Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 5-22 PRESENT VALUE OF AN ANNUITY A) Invest 2.500 Years 10 Percent 7% PV = B) Invest 70 Years 3 Percent 3% PV =

| PROBLEM 5-22 | ||||

| PRESENT VALUE OF AN ANNUITY | ||||

| A) | ||||

| Invest | 2.500 | |||

| Years | 10 | |||

| Percent | 7% | |||

| PV = | ||||

| B) | ||||

| Invest | 70 | |||

| Years | 3 | |||

| Percent | 3% | |||

| PV = | ||||

| C) | ||||

| Invest | 280 | |||

| Years | 7 | |||

| Percent | 6% | |||

| PV = | ||||

| D) | ||||

| Invest | 500 | |||

| Years | 10 | |||

| Percent | 10% | |||

| PV = | ||||

| MINI CASE | ||||

| A) | ||||

| B) | ||||

| C) | ||||

| 1) | ||||

| PV= | 5.000 | |||

| i= | 8% | |||

| n= | 10 | |||

| FV= | ||||

| 2) | ||||

| FV= | 1.671 | |||

| PV= | 400 | |||

| i= | 10% | |||

| n= | ||||

| 3) | ||||

| FV= | 4.046 | |||

| PV= | 1.000 | |||

| n= | 10 | |||

| i= | ||||

| D) | ||||

| PV= | 1.000 | |||

| i= | 10% | |||

| n= | 5 | |||

| FV= | ||||

| E) | ||||

| F) | ||||

| PMT= | 1.000 | |||

| i= | 10% | |||

| n= | 7 | |||

| PV= | ||||

| PV(a.d.)= | ||||

| G) | ||||

| PMT= | 1.000 | |||

| i= | 10% | |||

| n= | 7 | |||

| FV= | ||||

| FV(a.d.)= | ||||

| H) | ||||

| PV= | 100.000 | |||

| i= | 10% | |||

| n= | 25 | |||

| PMT= | ||||

| I) | ||||

| PP= | 1.000 | |||

| i= | 8% | |||

| PV= | ||||

| J) | ||||

| PMT= | 1.000 | |||

| i= | 10% | |||

| n= | 10 | |||

| n= | 9 | |||

| PV= | ||||

| K) | ||||

| PP= | 1.000 | |||

| i= | 10% | |||

| n= | 9 | |||

| PV= |

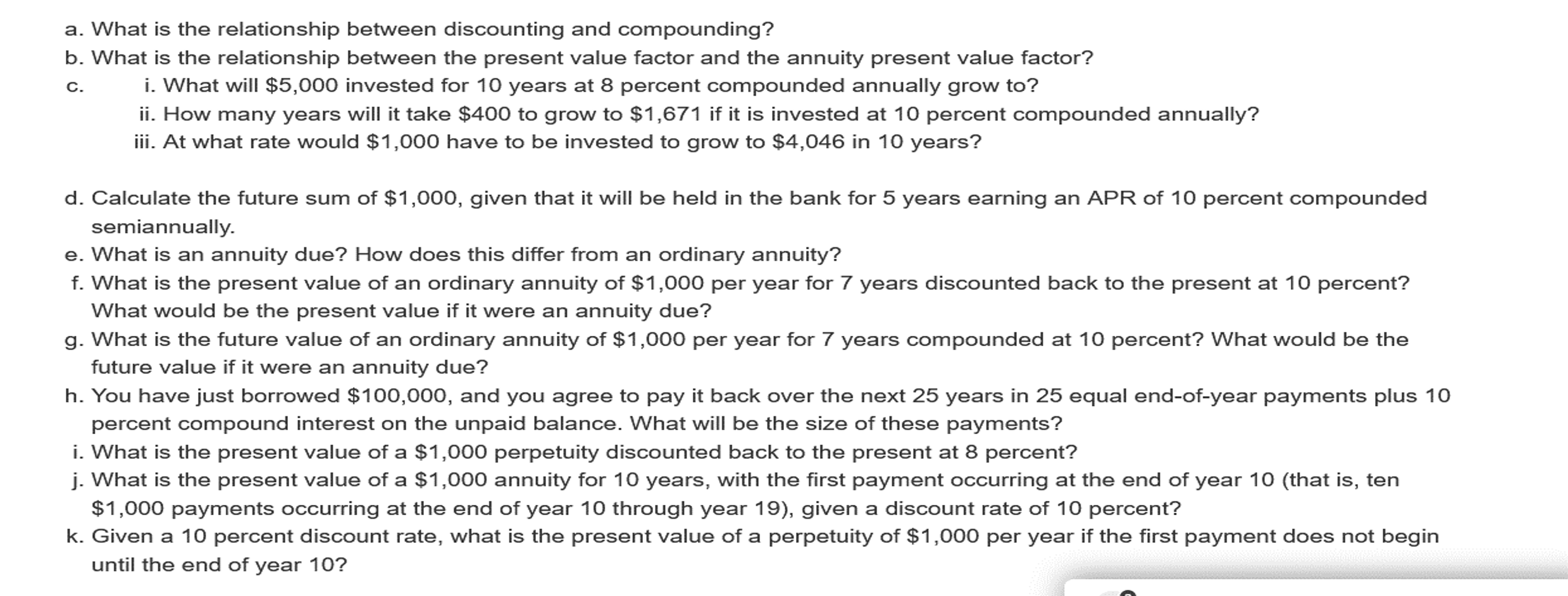

a. What is the relationship between discounting and compounding? b. What is the relationship between the present value factor and the annuity present value factor? c. i. What will $5,000 invested for 10 years at 8 percent compounded annually grow to? ii. How many years will it take $400 to grow to $1,671 if it is invested at 10 percent compounded annually? iii. At what rate would $1,000 have to be invested to grow to $4,046 in 10 years? d. Calculate the future sum of $1,000, given that it will be held in the bank for 5 years earning an APR of 10 percent compounded semiannually. e. What is an annuity due? How does this differ from an ordinary annuity? f. What is the present value of an ordinary annuity of $1,000 per year for 7 years discounted back to the present at 10 percent? What would be the present value if it were an annuity due? g. What is the future value of an ordinary annuity of $1,000 per year for 7 years compounded at 10 percent? What would be the future value if it were an annuity due? h. You have just borrowed $100,000, and you agree to pay it back over the next 25 years in 25 equal end-of-year payments plus 10 percent compound interest on the unpaid balance. What will be the size of these payments? i. What is the present value of a $1,000 perpetuity discounted back to the present at 8 percent? j. What is the present value of a $1,000 annuity for 10 years, with the first payment occurring at the end of year 10 (that is, ten $1,000 payments occurring at the end of year 10 through year 19), given a discount rate of 10 percent? k. Given a 10 percent discount rate, what is the present value of a perpetuity of $1,000 per year if the first payment does not begin until the end of year 10? a. What is the relationship between discounting and compounding? b. What is the relationship between the present value factor and the annuity present value factor? c. i. What will $5,000 invested for 10 years at 8 percent compounded annually grow to? ii. How many years will it take $400 to grow to $1,671 if it is invested at 10 percent compounded annually? iii. At what rate would $1,000 have to be invested to grow to $4,046 in 10 years? d. Calculate the future sum of $1,000, given that it will be held in the bank for 5 years earning an APR of 10 percent compounded semiannually. e. What is an annuity due? How does this differ from an ordinary annuity? f. What is the present value of an ordinary annuity of $1,000 per year for 7 years discounted back to the present at 10 percent? What would be the present value if it were an annuity due? g. What is the future value of an ordinary annuity of $1,000 per year for 7 years compounded at 10 percent? What would be the future value if it were an annuity due? h. You have just borrowed $100,000, and you agree to pay it back over the next 25 years in 25 equal end-of-year payments plus 10 percent compound interest on the unpaid balance. What will be the size of these payments? i. What is the present value of a $1,000 perpetuity discounted back to the present at 8 percent? j. What is the present value of a $1,000 annuity for 10 years, with the first payment occurring at the end of year 10 (that is, ten $1,000 payments occurring at the end of year 10 through year 19), given a discount rate of 10 percent? k. Given a 10 percent discount rate, what is the present value of a perpetuity of $1,000 per year if the first payment does not begin until the end of year 10

a. What is the relationship between discounting and compounding? b. What is the relationship between the present value factor and the annuity present value factor? c. i. What will $5,000 invested for 10 years at 8 percent compounded annually grow to? ii. How many years will it take $400 to grow to $1,671 if it is invested at 10 percent compounded annually? iii. At what rate would $1,000 have to be invested to grow to $4,046 in 10 years? d. Calculate the future sum of $1,000, given that it will be held in the bank for 5 years earning an APR of 10 percent compounded semiannually. e. What is an annuity due? How does this differ from an ordinary annuity? f. What is the present value of an ordinary annuity of $1,000 per year for 7 years discounted back to the present at 10 percent? What would be the present value if it were an annuity due? g. What is the future value of an ordinary annuity of $1,000 per year for 7 years compounded at 10 percent? What would be the future value if it were an annuity due? h. You have just borrowed $100,000, and you agree to pay it back over the next 25 years in 25 equal end-of-year payments plus 10 percent compound interest on the unpaid balance. What will be the size of these payments? i. What is the present value of a $1,000 perpetuity discounted back to the present at 8 percent? j. What is the present value of a $1,000 annuity for 10 years, with the first payment occurring at the end of year 10 (that is, ten $1,000 payments occurring at the end of year 10 through year 19), given a discount rate of 10 percent? k. Given a 10 percent discount rate, what is the present value of a perpetuity of $1,000 per year if the first payment does not begin until the end of year 10? a. What is the relationship between discounting and compounding? b. What is the relationship between the present value factor and the annuity present value factor? c. i. What will $5,000 invested for 10 years at 8 percent compounded annually grow to? ii. How many years will it take $400 to grow to $1,671 if it is invested at 10 percent compounded annually? iii. At what rate would $1,000 have to be invested to grow to $4,046 in 10 years? d. Calculate the future sum of $1,000, given that it will be held in the bank for 5 years earning an APR of 10 percent compounded semiannually. e. What is an annuity due? How does this differ from an ordinary annuity? f. What is the present value of an ordinary annuity of $1,000 per year for 7 years discounted back to the present at 10 percent? What would be the present value if it were an annuity due? g. What is the future value of an ordinary annuity of $1,000 per year for 7 years compounded at 10 percent? What would be the future value if it were an annuity due? h. You have just borrowed $100,000, and you agree to pay it back over the next 25 years in 25 equal end-of-year payments plus 10 percent compound interest on the unpaid balance. What will be the size of these payments? i. What is the present value of a $1,000 perpetuity discounted back to the present at 8 percent? j. What is the present value of a $1,000 annuity for 10 years, with the first payment occurring at the end of year 10 (that is, ten $1,000 payments occurring at the end of year 10 through year 19), given a discount rate of 10 percent? k. Given a 10 percent discount rate, what is the present value of a perpetuity of $1,000 per year if the first payment does not begin until the end of year 10 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started