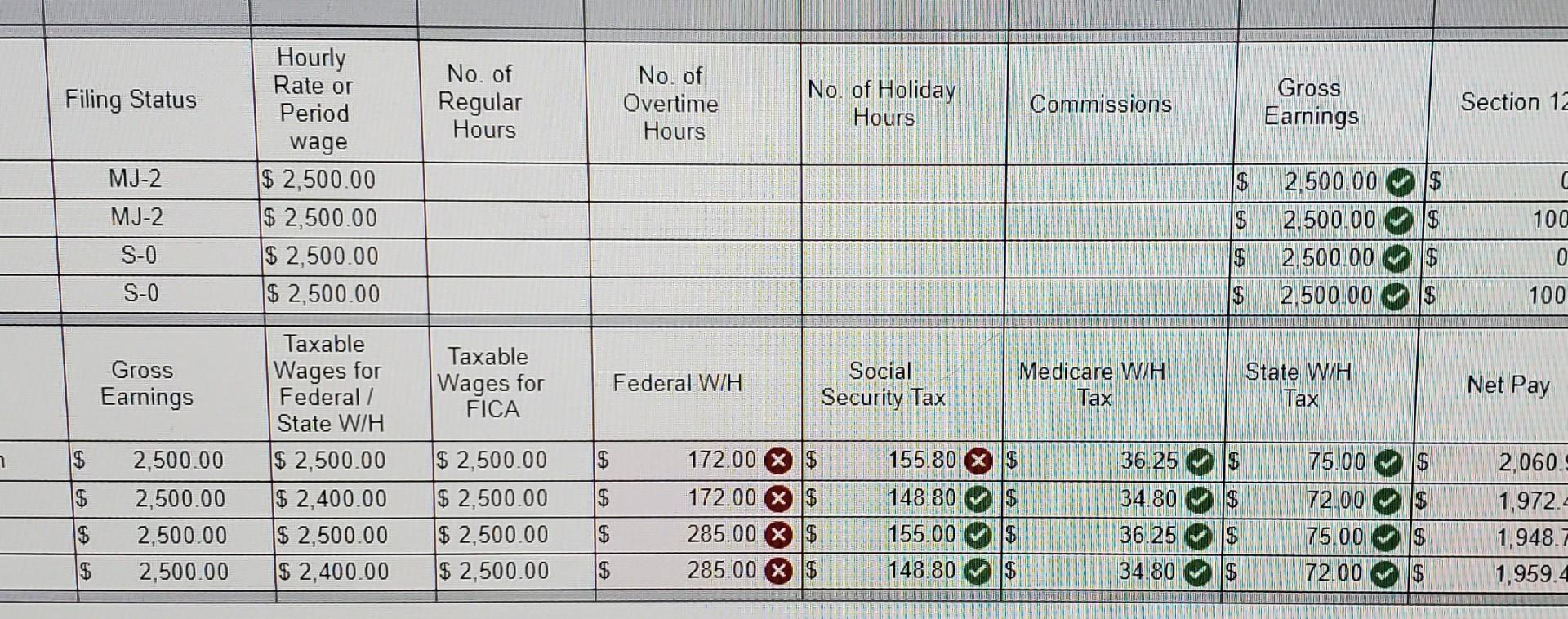

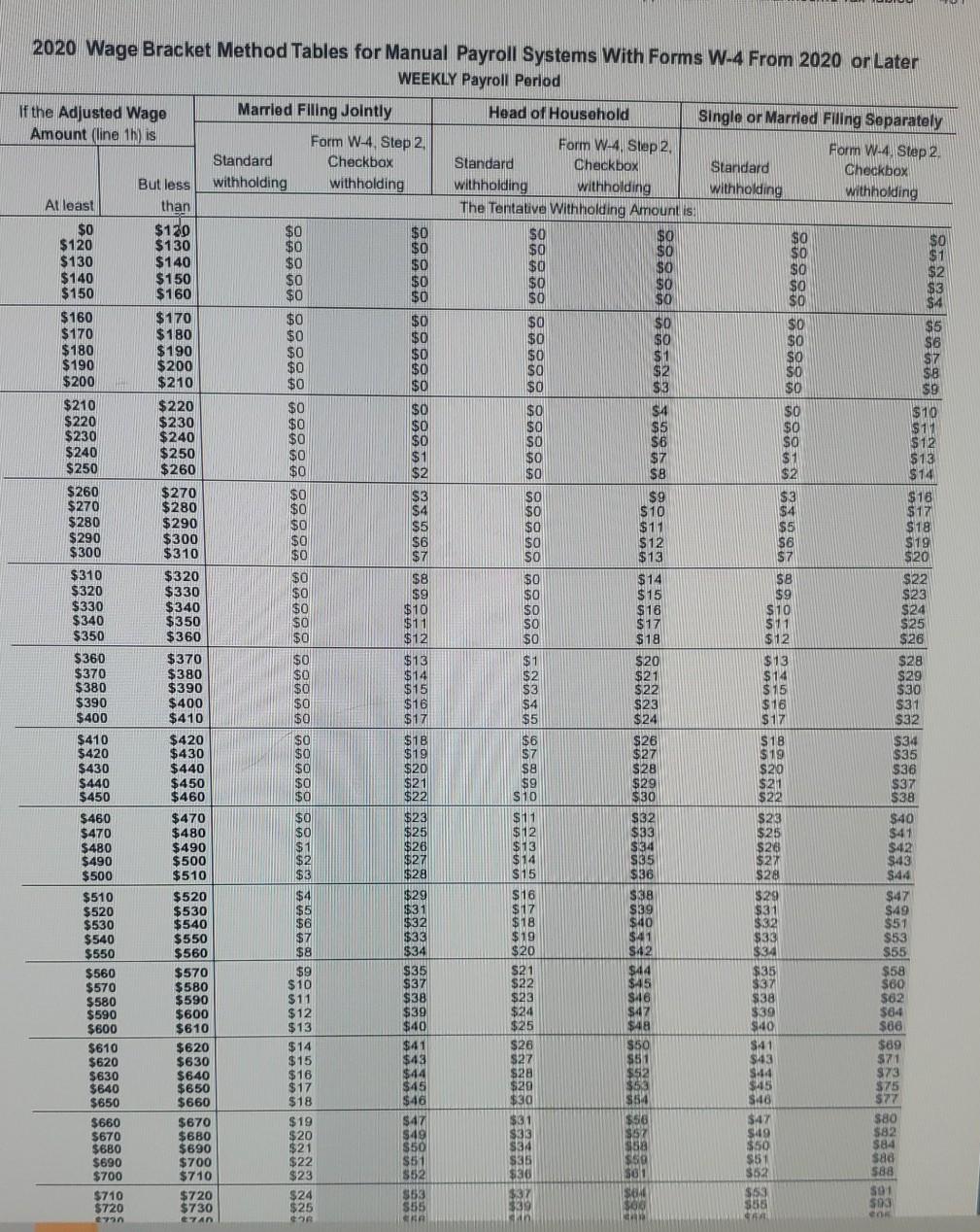

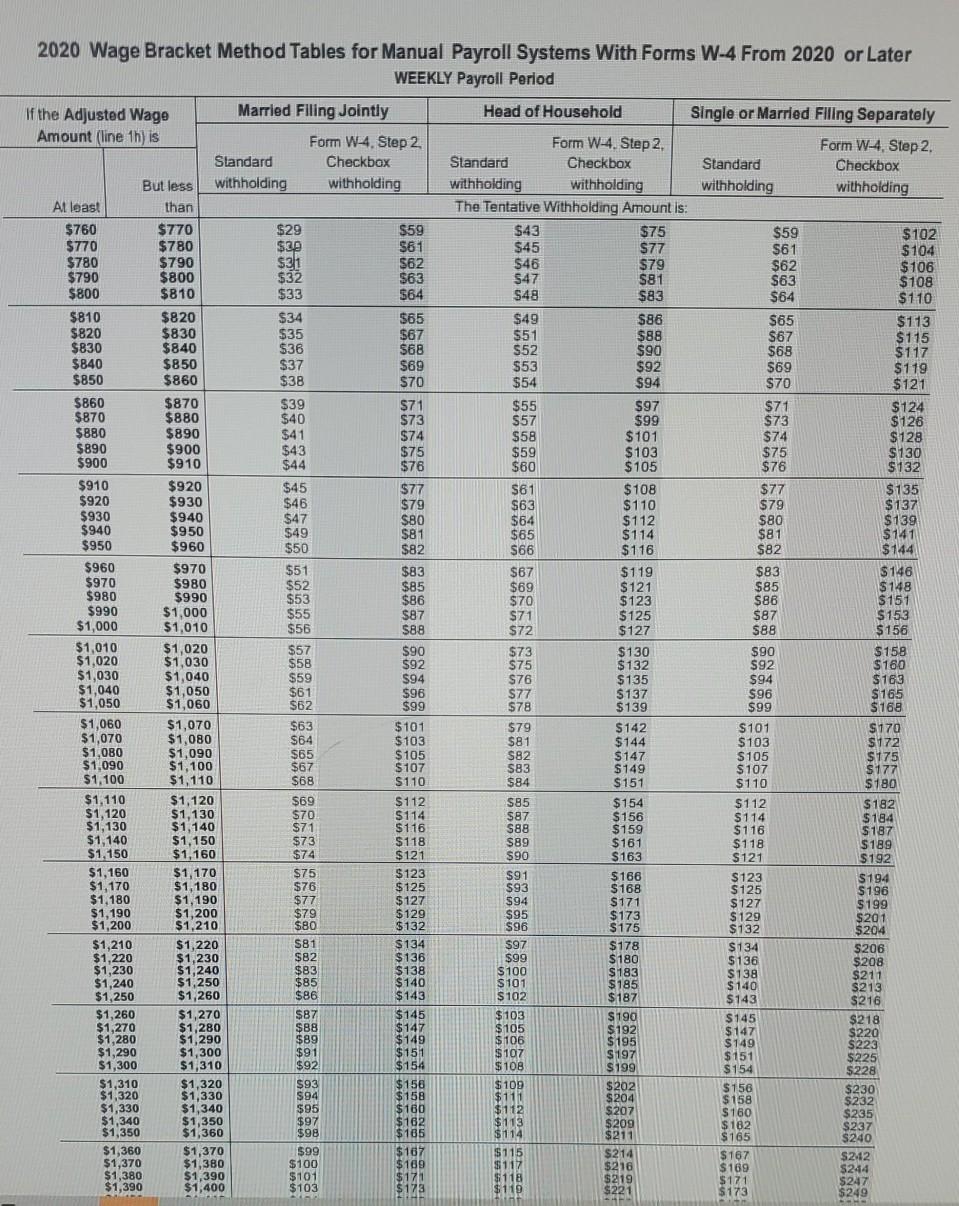

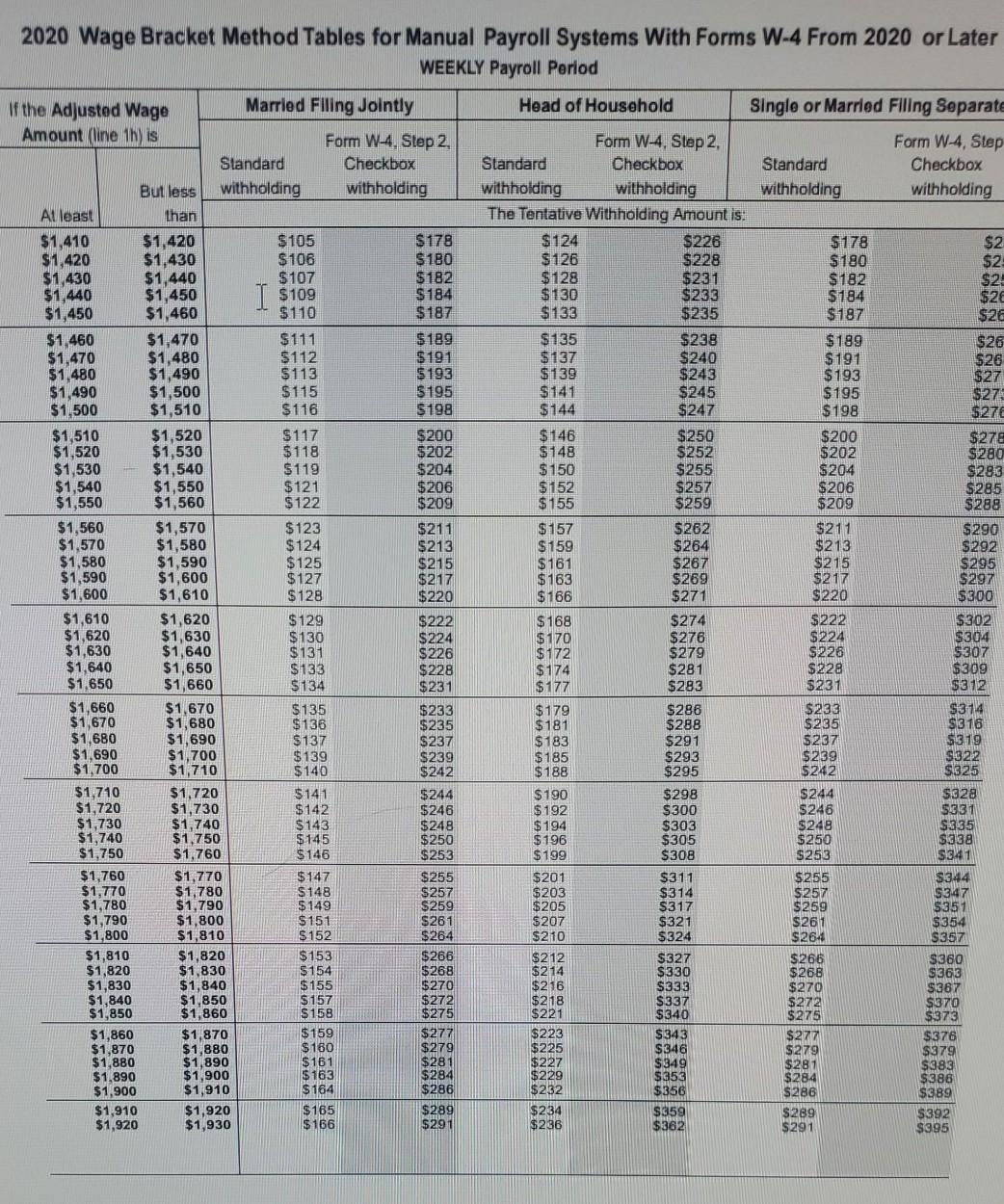

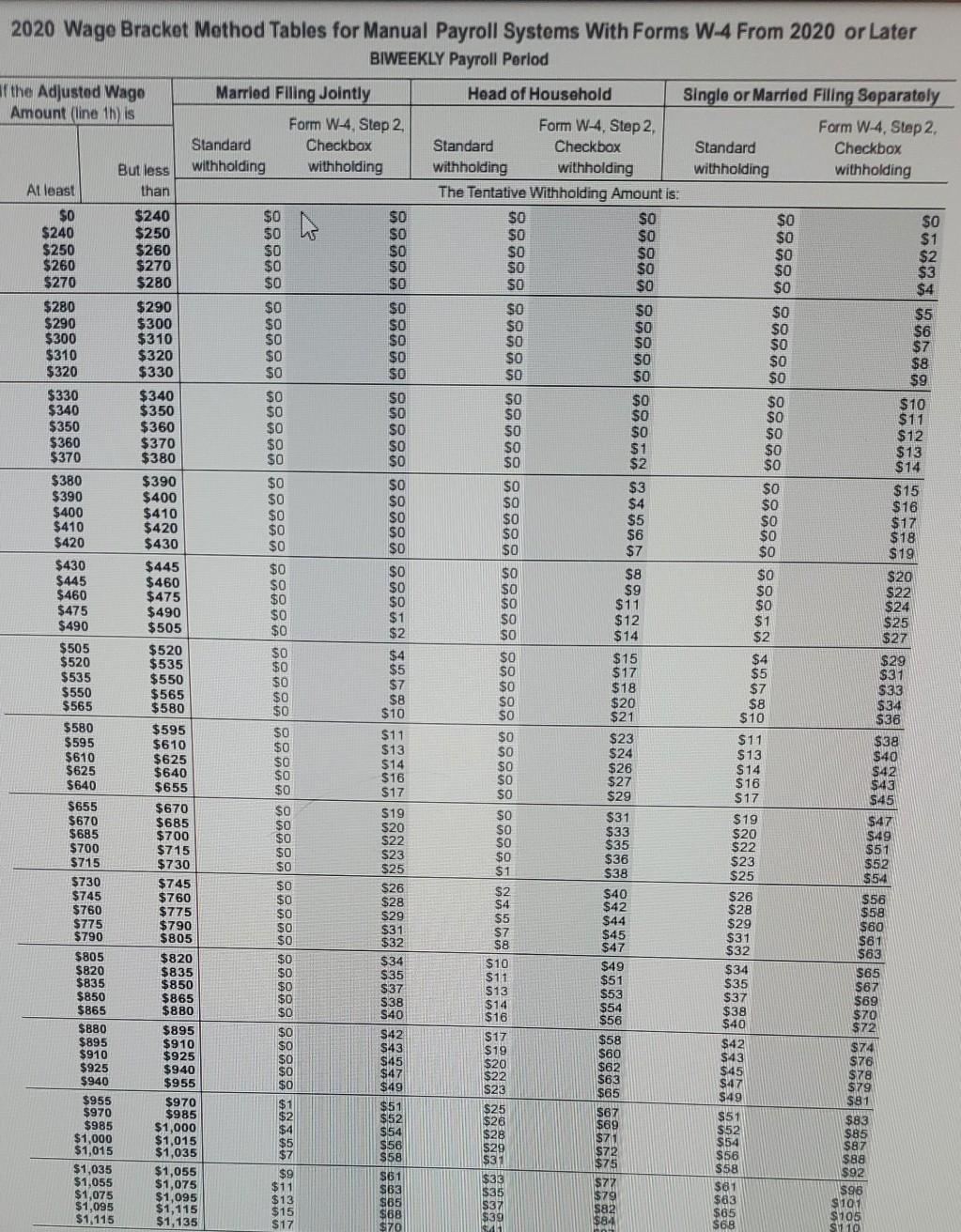

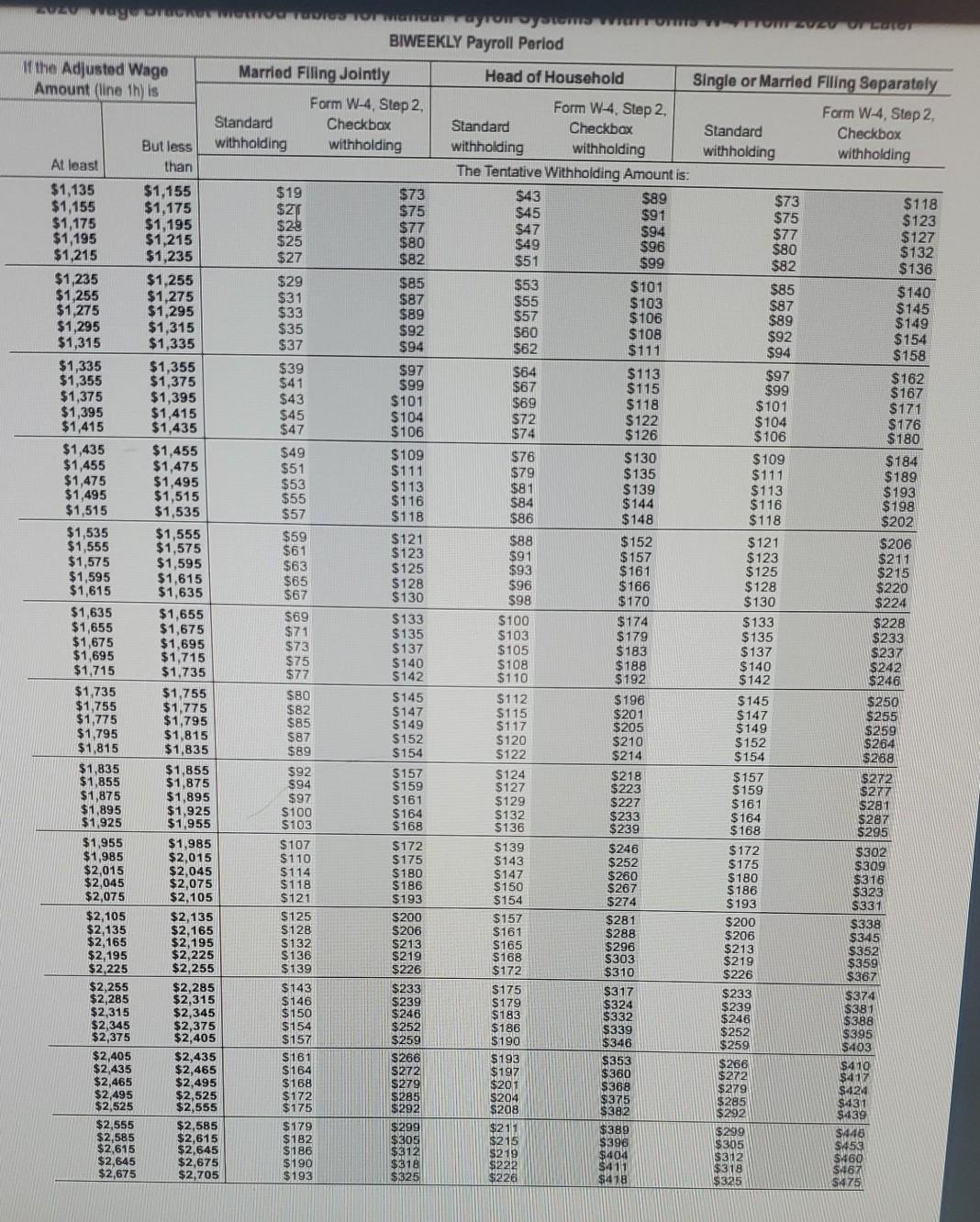

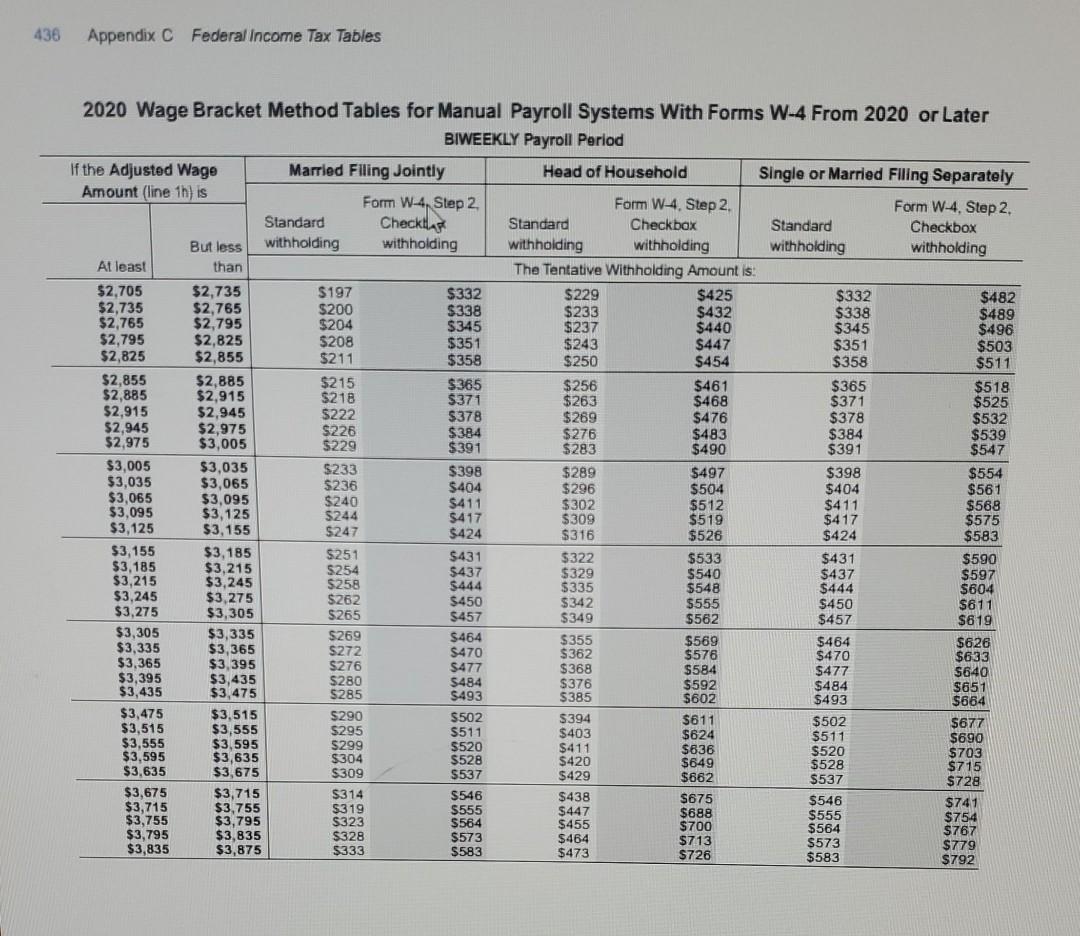

Problem 5-1A (Static) Compute the net pay for Karen Wilson and Katie Smith. Assume that they are paid a $2,500 salary biweekly, subject to federal

Problem 5-1A (Static) Compute the net pay for Karen Wilson and Katie Smith. Assume that they are paid a $2,500 salary biweekly, subject to federal income tax (use the wage-bracket method) in Appendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the cafeteria plan, the deduction for the pay period is $100; otherwise, there is no deduction for the cafeteria plan. The cafeteria plan qualifies under Section 125. You do not need to complete the number of hours. Additional information for Karen: Box 2 is not checked and the dependents are under 17. Additional information for Katie: Box 2 is checked. (Round your intermediate calculations and final answers to 2 decimal places.) Filing Status No. of Regular Hours No. of Overtime Hours No. of Holiday Hours Commissions Gross Earnings Section 12 MJ-2 Hourly Rate or Period wage $ 2,500.00 $ 2,500.00 $ 2,500.00 $ 2,500.00 $ $ MJ-2 $ $ 100 2,500.00 2,500.00 2.500.00 2,500.00 S-0 19 0 S-0 $ $ 100 Gross Earnings Taxable Wages for FICA Federal W/H Social Security Tax Medicare WIH Tax State WH Tax Net Pay 7 $ Taxable Wages for Federal / State WIH $ 2,500.00 $ 2,400.00 $ 2,500.00 $ 2,400.00 $ 155.80 $ 36.25 $ 75.00 $ $ $ $ 2,500.00 2,500.00 2,500.00 2,500.00 $ $ 2,500.00 $ 2,500.00 $ 2,500.00 $ 2,500.00 172.00 172.00 X $ 285.00 X $ 285.00 $ $ 148.80 155.00 148.80 $ 2,060. 1,972.- 1,948.7 1,959.4 34.80 36.25 34.80 $ 72.00 75.00 72.00 $ $ $ 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Perlod If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 16) is Form W-4. Step 2 Form W-4, Step 2 Forrn W-4 Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: $0 $120 $0 $0 $0 $0 $120 $130 $O $0 $0 $0 $0 $0 $0 $130 $140 $1 $0 $0 $0 $0 $0 $140 $150 $0 $2 $0 $0 $0 $0 $150 $160 $3 $0 $0 SO $0 $0 $160 $170 $0 $0 $0 SO $10 $170 $5 $180 $0 $0 $0 $0 $0 $6 $180 $190 $0 $0 SO $1 so $190 S7 $200 $0 $0 SO 92 SO SB $200 $210 $0 $0 $0 $3 $0 $9 $210 $220 $0 $0 $0 $4 $0 $10 $220 $230 $0 $0 sa $5 $0 $230 $11 $240 $0 $0 $0 $6 $0 $12 $240 $250 $0 $1 $0 $7 $1 $13 $250 $260 $0 $2 $0 $8 $2 $14 $260 $270 $0 $3 SO $9 $3 $16 $270 $280 $0 $4 $0 S10 $4 $17 $280 $290 $0 $5 $0 $11 $5 $18 $290 $300 $6 SO $12 S6 $19 $300 $310 $0 $7 SO $13 $7 $20 $310 $320 $0 $8 $0 $14 $8 $22 $320 $330 SO $9 SO $15 $9 $23 $330 $340 $0 $10 $0 $16 $10 S24 $340 $350 SO $11 SO $17 $11 $25 $350 $360 $0 $12 SO $18 $12 $26 $360 $370 $0 $13 1 $20 $13 $28 $370 $380 $0 $14 52 $21 $14 $29 $380 $390 $0 $15 $22 $15 $30 $390 $400 so $16 $4 $23 $16 $31 $400 $410 $0 $17 $5 $24 $17 $32 $410 $420 $0 $18 $26 S18 $34 $420 $430 $0 $19 57 $27 $19 $35 $430 $440 $0 $20 sa $28 $20 $36 $440 $450 $0 $21 $9 $29 $21 $37 $450 $460 $0 $22 S10 $30 $22 $38 $460 $470 $ $0 $23 $11 $32 $23 $40 $470 $480 $0 $25 $12 $33 $25 $41 $480 $490 $26 $13 $34 $26 $42 $490 $500 $2 $27 $14 $35 $27 $443 $500 $510 $28 $15 $36 $28 $44 $510 $520 $4 $29 $16 $38 $.29 $47 $520 $530 $5 $17 $39 $31 $49 $530 $540 $6 $32 $18 $40 $32 $51 $540 $550 $7 $33 $19 $41 $33 $53 $550 $560 $8 $34 $20 S42 $34 $55 $560 $570 $9 $35 $21 $44 $ $35 $58 $570 $580 $10 $37 $22 $45 937 $80 $580 $590 $11 $38 $23 $46 $38 $62 $590 $600 $12 $39 $24 $47 $39 $64 $600 $610 $13 $40 $25 $4a $40 $80 $610 $620 $14 $41 $26 $50 $41 $89 $620 $630 $15 $43 $27 $51 $43 $71 $630 $640 $16 $44 $28 $ 944 873 $640 $650 $17 $45 $29 $53 $45 $75 $650 $660 $18 $46 $30 S54 948 $77 $660 $670 $19 $47 $31 $58 S80 547 $670 $680 $20 $49 $33 $57 $49 $82 $680 $690 $50 S34 ssa $50 984 $690 $700 $22 $51 $35 $50 $51 saa $700 $710 $23 S52 $30 SOL 952 $88 $710 $720 $24 $53 $37 $8.44 $53 501 $720 $730 $25 S55 300 503 339 $38 TAN CHA dan $31 $21 $77 $980 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 1h) is Form W-4. Step 2 Form W-4. Step 2 Form W-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding Al least than The Tentative Withholding Amount is: $760 $770 $29 $59 $43 $75 $59 $102 $770 $780 $39 561 $45 $77 $61 $104 $780 $790 $31 562 $46 $79 $62 $106 $790 $800 $32 $63 547 81 $63 $108 $800 $810 $33 $64 548 $83 $64 $110 $810 $820 $34 $65 $49 $86 $65 $113 $820 $830 $35 $67 551 $88 $67 $115 $830 $840 $36 $68 552 $90 $68 $117 $B40 $850 $37 $69 $53 $92 $69 $119 $850 $860 $38 $70 $54 $94 $70 $121 $860 $870 $39 $71 $55 $97 $71 $870 $124 $880 $40 $73 $57 $99 $73 $126 $880 $890 $41 $74 $58 $ 101 $74 $128 $890 $900 $43 $75 $59 $103 $75 $130 $900 $910 $44 $76 $60 $105 $76 $132 $910 $920 $45 361 $108 $77 $135 $920 $930 $46 $79 $63 $110 $79 $137 $930 $940 $47 $80 $64 $112 $80 $139 $940 $950 $49 $81 $65 $114 $81 $141 $950 $960 $50 $82 S66 $116 $82 $144 M. $960 $970 $51 $83 $67 $119 $83 $146 $970 $980 $52 $85 $69 $121 $85 $148 $990 $53 $86 $70 $123 S88 $990 $ 151 $1,000 $55 $87 $71 $125 $1.000 S87 $153 $1,010 $56 $88 $72 $127 $88 $156 $1,010 $1,020 $57 $90 $73 $130 $90 $158 $1,020 $1,030 $58 $92 $75 $132 S92 $160 $1,030 $1,040 $59 $94 $76 $135 $94 $1,040 $163 $1,050 $61 $96 $77 $137 $96 $1,050 $ 165 $1,060 $62 $99 $78 S139 $99 $168 $1,060 $1,070 $63 $101 $79 $142 S101 $170 $1,070 $1,080 564 $81 $144 $103 $1,080 $172 $1,090 $65 $105 $82 $147 $105 $1,090 $1,100 $175 $67 $107 $83 $149 $107 $177 $1,100 $1,110 S68 $110 $84 S151 $110 $180 $1.110 $1,120 $69 $112 85 $154 $112 $1,120 S182 $1,130 $70 $114 S87 $156 $114 $1,130 $184 $1,140 $71 $116 S88 $159 $116 $187 $1,140 $1,150 $73 $118 S89 $161 $118 S189 $1,150 $1,160 $74 $121 $90 $163 $121 $192 $1,160 $1 170 $75 $123 $91 $1,170 $166 $123 $1,180 $76 $194 $125 $93 $168 $1,180 $125 $196 $1,190 $77. $127 594 $171 $127 $199 $1,190 $1,200 $79 $ 129 $95 $173 $1,200 $ 129 $1,210 $80 $201 $132 $96 $175 $132 $204 $1,210 $1,220 S81 $134 $97 $178 $134 $1,220 $206 $1,230 $82 $136 $99 $180 $1,230 $136 $1,240 $83 $208 $138 $100 S183 $1,240 $1,250 $138 $211 $85 $140 S 101 $140 $213 $1,250 $1,260 $86 $143 $ 102 $187 $143 $1,260 $1,270 $87 $145 $103 $190 $1,270 $145 $1,280 $88 $147 $218 $105 $192 $147 $1,280 $1.290 $89 $149 $220 $195 $149 $1,290 $1,300 $91 $151 $223 $107 $1971 $1,300 $151 $1,310 $225 $92 $154 $106 $199 $154 $228 $1,310 $1,320 $93 $156 $109 S202 $156 $1,320 $1,330 $94 $158 $116 $204 $230 $1,330 $ 158 $1,340 $95 $180 $232 $112 $207 $160 $1,340 $1,350 $97 $182 $235 $113 $209 $1,350 $ 182 $98 $237 $1,360 $185 $114 $211 $165 $240 $1,360 $1,370 $99 $187 $115 $1,370 $214 $167 $242 $1,380 $100 $109 $117 $216 $1,380 $169 $1,390 $101 $171 $244 $118 $1,390 $219 $1,400 $103 $173 $247 $171 $119 $221 $173 - $249 THE $103 $185 S216 $106 $184 $189 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Flling Jointly Head of Household Single or Married Filing Separate Amount (line Thy is Form W-4. Step 2 Form W-4, Step 2 Form W-4, Step Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding withholding withholding Alleast than The Tentative Withholding Amount is: $1,410 $1,420 $105 $178 $124 $226 $178 $2 $1,420 $1,430 $106 $180 $126 $228 $180 $2 $1,430 $1,440 $107 $ 182 $128 $231 $182 $2 $1,440 $1,450 $109 $130 $233 $184 $28 $1,450 $1,460 $110 $187 $133 $235 $187 $26 $1,460 $1,470 $111 $135 $238 $189 $26 $1,470 $1,480 5112 5191 $137 $240 $191 $26 $1,480 $1,490 $113 5193 $ 139 $243 $193 $27 $1,490 $1,500 $115 $195 $141 $245 $195 $27 $1,500 $1,510 $116 5198 $144 $247 $198 $27 $1,510 $1,520 $117 $200 $ 146 $250 $200 $278 $1,520 $1,530 $118 $202 $ 148 5252 $202 $280 $1,530 $1,540 $119 $204 $150 $255 $204 $283 $1,540 $1,550 $121 $206 $152 $257 $206 $285 $1,550 $1,560 $122 $209 $ 155 $259 $209 $288 $1,560 $1,570 $123 $211 $157 $262 $211 $290 $1,570 $1,580 $124 $213 $159 $264 $213 $292 $1,580 $1,590 $125 $215 $161 $267 $215 $1,590 $295 $1,600 $127 $217 $ 163 $269 $217 $297 $1,600 $1,610 $128 $220 $166 $271 $220 $300 $1,610 $1,620 $129 $222 $168 $274 $222 $302 $1,620 $1,630 $130 $224 $ 170 $276 $224 $304 $1,630 $1,640 $131 $226 $ 172 $279 $226 $307 $1,640 $1,650 $133 $228 $174 $281 $228 $309 $1,650 $1,660 $134 $231 $177 $283 $231 $312 $1.660 $1,670 $135 $233 $179 $286 $233 $314 $1,670 $1,680 $138 $235 $181 $288 $235 S3 16 $1,680 $1,690 $137 $237 $183 $291 5237 $319 $1,690 $1,700 $ 139 $239 $185 $293 $239 $322 $1,700 $1,710 $140 $242 $ 188 $295 $242 $325 $1,710 $1,720 $ 141 $244 $190 $298 $244 $328 $1,720 $1,730 $142 $246 $ 192 $300 $246 $331 $1,730 $1,740 $143 $248 $194 $303 $248 $335 $1,740 $1.750 $145 $250 $196 $305 $250 $338 $1,750 $1,760 $146 $253 $308 $253 $341 $1,760 $1,770 $147 $255 $201 $311 5255 $344 $1,770 $1,780 $ 148 5257 $203 $314 5257 $347 $1,780 $1,790 $ 149 $259 $205 S317 $259 5351 $1,790 $1,800 $151 $261 $207 $321 $261 $354 $1,800 $1,810 $152 $210 S324 $264 $357 $1,810 $1,820 $153 $266 $212 $327 5266 $360 $1,820 $1,830 $154 $214 $330 $268 $363 $1,830 $1,840 $216 $333 $270 S367 $1,840 $1,850 $ 157 $272 $218 $337 $1,850 $1,860 $ 158 $221 $340 $275 $1373 $1,860 $1,870 $ 159 $277 $223 $343 $277 $1,870 $1,880 $376 $ 160 $279 $225 $346 $279 $1,880 $1,890 $181 $281 $379 $227 $349 $281 $1.890 $1,900 $ 163 $284 $383 $229 $353 $284 $386 $1,900 $1,910 $164 $286 $232 $356 $286 $389 $1,910 $1,920 $165 $289 $234 $359 $289 $392 $1,920 $1,930 $166 $291 $236 $362 $291 $395 $199 $264 $268 $155 $270 $275 $272 $370 so $0 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line this Form W-4, Step 2 Form W-4. Step 2 Form W-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $240 $0 $0 SO SO SO SO $240 $250 SO SO $0 $1 $250 $260 $0 SO SO SO so $260 $270 $0 SO SO SO SO $3 $270 $280 $0 SO SO SO SO $4 $280 $290 $0 SO so SO SO $5 $290 $300 $0 SO SO $0 SO $300 $310 SO $0 SO SO SO $7 $310 $320 SO $0 SO $0 $0 $8 $320 $330 SO so SO SO $0 $9 $330 $340 $0 SO SO $o so $10 $340 $350 SO SO SO SO so $11 $350 $360 SO SO so SO $12 $360 $370 $0 SO S1 $0 $13 $370 $380 SO $0 SO S2 so $14 $380 $390 $0 SO SO $3 $0 $15 $390 $400 $0 $0 $0 $4 $0 $16 $400 $410 $0 SO so $5 SO $17 $410 $420 $0 $0 SO $6 so $18 $420 $430 SO $0 sa $7 $0 $19 $430 $445 $0 $0 SO $8 $0 $20 $445 $460 so $0 SO $9 $0 $22 $460 $475 $0 $0 SO $11 SO $24 $475 $490 SO $1 SO $12 $1 $25 $490 $505 $0 $2 $0 $14 $2 $27 $505 $520 SO $4 SO $15 $4 $520 $29 $535 $0 $5 SO $5 $31 $535 $550 $0 $7 $0 $18 $7 $33 $550 $565 $0 $8 SO $20 $8 $565 $580 $34 $0 $10 SO $21 $10 $38 $580 $595 SO $11 $0 $23 $595 $610 $11 $38 $0 $13 SO $24 $13 $610 $40 $625 $0 $14 SO $26 $625 $14 $42 $640 $0 $10 $0 $27 $16 $640 $655 $43 $0 $17 SO S29 $17 545 $655 $670 SC $19 SO $31 $685 $19 $47 so S20 SO $33 $685 $20 $700 $49 so S22 SO $700 $35 $715 $22 $51 $0 S23 $0 $715 $36 $23 $730 SO $52 $25 $1 $25 $54 $730 $745 $0 S26 S2 $40 $745 $760 so $28 $26 $56 $4 $42 $760 $775 $28 SO $58 $29 $5 $44 $775 $790 SO $29 $31 $60 $790 $7 $805 $45 $0 $31 $32 561 $8 $47 $32 $63 $805 $820 $c $34 $10 $49 $835 $34 $0 $35 $65 $11 $835 $51 $850 $O S37 $35 $13 $67 $53 $850 $865 SO $37 S38 $14 $69 $865 $880 $54 SO $38 S40 $16 $70 $56 $40 $72 $880 $895 $0 $42 $895 $17 $58 $910 $42 SO $43 $910 $74 $925 $19 $60 so $43 $45 $20 $76 $925 $940 $0 $47 $45 $22 $940 $63 $0 $49 $47 $79 $23 $65 $49 $955 $970 $81 $1 $51 $25 $970 $985 S67 $2 $52 $51 $26 $985 $83 $1,000 $69 $4 $54 $52 $1,000 $28 $85 $1,015 $71 $5 S56 $54 $1,015 529 $87 $1,035 $7 $72 $58 $31 $56 $75 $88 $1,035 S58 $1,055 $9 S61 $92 $1,055 $33 $77 $1,075 $11 SB3 $1,075 $35 $96 $1,095 $13 $79 $65 $83 $1,095 S37 $ 101 $1,115 $15 $82 $68 $65 $39 $1,115 $105 $1,135 $84 $17 $68 $70 S110 $17 $38 $820 $62 $955 $78 $77 CAVALLOWFUmurayronyms TTON TO US BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Amount (line thy is Single or Married Filing Separately Form W-4, Step 2 Form W 4. Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: $1,135 $1,155 $19 $73 $43 $89 $1,155 $1,175 SZI $73 $75 $118 $45 $91 $1,175 $1,195 $23 $75 $77 547 $123 $1,195 $94 $1.215 $25 $80 $49 $127 $96 $1,215 $1,235 $27 $80 $82 $132 551 $99 $82 $136 $1,235 $1,255 $29 $85 $53 $ 101 $1,255 $1,275 $85 $31 $87 $140 $55 S103 $1,275 $1,295 $33 $87 $89 $57 $145 $106 $1,295 $1,315 $89 $35 $92 $149 $60 $108 $1,315 $92 $1,335 $37 $154 $94 $62 $111 $94 $1,335 $ 158 $1,355 $39 $97 $64 $113 $1,355 $1,375 $41 $97 $99 $67 $162 $115 $1,375 $1,395 $43 $99 $101 $167 $69 $118 $101 $1,395 $1,415 $45 $104 $171 $72 $122 $1,415 $1,435 $104 $47 $176 $106 $74 $126 $106 $180 $1,435 $1,455 $49 $109 $76 $130 $1,455 $1,475 $ 109 $51 $184 $111 $79 $135 $1,475 $1,495 $111 $189 $53 $113 $81 $1,495 $1,515 $ 139 $113 $193 $55 $116 $84 $144 $1,515 $116 $198 $1,535 $57 $118 $86 $148 $118 $202 $1,535 $1,555 $59 $1,555 $121 $88 $152 $1,575 $121 $61 $206 $123 $1,575 $91 $ 157 $1,595 $123 $63 $211 $125 $93 $161 $1,595 $125 $1,615 $65 $215 $128 $1,615 $96 $166 $1,635 $128 567 $220 $130 $98 $170 $130 $224 $1,635 $1,655 $69 $133 $100 $174 $1,655 $133 $228 $1,675 $71 $135 $179 $1,675 $1,695 $135 $233 $73 $137 $1,695 $105 $1,715 $183 $137 $237 $75 $140 $1,715 S108 $188 $140 $1.735 $77 5142 $242 $110 $192 $142 $246 $1,735 $80 $145 $112 $1,755 $196 $145 $1,775 $250 $82 $147 $115 $1,775 $201 $1,795 $147 $255 $85 S149 $117 $1,795 $205 $149 $1.815 $87 $152 $259 $120 $210 $1,815 $152 $1,835 $264 $89 $154 $122 $214 $154 S268 $1,835 $1,855 $92 5157 $124 $218 $1,855 $1,875 $157 $94 $272 $159 $127 $223 $1,875 $159 $1,895 $97 $277 $161 $129 $227 $1,895 $1.925 $161 $100 $281 $164 $132 $1,925 $233 $1,955 S103 $164 $168 S136 $287 $239 $168 $295 $1,955 $1,985 $107 $172 $139 $246 $1,985 $172 $2,015 $110 $175 $302 $143 $252 $2,015 $175 $2,045 $114 $309 $2,045 $180 $147 $260 $2,075 $180 $118 S316 $186 S150 $267 $2,075 $2,105 $121 $193 $154 $323 5274 $193 $331 $2,105 $2,135 $125 $157 $281 $2,135 $2,165 $12B $200 $206 $338 $161 $345 $2,165 $2,195 $206 5132 $213 S165 $2,195 $2,225 5136 $219 $168 $352 S303 $2,225 $2.255 $139 $226 $172 $359 $310 $226 $367 $2,255 $2,285 $143 $233 S175 $317 $2,285 $2,315 $233 146 $239 $179 $374 $2,315 $324 $239 $2,345 $150 $246 $183 $381 $332 $2,345 $248 $2,375 $154 $252 $186 $388 $339 $2,375 $2,405 $252 $157 $395 $259 $190 $346 $259 $403 $2,405 $2,435 $193 $353 $2,435 $2,465 $164 $266 $272 $197 $410 $360 $2,465 $2,495 $168 $272 $279 $201 $417 $368 $2,495 $2,525 $279 $172 $285 $424 $204 $375 $2.525 $2,555 $175 $292 $285 $431 $382 $292 $439 $2,555 $2,585 $179 $299 $211 $389 $2,585 $2,615 $182 $305 $299 $448 $215 S396 $2,615 $2,645 $305 S186 $312 $453 $219 $2,645 $2,675 $404 $190 $318 $312 $222 $460 $2,675 $318 $2,705 $193 $325 S467 $226 $418 $325 $475 S103 $1,755 $186 $200 $288 $296 $213 $219 $161 $266 $208 $411 436 Appendix C Federal Income Tax Tables But less $391 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 1h) is Form W-4, Step 2 Form W-4. Step 2 Form W-4, Step 2 Standard Checklas Standard Checkbox Standard Checkbox withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is. $2.705 $2,735 $197 $332 $229 $425 $332 $2,735 $482 $2,765 $200 $338 $233 $432 $2,765 $338 $489 $2,795 $204 $345 $237 $440 $345 $496 $2,795 $2,825 $208 $351 $243 $447 $2,825 $351 $503 $2,855 $211 $358 $250 $454 $358 $511 $2,855 $2,885 $215 $365 $2,885 $256 $461 $365 $518 $2,915 $218 $371 $263 $468 $371 $2,915 $525 $2,945 $222 $378 $269 $2,945 $476 $378 $532 $2,975 5226 $384 $2,975 $276 $483 $384 $3,005 $539 $229 $391 $283 $490 $547 $3,005 $3,035 $233 $398 $289 $3,035 $497 $398 $554 $3,065 $236 $404 $3,065 $296 $504 $404 $561 $3,095 $240 SA11 $3,095 $302 $512 $411 $568 $3,125 5244 5417 $3,125 $309 $519 $417 $575 $3,155 $247 $424 $316 $526 $424 $583 $3,155 $3,185 5251 $3,185 $322 $533 $431 $590 $3,215 5254 $3,215 $437 $540 $437 $3,245 $597 $258 $444 $335 $3,245 $444 $3,275 $604 $262 $450 $3,275 $342 5555 $3,305 $450 $265 $611 5457 $349 $562 $457 $619 $3,305 $3,335 $269 $3,335 $355 5569 $3,365 $464 $626 $470 $362 $576 $3,365 $470 $3,395 $633 $276 $368 $3,395 $584 $3,435 $477 $280 5640 5484 $376 $3,435 $3,475 $592 5285 $484 $493 $651 $385 $602 $493 $664 $3,475 $3,515 $290 $502 $394 $3,515 5611 $3,555 $502 $677 $295 $511 $403 $624 $3,555 $3,595 5299 $511 $690 $520 $3,595 $3,635 $411 $636 $304 S520 $703 $3,635 $528 $420 $649 $3,675 $309 $528 $537 $715 $429 $662 $537 $728 $3,675 $3,715 $314 $546 $438 $3,715 $675 $3,755 $319 $546 5555 $447 $741 $3,755 $3,795 5323 $688 $564 $555 $754 $455 $3,795 $700 $3,835 $328 $564 $767 $464 $3,835 $713 $3,875 $333 $583 $573 $473 $779 $726 $583 $792 $431 $329 $548 $464 $272 $477 $573 Problem 5-1A (Static) Compute the net pay for Karen Wilson and Katie Smith. Assume that they are paid a $2,500 salary biweekly, subject to federal income tax (use the wage-bracket method) in Appendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the cafeteria plan, the deduction for the pay period is $100; otherwise, there is no deduction for the cafeteria plan. The cafeteria plan qualifies under Section 125. You do not need to complete the number of hours. Additional information for Karen: Box 2 is not checked and the dependents are under 17. Additional information for Katie: Box 2 is checked. (Round your intermediate calculations and final answers to 2 decimal places.) Filing Status No. of Regular Hours No. of Overtime Hours No. of Holiday Hours Commissions Gross Earnings Section 12 MJ-2 Hourly Rate or Period wage $ 2,500.00 $ 2,500.00 $ 2,500.00 $ 2,500.00 $ $ MJ-2 $ $ 100 2,500.00 2,500.00 2.500.00 2,500.00 S-0 19 0 S-0 $ $ 100 Gross Earnings Taxable Wages for FICA Federal W/H Social Security Tax Medicare WIH Tax State WH Tax Net Pay 7 $ Taxable Wages for Federal / State WIH $ 2,500.00 $ 2,400.00 $ 2,500.00 $ 2,400.00 $ 155.80 $ 36.25 $ 75.00 $ $ $ $ 2,500.00 2,500.00 2,500.00 2,500.00 $ $ 2,500.00 $ 2,500.00 $ 2,500.00 $ 2,500.00 172.00 172.00 X $ 285.00 X $ 285.00 $ $ 148.80 155.00 148.80 $ 2,060. 1,972.- 1,948.7 1,959.4 34.80 36.25 34.80 $ 72.00 75.00 72.00 $ $ $ 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Perlod If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 16) is Form W-4. Step 2 Form W-4, Step 2 Forrn W-4 Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: $0 $120 $0 $0 $0 $0 $120 $130 $O $0 $0 $0 $0 $0 $0 $130 $140 $1 $0 $0 $0 $0 $0 $140 $150 $0 $2 $0 $0 $0 $0 $150 $160 $3 $0 $0 SO $0 $0 $160 $170 $0 $0 $0 SO $10 $170 $5 $180 $0 $0 $0 $0 $0 $6 $180 $190 $0 $0 SO $1 so $190 S7 $200 $0 $0 SO 92 SO SB $200 $210 $0 $0 $0 $3 $0 $9 $210 $220 $0 $0 $0 $4 $0 $10 $220 $230 $0 $0 sa $5 $0 $230 $11 $240 $0 $0 $0 $6 $0 $12 $240 $250 $0 $1 $0 $7 $1 $13 $250 $260 $0 $2 $0 $8 $2 $14 $260 $270 $0 $3 SO $9 $3 $16 $270 $280 $0 $4 $0 S10 $4 $17 $280 $290 $0 $5 $0 $11 $5 $18 $290 $300 $6 SO $12 S6 $19 $300 $310 $0 $7 SO $13 $7 $20 $310 $320 $0 $8 $0 $14 $8 $22 $320 $330 SO $9 SO $15 $9 $23 $330 $340 $0 $10 $0 $16 $10 S24 $340 $350 SO $11 SO $17 $11 $25 $350 $360 $0 $12 SO $18 $12 $26 $360 $370 $0 $13 1 $20 $13 $28 $370 $380 $0 $14 52 $21 $14 $29 $380 $390 $0 $15 $22 $15 $30 $390 $400 so $16 $4 $23 $16 $31 $400 $410 $0 $17 $5 $24 $17 $32 $410 $420 $0 $18 $26 S18 $34 $420 $430 $0 $19 57 $27 $19 $35 $430 $440 $0 $20 sa $28 $20 $36 $440 $450 $0 $21 $9 $29 $21 $37 $450 $460 $0 $22 S10 $30 $22 $38 $460 $470 $ $0 $23 $11 $32 $23 $40 $470 $480 $0 $25 $12 $33 $25 $41 $480 $490 $26 $13 $34 $26 $42 $490 $500 $2 $27 $14 $35 $27 $443 $500 $510 $28 $15 $36 $28 $44 $510 $520 $4 $29 $16 $38 $.29 $47 $520 $530 $5 $17 $39 $31 $49 $530 $540 $6 $32 $18 $40 $32 $51 $540 $550 $7 $33 $19 $41 $33 $53 $550 $560 $8 $34 $20 S42 $34 $55 $560 $570 $9 $35 $21 $44 $ $35 $58 $570 $580 $10 $37 $22 $45 937 $80 $580 $590 $11 $38 $23 $46 $38 $62 $590 $600 $12 $39 $24 $47 $39 $64 $600 $610 $13 $40 $25 $4a $40 $80 $610 $620 $14 $41 $26 $50 $41 $89 $620 $630 $15 $43 $27 $51 $43 $71 $630 $640 $16 $44 $28 $ 944 873 $640 $650 $17 $45 $29 $53 $45 $75 $650 $660 $18 $46 $30 S54 948 $77 $660 $670 $19 $47 $31 $58 S80 547 $670 $680 $20 $49 $33 $57 $49 $82 $680 $690 $50 S34 ssa $50 984 $690 $700 $22 $51 $35 $50 $51 saa $700 $710 $23 S52 $30 SOL 952 $88 $710 $720 $24 $53 $37 $8.44 $53 501 $720 $730 $25 S55 300 503 339 $38 TAN CHA dan $31 $21 $77 $980 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 1h) is Form W-4. Step 2 Form W-4. Step 2 Form W-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding Al least than The Tentative Withholding Amount is: $760 $770 $29 $59 $43 $75 $59 $102 $770 $780 $39 561 $45 $77 $61 $104 $780 $790 $31 562 $46 $79 $62 $106 $790 $800 $32 $63 547 81 $63 $108 $800 $810 $33 $64 548 $83 $64 $110 $810 $820 $34 $65 $49 $86 $65 $113 $820 $830 $35 $67 551 $88 $67 $115 $830 $840 $36 $68 552 $90 $68 $117 $B40 $850 $37 $69 $53 $92 $69 $119 $850 $860 $38 $70 $54 $94 $70 $121 $860 $870 $39 $71 $55 $97 $71 $870 $124 $880 $40 $73 $57 $99 $73 $126 $880 $890 $41 $74 $58 $ 101 $74 $128 $890 $900 $43 $75 $59 $103 $75 $130 $900 $910 $44 $76 $60 $105 $76 $132 $910 $920 $45 361 $108 $77 $135 $920 $930 $46 $79 $63 $110 $79 $137 $930 $940 $47 $80 $64 $112 $80 $139 $940 $950 $49 $81 $65 $114 $81 $141 $950 $960 $50 $82 S66 $116 $82 $144 M. $960 $970 $51 $83 $67 $119 $83 $146 $970 $980 $52 $85 $69 $121 $85 $148 $990 $53 $86 $70 $123 S88 $990 $ 151 $1,000 $55 $87 $71 $125 $1.000 S87 $153 $1,010 $56 $88 $72 $127 $88 $156 $1,010 $1,020 $57 $90 $73 $130 $90 $158 $1,020 $1,030 $58 $92 $75 $132 S92 $160 $1,030 $1,040 $59 $94 $76 $135 $94 $1,040 $163 $1,050 $61 $96 $77 $137 $96 $1,050 $ 165 $1,060 $62 $99 $78 S139 $99 $168 $1,060 $1,070 $63 $101 $79 $142 S101 $170 $1,070 $1,080 564 $81 $144 $103 $1,080 $172 $1,090 $65 $105 $82 $147 $105 $1,090 $1,100 $175 $67 $107 $83 $149 $107 $177 $1,100 $1,110 S68 $110 $84 S151 $110 $180 $1.110 $1,120 $69 $112 85 $154 $112 $1,120 S182 $1,130 $70 $114 S87 $156 $114 $1,130 $184 $1,140 $71 $116 S88 $159 $116 $187 $1,140 $1,150 $73 $118 S89 $161 $118 S189 $1,150 $1,160 $74 $121 $90 $163 $121 $192 $1,160 $1 170 $75 $123 $91 $1,170 $166 $123 $1,180 $76 $194 $125 $93 $168 $1,180 $125 $196 $1,190 $77. $127 594 $171 $127 $199 $1,190 $1,200 $79 $ 129 $95 $173 $1,200 $ 129 $1,210 $80 $201 $132 $96 $175 $132 $204 $1,210 $1,220 S81 $134 $97 $178 $134 $1,220 $206 $1,230 $82 $136 $99 $180 $1,230 $136 $1,240 $83 $208 $138 $100 S183 $1,240 $1,250 $138 $211 $85 $140 S 101 $140 $213 $1,250 $1,260 $86 $143 $ 102 $187 $143 $1,260 $1,270 $87 $145 $103 $190 $1,270 $145 $1,280 $88 $147 $218 $105 $192 $147 $1,280 $1.290 $89 $149 $220 $195 $149 $1,290 $1,300 $91 $151 $223 $107 $1971 $1,300 $151 $1,310 $225 $92 $154 $106 $199 $154 $228 $1,310 $1,320 $93 $156 $109 S202 $156 $1,320 $1,330 $94 $158 $116 $204 $230 $1,330 $ 158 $1,340 $95 $180 $232 $112 $207 $160 $1,340 $1,350 $97 $182 $235 $113 $209 $1,350 $ 182 $98 $237 $1,360 $185 $114 $211 $165 $240 $1,360 $1,370 $99 $187 $115 $1,370 $214 $167 $242 $1,380 $100 $109 $117 $216 $1,380 $169 $1,390 $101 $171 $244 $118 $1,390 $219 $1,400 $103 $173 $247 $171 $119 $221 $173 - $249 THE $103 $185 S216 $106 $184 $189 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later WEEKLY Payroll Period If the Adjusted Wage Married Flling Jointly Head of Household Single or Married Filing Separate Amount (line Thy is Form W-4. Step 2 Form W-4, Step 2 Form W-4, Step Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding withholding withholding Alleast than The Tentative Withholding Amount is: $1,410 $1,420 $105 $178 $124 $226 $178 $2 $1,420 $1,430 $106 $180 $126 $228 $180 $2 $1,430 $1,440 $107 $ 182 $128 $231 $182 $2 $1,440 $1,450 $109 $130 $233 $184 $28 $1,450 $1,460 $110 $187 $133 $235 $187 $26 $1,460 $1,470 $111 $135 $238 $189 $26 $1,470 $1,480 5112 5191 $137 $240 $191 $26 $1,480 $1,490 $113 5193 $ 139 $243 $193 $27 $1,490 $1,500 $115 $195 $141 $245 $195 $27 $1,500 $1,510 $116 5198 $144 $247 $198 $27 $1,510 $1,520 $117 $200 $ 146 $250 $200 $278 $1,520 $1,530 $118 $202 $ 148 5252 $202 $280 $1,530 $1,540 $119 $204 $150 $255 $204 $283 $1,540 $1,550 $121 $206 $152 $257 $206 $285 $1,550 $1,560 $122 $209 $ 155 $259 $209 $288 $1,560 $1,570 $123 $211 $157 $262 $211 $290 $1,570 $1,580 $124 $213 $159 $264 $213 $292 $1,580 $1,590 $125 $215 $161 $267 $215 $1,590 $295 $1,600 $127 $217 $ 163 $269 $217 $297 $1,600 $1,610 $128 $220 $166 $271 $220 $300 $1,610 $1,620 $129 $222 $168 $274 $222 $302 $1,620 $1,630 $130 $224 $ 170 $276 $224 $304 $1,630 $1,640 $131 $226 $ 172 $279 $226 $307 $1,640 $1,650 $133 $228 $174 $281 $228 $309 $1,650 $1,660 $134 $231 $177 $283 $231 $312 $1.660 $1,670 $135 $233 $179 $286 $233 $314 $1,670 $1,680 $138 $235 $181 $288 $235 S3 16 $1,680 $1,690 $137 $237 $183 $291 5237 $319 $1,690 $1,700 $ 139 $239 $185 $293 $239 $322 $1,700 $1,710 $140 $242 $ 188 $295 $242 $325 $1,710 $1,720 $ 141 $244 $190 $298 $244 $328 $1,720 $1,730 $142 $246 $ 192 $300 $246 $331 $1,730 $1,740 $143 $248 $194 $303 $248 $335 $1,740 $1.750 $145 $250 $196 $305 $250 $338 $1,750 $1,760 $146 $253 $308 $253 $341 $1,760 $1,770 $147 $255 $201 $311 5255 $344 $1,770 $1,780 $ 148 5257 $203 $314 5257 $347 $1,780 $1,790 $ 149 $259 $205 S317 $259 5351 $1,790 $1,800 $151 $261 $207 $321 $261 $354 $1,800 $1,810 $152 $210 S324 $264 $357 $1,810 $1,820 $153 $266 $212 $327 5266 $360 $1,820 $1,830 $154 $214 $330 $268 $363 $1,830 $1,840 $216 $333 $270 S367 $1,840 $1,850 $ 157 $272 $218 $337 $1,850 $1,860 $ 158 $221 $340 $275 $1373 $1,860 $1,870 $ 159 $277 $223 $343 $277 $1,870 $1,880 $376 $ 160 $279 $225 $346 $279 $1,880 $1,890 $181 $281 $379 $227 $349 $281 $1.890 $1,900 $ 163 $284 $383 $229 $353 $284 $386 $1,900 $1,910 $164 $286 $232 $356 $286 $389 $1,910 $1,920 $165 $289 $234 $359 $289 $392 $1,920 $1,930 $166 $291 $236 $362 $291 $395 $199 $264 $268 $155 $270 $275 $272 $370 so $0 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line this Form W-4, Step 2 Form W-4. Step 2 Form W-4. Step 2 Standard Checkbox Standard Checkbox Standard Checkbox But less withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: SO $240 $0 $0 SO SO SO SO $240 $250 SO SO $0 $1 $250 $260 $0 SO SO SO so $260 $270 $0 SO SO SO SO $3 $270 $280 $0 SO SO SO SO $4 $280 $290 $0 SO so SO SO $5 $290 $300 $0 SO SO $0 SO $300 $310 SO $0 SO SO SO $7 $310 $320 SO $0 SO $0 $0 $8 $320 $330 SO so SO SO $0 $9 $330 $340 $0 SO SO $o so $10 $340 $350 SO SO SO SO so $11 $350 $360 SO SO so SO $12 $360 $370 $0 SO S1 $0 $13 $370 $380 SO $0 SO S2 so $14 $380 $390 $0 SO SO $3 $0 $15 $390 $400 $0 $0 $0 $4 $0 $16 $400 $410 $0 SO so $5 SO $17 $410 $420 $0 $0 SO $6 so $18 $420 $430 SO $0 sa $7 $0 $19 $430 $445 $0 $0 SO $8 $0 $20 $445 $460 so $0 SO $9 $0 $22 $460 $475 $0 $0 SO $11 SO $24 $475 $490 SO $1 SO $12 $1 $25 $490 $505 $0 $2 $0 $14 $2 $27 $505 $520 SO $4 SO $15 $4 $520 $29 $535 $0 $5 SO $5 $31 $535 $550 $0 $7 $0 $18 $7 $33 $550 $565 $0 $8 SO $20 $8 $565 $580 $34 $0 $10 SO $21 $10 $38 $580 $595 SO $11 $0 $23 $595 $610 $11 $38 $0 $13 SO $24 $13 $610 $40 $625 $0 $14 SO $26 $625 $14 $42 $640 $0 $10 $0 $27 $16 $640 $655 $43 $0 $17 SO S29 $17 545 $655 $670 SC $19 SO $31 $685 $19 $47 so S20 SO $33 $685 $20 $700 $49 so S22 SO $700 $35 $715 $22 $51 $0 S23 $0 $715 $36 $23 $730 SO $52 $25 $1 $25 $54 $730 $745 $0 S26 S2 $40 $745 $760 so $28 $26 $56 $4 $42 $760 $775 $28 SO $58 $29 $5 $44 $775 $790 SO $29 $31 $60 $790 $7 $805 $45 $0 $31 $32 561 $8 $47 $32 $63 $805 $820 $c $34 $10 $49 $835 $34 $0 $35 $65 $11 $835 $51 $850 $O S37 $35 $13 $67 $53 $850 $865 SO $37 S38 $14 $69 $865 $880 $54 SO $38 S40 $16 $70 $56 $40 $72 $880 $895 $0 $42 $895 $17 $58 $910 $42 SO $43 $910 $74 $925 $19 $60 so $43 $45 $20 $76 $925 $940 $0 $47 $45 $22 $940 $63 $0 $49 $47 $79 $23 $65 $49 $955 $970 $81 $1 $51 $25 $970 $985 S67 $2 $52 $51 $26 $985 $83 $1,000 $69 $4 $54 $52 $1,000 $28 $85 $1,015 $71 $5 S56 $54 $1,015 529 $87 $1,035 $7 $72 $58 $31 $56 $75 $88 $1,035 S58 $1,055 $9 S61 $92 $1,055 $33 $77 $1,075 $11 SB3 $1,075 $35 $96 $1,095 $13 $79 $65 $83 $1,095 S37 $ 101 $1,115 $15 $82 $68 $65 $39 $1,115 $105 $1,135 $84 $17 $68 $70 S110 $17 $38 $820 $62 $955 $78 $77 CAVALLOWFUmurayronyms TTON TO US BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Amount (line thy is Single or Married Filing Separately Form W-4, Step 2 Form W 4. Step 2 Form W-4, Step 2 Standard Checkbox Standard Checkbox Standard Checkbox Butless withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is: $1,135 $1,155 $19 $73 $43 $89 $1,155 $1,175 SZI $73 $75 $118 $45 $91 $1,175 $1,195 $23 $75 $77 547 $123 $1,195 $94 $1.215 $25 $80 $49 $127 $96 $1,215 $1,235 $27 $80 $82 $132 551 $99 $82 $136 $1,235 $1,255 $29 $85 $53 $ 101 $1,255 $1,275 $85 $31 $87 $140 $55 S103 $1,275 $1,295 $33 $87 $89 $57 $145 $106 $1,295 $1,315 $89 $35 $92 $149 $60 $108 $1,315 $92 $1,335 $37 $154 $94 $62 $111 $94 $1,335 $ 158 $1,355 $39 $97 $64 $113 $1,355 $1,375 $41 $97 $99 $67 $162 $115 $1,375 $1,395 $43 $99 $101 $167 $69 $118 $101 $1,395 $1,415 $45 $104 $171 $72 $122 $1,415 $1,435 $104 $47 $176 $106 $74 $126 $106 $180 $1,435 $1,455 $49 $109 $76 $130 $1,455 $1,475 $ 109 $51 $184 $111 $79 $135 $1,475 $1,495 $111 $189 $53 $113 $81 $1,495 $1,515 $ 139 $113 $193 $55 $116 $84 $144 $1,515 $116 $198 $1,535 $57 $118 $86 $148 $118 $202 $1,535 $1,555 $59 $1,555 $121 $88 $152 $1,575 $121 $61 $206 $123 $1,575 $91 $ 157 $1,595 $123 $63 $211 $125 $93 $161 $1,595 $125 $1,615 $65 $215 $128 $1,615 $96 $166 $1,635 $128 567 $220 $130 $98 $170 $130 $224 $1,635 $1,655 $69 $133 $100 $174 $1,655 $133 $228 $1,675 $71 $135 $179 $1,675 $1,695 $135 $233 $73 $137 $1,695 $105 $1,715 $183 $137 $237 $75 $140 $1,715 S108 $188 $140 $1.735 $77 5142 $242 $110 $192 $142 $246 $1,735 $80 $145 $112 $1,755 $196 $145 $1,775 $250 $82 $147 $115 $1,775 $201 $1,795 $147 $255 $85 S149 $117 $1,795 $205 $149 $1.815 $87 $152 $259 $120 $210 $1,815 $152 $1,835 $264 $89 $154 $122 $214 $154 S268 $1,835 $1,855 $92 5157 $124 $218 $1,855 $1,875 $157 $94 $272 $159 $127 $223 $1,875 $159 $1,895 $97 $277 $161 $129 $227 $1,895 $1.925 $161 $100 $281 $164 $132 $1,925 $233 $1,955 S103 $164 $168 S136 $287 $239 $168 $295 $1,955 $1,985 $107 $172 $139 $246 $1,985 $172 $2,015 $110 $175 $302 $143 $252 $2,015 $175 $2,045 $114 $309 $2,045 $180 $147 $260 $2,075 $180 $118 S316 $186 S150 $267 $2,075 $2,105 $121 $193 $154 $323 5274 $193 $331 $2,105 $2,135 $125 $157 $281 $2,135 $2,165 $12B $200 $206 $338 $161 $345 $2,165 $2,195 $206 5132 $213 S165 $2,195 $2,225 5136 $219 $168 $352 S303 $2,225 $2.255 $139 $226 $172 $359 $310 $226 $367 $2,255 $2,285 $143 $233 S175 $317 $2,285 $2,315 $233 146 $239 $179 $374 $2,315 $324 $239 $2,345 $150 $246 $183 $381 $332 $2,345 $248 $2,375 $154 $252 $186 $388 $339 $2,375 $2,405 $252 $157 $395 $259 $190 $346 $259 $403 $2,405 $2,435 $193 $353 $2,435 $2,465 $164 $266 $272 $197 $410 $360 $2,465 $2,495 $168 $272 $279 $201 $417 $368 $2,495 $2,525 $279 $172 $285 $424 $204 $375 $2.525 $2,555 $175 $292 $285 $431 $382 $292 $439 $2,555 $2,585 $179 $299 $211 $389 $2,585 $2,615 $182 $305 $299 $448 $215 S396 $2,615 $2,645 $305 S186 $312 $453 $219 $2,645 $2,675 $404 $190 $318 $312 $222 $460 $2,675 $318 $2,705 $193 $325 S467 $226 $418 $325 $475 S103 $1,755 $186 $200 $288 $296 $213 $219 $161 $266 $208 $411 436 Appendix C Federal Income Tax Tables But less $391 2020 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Married Filing Jointly Head of Household Single or Married Filing Separately Amount (line 1h) is Form W-4, Step 2 Form W-4. Step 2 Form W-4, Step 2 Standard Checklas Standard Checkbox Standard Checkbox withholding withholding withholding withholding withholding withholding At least than The Tentative Withholding Amount is. $2.705 $2,735 $197 $332 $229 $425 $332 $2,735 $482 $2,765 $200 $338 $233 $432 $2,765 $338 $489 $2,795 $204 $345 $237 $440 $345 $496 $2,795 $2,825 $208 $351 $243 $447 $2,825 $351 $503 $2,855 $211 $358 $250 $454 $358 $511 $2,855 $2,885 $215 $365 $2,885 $256 $461 $365 $518 $2,915 $218 $371 $263 $468 $371 $2,915 $525 $2,945 $222 $378 $269 $2,945 $476 $378 $532 $2,975 5226 $384 $2,975 $276 $483 $384 $3,005 $539 $229 $391 $283 $490 $547 $3,005 $3,035 $233 $398 $289 $3,035 $497 $398 $554 $3,065 $236 $404 $3,065 $296 $504 $404 $561 $3,095 $240 SA11 $3,095 $302 $512 $411 $568 $3,125 5244 5417 $3,125 $309 $519 $417 $575 $3,155 $247 $424 $316 $526 $424 $583 $3,155 $3,185 5251 $3,185 $322 $533 $431 $590 $3,215 5254 $3,215 $437 $540 $437 $3,245 $597 $258 $444 $335 $3,245 $444 $3,275 $604 $262 $450 $3,275 $342 5555 $3,305 $450 $265 $611 5457 $349 $562 $457 $619 $3,305 $3,335 $269 $3,335 $355 5569 $3,365 $464 $626 $470 $362 $576 $3,365 $470 $3,395 $633 $276 $368 $3,395 $584 $3,435 $477 $280 5640 5484 $376 $3,435 $3,475 $592 5285 $484 $493 $651 $385 $602 $493 $664 $3,475 $3,515 $290 $502 $394 $3,515 5611 $3,555 $502 $677 $295 $511 $403 $624 $3,555 $3,595 5299 $511 $690 $520 $3,595 $3,635 $411 $636 $304 S520 $703 $3,635 $528 $420 $649 $3,675 $309 $528 $537 $715 $429 $662 $537 $728 $3,675 $3,715 $314 $546 $438 $3,715 $675 $3,755 $319 $546 5555 $447 $741 $3,755 $3,795 5323 $688 $564 $555 $754 $455 $3,795 $700 $3,835 $328 $564 $767 $464 $3,835 $713 $3,875 $333 $583 $573 $473 $779 $726 $583 $792 $431 $329 $548 $464 $272 $477 $573

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started