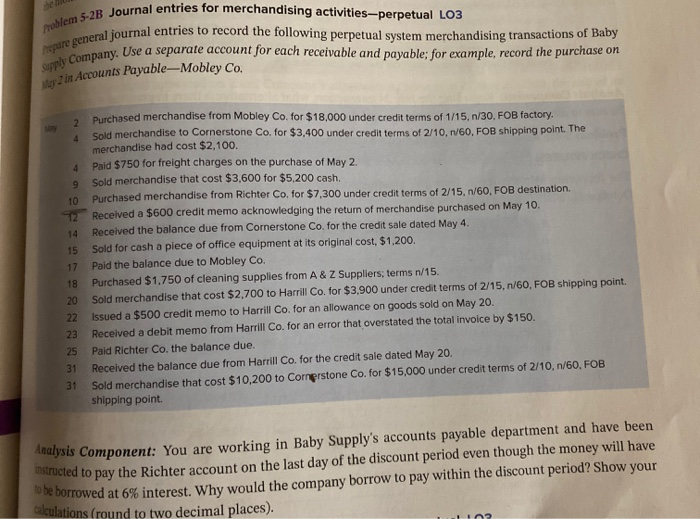

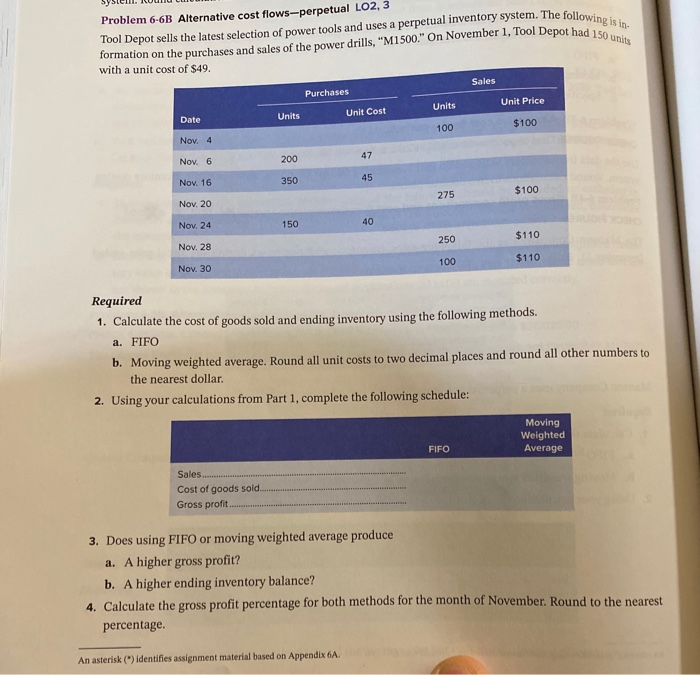

Problem 5-2B Journal entries for merchandising activities-perpetual LO3 sure general journal entries to record the following perpetual system merchandising transactions of Baby Supply Company. Use a separate account for each receivable and payable; for example, record the purchase on May2 in Accounts Payable-Mobley Co. 4 4 9 10 2 14 15 17 18 20 22 23 25 31 31 Purchased merchandise from Mobley Co. for $18,000 under credit terms of 1/15, n/30. FOB factory Sold merchandise to Cornerstone Co, for $3,400 under credit terms of 2/10, 1/60, FOB shipping point. The merchandise had cost $2,100. Paid $750 for freight charges on the purchase of May 2. Sold merchandise that cost $3,600 for $5,200 cash. Purchased merchandise from Richter Co, for $7,300 under credit terms of 2/15, 1/60, FOB destination. Received a $600 credit memo acknowledging the return of merchandise purchased on May 10. Received the balance due from Cornerstone Co. for the credit sale dated May 4. Sold for cash a piece of office equipment at its original cost, $1.200. Paid the balance due to Mobley Co. Purchased $1.750 of cleaning supplies from A & Z Suppliers; terms n/15. Sold merchandise that cost $2,700 to Harrill Co. for $3,900 under credit terms of 2/15. n/60, FOB shipping point. Issued a $500 credit memo to Harrill Co, for an allowance on goods sold on May 20. Received a debit memo from Harrill Co. for an error that overstated the total invoice by $150. Paid Richter Co. the balance due. Received the balance due from Harrill Co. for the credit sale dated May 20. Sold merchandise that cost $10,200 to Cornerstone Co. for $15,000 under credit terms of 2/10,n/60, FOB shipping point. Analysis Component: You are working in Baby Supply's accounts payable department and have been nstructed to pay the Richter account on the last day of the discount period even though the money will have be borrowed at 6% interest. Why would the company borrow to pay within the discount period? Show your calculations (round to two decimal places). 102 Tool Depot sells the latest selection of power tools and uses a perpetual inventory system. The following is in formation on the purchases and sales of the power drills, "M1500." On November 1, Tool Depot had 150 units Problem 6-6B Alternative cost flows-perpetual LO2, 3 with a unit cost of $49. Sales Purchases Unit Price Units Date Units Unit Cost 100 $100 Nov. 4 200 47 Nov. 6 350 45 Nov. 16 $100 275 Nov. 20 Nov. 24 150 40 $110 250 Nov. 28 100 $110 Nov. 30 Required 1. Calculate the cost of goods sold and ending inventory using the following methods. a. FIFO b. Moving weighted average. Round all unit costs to two decimal places and round all other numbers to the nearest dollar. 2. Using your calculations from Part 1, complete the following schedule: Moving Weighted Average FIFO Sales.... Cost of goods sold Gross profit 3. Does using FIFO or moving weighted average produce a. A higher gross profit? b. A higher ending inventory balance? 4. Calculate the gross profit percentage for both methods for the month of November. Round to the nearest percentage. An asterisk (*) identifies assignment material based on Appendix 6A