Answered step by step

Verified Expert Solution

Question

1 Approved Answer

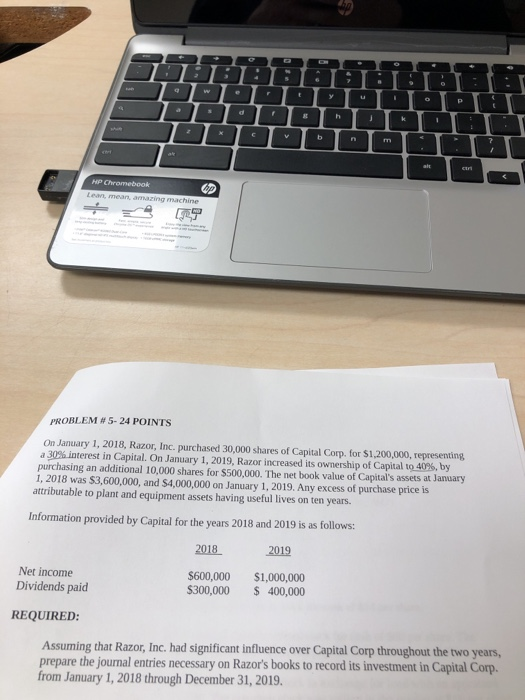

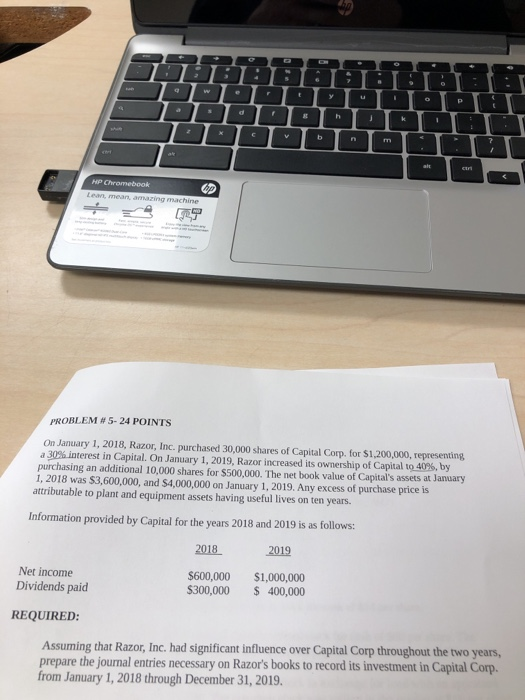

PROBLEM # 5-24 POINTS On January 1, 2018, Razor, Inc. purchased 30,000 shares of Capital Corp. for $1,200,000, representing, a 30% interest in Capital. On

PROBLEM # 5-24 POINTS On January 1, 2018, Razor, Inc. purchased 30,000 shares of Capital Corp. for $1,200,000, representing, a 30% interest in Capital. On January 1, 2019, Razor increased its ownership of Capital to 40%, by purchasing an additional 10,000 shares for $500,000. The net book value of Capital's assets at January 1, 2018 was $3,600,000, and $4,000,000 on January 1, 2019. Any excess of purchase price is attributable to plant and equipment assets having useful lives on ten years Information provided by Capital for the years 2018 and 2019 is as follows: 2018 2019 Net income Dividends paid $600,000 $1,000,000 S300,000 400,000 REQUIRED: Assuming that Razor, Inc. had significant influence over Capital Corp throughout the two years, prepare the journal entries necessary on Razor's books to record its investment in Capital Corp. from January 1, 2018 through December 31, 2019

PROBLEM # 5-24 POINTS On January 1, 2018, Razor, Inc. purchased 30,000 shares of Capital Corp. for $1,200,000, representing, a 30% interest in Capital. On January 1, 2019, Razor increased its ownership of Capital to 40%, by purchasing an additional 10,000 shares for $500,000. The net book value of Capital's assets at January 1, 2018 was $3,600,000, and $4,000,000 on January 1, 2019. Any excess of purchase price is attributable to plant and equipment assets having useful lives on ten years Information provided by Capital for the years 2018 and 2019 is as follows: 2018 2019 Net income Dividends paid $600,000 $1,000,000 S300,000 400,000 REQUIRED: Assuming that Razor, Inc. had significant influence over Capital Corp throughout the two years, prepare the journal entries necessary on Razor's books to record its investment in Capital Corp. from January 1, 2018 through December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started