Answered step by step

Verified Expert Solution

Question

1 Approved Answer

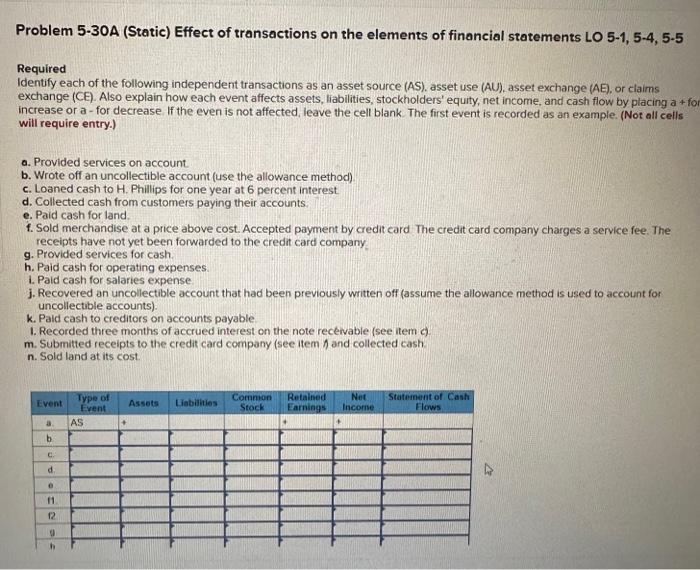

Problem 5-30A (Static) Effect of transactions on the elements of financial statements LO 5-1, 5-4, 5-5 Required Identify each of the following independent transactions as

Problem 5-30A (Static) Effect of transactions on the elements of financial statements LO 5-1, 5-4, 5-5 Required Identify each of the following independent transactions as an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects assets, liabilities, stockholders' equity, net income, and cash flow by placing a + for increase or a - for decrease. If the even is not affected, leave the cell blank. The first event is recorded as an example. (Not all cells will require entry.) a. Provided services on account. b. Wrote off an uncollectible account (use the allowance method). c. Loaned cash to H. Phillips for one year at 6 percent interest. d. Collected cash from customers paying their accounts. e. Paid cash for land. f. Sold merchandise at a price above cost. Accepted payment by credit card. The credit card company charges a service fee. The receipts have not yet been forwarded to the credit card company g. Provided services for cash. h. Paid cash for operating expenses. i. Paid cash for salaries expense. j. Recovered an uncollectible account that had been previously written off (assume the allowance method is used to account for uncollectible accounts). k. Paid cash to creditors on accounts payable I. Recorded three months of accrued interest on the note receivable (see item c). m. Submitted receipts to the credit card company (see item and collected cash. n. Sold land at its cost. Event a. b. C. P e f1 f2 46 9 h Type of Event AS + Assets Liabilities Common Retained Stock Earnings + + Net Income Statement of Cash Flows 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started