Question

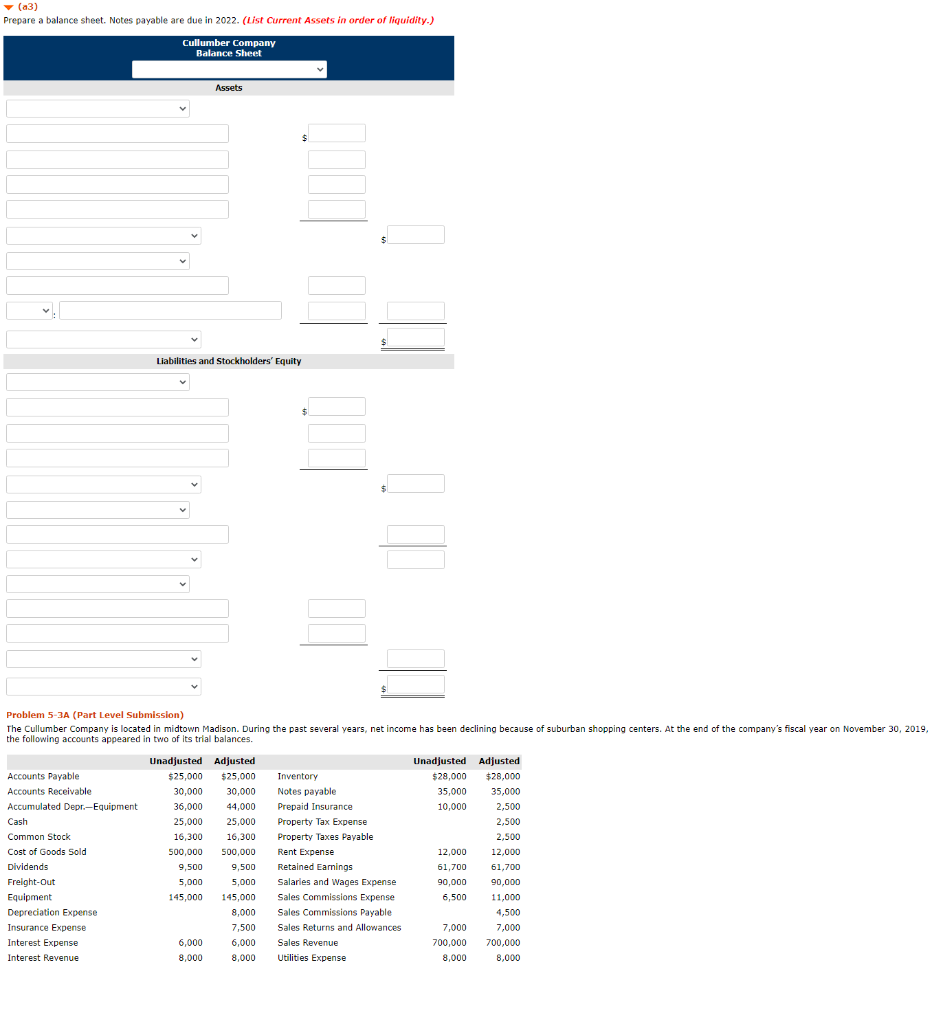

Problem 5-3A (Part Level Submission) The Cullumber Company is located in midtown Madison. During the past several years, net income has been declining because of

Problem 5-3A (Part Level Submission) The Cullumber Company is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the companys fiscal year on November 30, 2019, the following accounts appeared in two of its trial balances. Unadjusted Adjusted Unadjusted Adjusted Accounts Payable $25,000 $25,000 Inventory $28,000 $28,000 Accounts Receivable 30,000 30,000 Notes payable 35,000 35,000 Accumulated Depr.Equipment 36,000 44,000 Prepaid Insurance 10,000 2,500 Cash 25,000 25,000 Property Tax Expense 2,500 Common Stock 16,300 16,300 Property Taxes Payable 2,500 Cost of Goods Sold 500,000 500,000 Rent Expense 12,000 12,000 Dividends 9,500 9,500 Retained Earnings 61,700 61,700 Freight-Out 5,000 5,000 Salaries and Wages Expense 90,000 90,000 Equipment 145,000 145,000 Sales Commissions Expense 6,500 11,000 Depreciation Expense 8,000 Sales Commissions Payable 4,500 Insurance Expense 7,500 Sales Returns and Allowances 7,000 7,000 Interest Expense 6,000 6,000 Sales Revenue 700,000 700,000 Interest Revenue 8,000 8,000 Utilities Expense 8,000 8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started