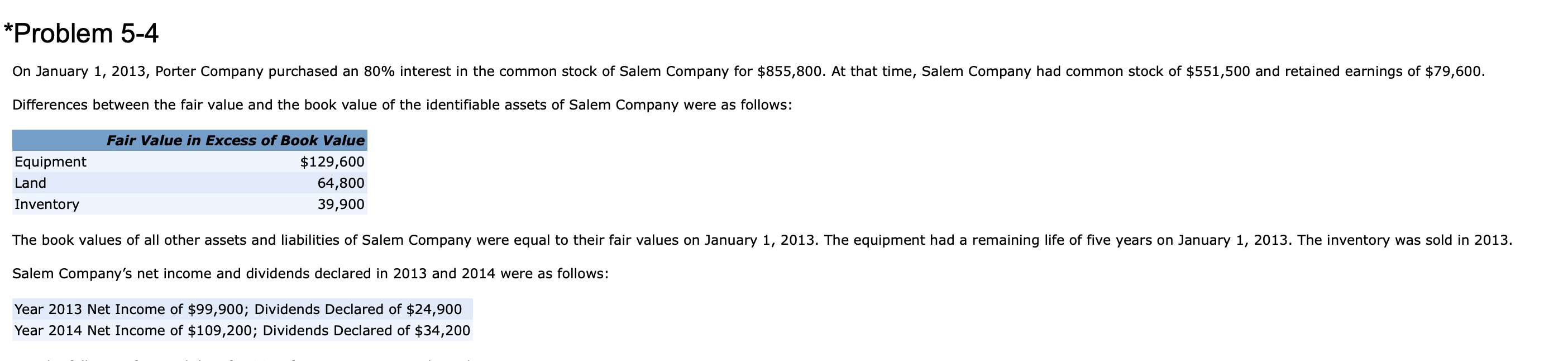

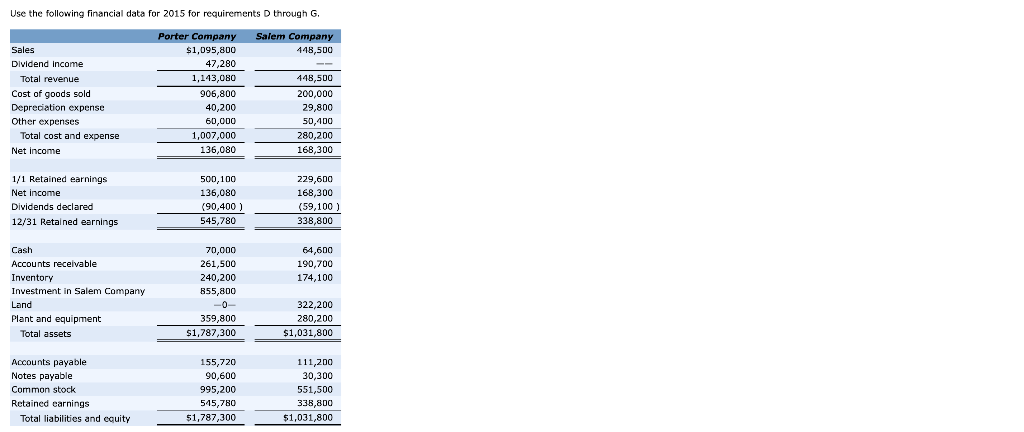

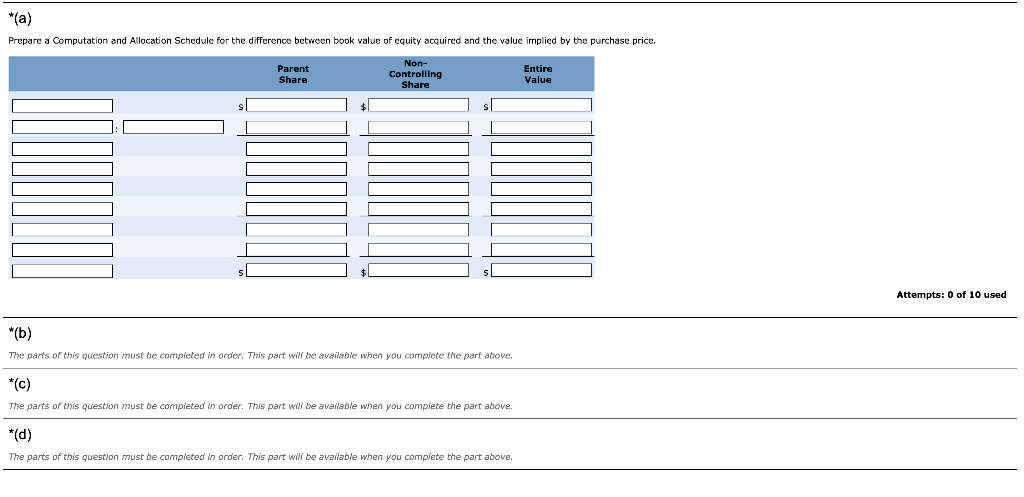

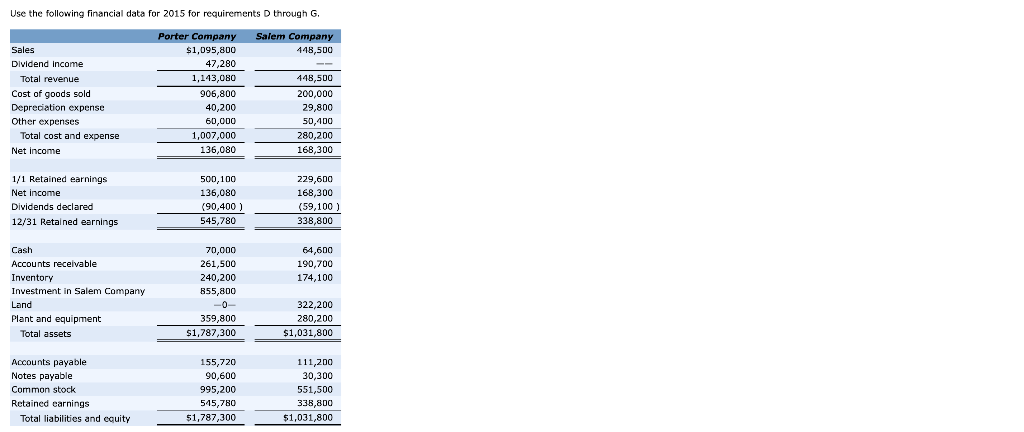

*Problem 5-4 On January 1, 2013, Porter Company purchased an 80% interest in the common stock of Salem Company for $855,800. At that time, Salem Company had common stock of $551,500 and retained earnings of $79,600. Differences between the fair value and the book value of the identifiable assets of Salem Company were as follows: Fair Value in Excess of Book Value Equipment Land Inventory $129,600 64,800 39,900 The book values of all other assets and liabilities of Salem Company were equal to their fair values on January 1, 2013. The equipment had a remaining life of five years on January 1, 2013. The inventory was sold in 2013. Salem Company's net income and dividends declared in 2013 and 2014 were as follows: Year 2013 Net Income of $99,900; Dividends Declared of $24,900 Year 2014 Net Income of $109,200; Dividends Declared of $34,200 Use the following financial data for 2015 for requirements through G. Porter Company $1,095,800 Salem Company 448,500 47,280 Sales Dividend Income Total revenue Cost of goods sold Depreciation expense Other expenses Total cost and expense Net Income 1,143,080 906,800 40,200 60,000 1,007,000 136,080 448,500 200,000 29,800 50,100 280,200 168,300 1/1 Retained earnings Net income Dividends declared 12/31 Retained earnings 500,100 136,080 (90,400) 545,780 229,600 168,300 (59,100 338,800 Cash Accounts receivable Inventory Investment in Salem Company Land Plant and equipment Total assets 70,000 261,500 240,200 855,800 64,600 190,700 174,100 359,800 $1,787,300 322.200 280,200 $1,031.800 Accounts payable Notes payable Common stock Retained earnings Total liabilities and equity 155,720 90,600 995,200 545,780 $1,787,300 111,200 30,300 551,500 338,800 $1,031,800 *(a) Prepare a Computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. Non- Parent Entire Share Controlling Value Share sh Attempts: 0 of 10 used *(b) The parts of this question must be completed in order. This part will be available when you complete the part above. *(c) The parts of this question must be completed in order. This part will be available when you complete the part above. *(d) The parts of this question must be completed in order. This part will be available when you complete the part above. *Problem 5-4 On January 1, 2013, Porter Company purchased an 80% interest in the common stock of Salem Company for $855,800. At that time, Salem Company had common stock of $551,500 and retained earnings of $79,600. Differences between the fair value and the book value of the identifiable assets of Salem Company were as follows: Fair Value in Excess of Book Value Equipment Land Inventory $129,600 64,800 39,900 The book values of all other assets and liabilities of Salem Company were equal to their fair values on January 1, 2013. The equipment had a remaining life of five years on January 1, 2013. The inventory was sold in 2013. Salem Company's net income and dividends declared in 2013 and 2014 were as follows: Year 2013 Net Income of $99,900; Dividends Declared of $24,900 Year 2014 Net Income of $109,200; Dividends Declared of $34,200 Use the following financial data for 2015 for requirements through G. Porter Company $1,095,800 Salem Company 448,500 47,280 Sales Dividend Income Total revenue Cost of goods sold Depreciation expense Other expenses Total cost and expense Net Income 1,143,080 906,800 40,200 60,000 1,007,000 136,080 448,500 200,000 29,800 50,100 280,200 168,300 1/1 Retained earnings Net income Dividends declared 12/31 Retained earnings 500,100 136,080 (90,400) 545,780 229,600 168,300 (59,100 338,800 Cash Accounts receivable Inventory Investment in Salem Company Land Plant and equipment Total assets 70,000 261,500 240,200 855,800 64,600 190,700 174,100 359,800 $1,787,300 322.200 280,200 $1,031.800 Accounts payable Notes payable Common stock Retained earnings Total liabilities and equity 155,720 90,600 995,200 545,780 $1,787,300 111,200 30,300 551,500 338,800 $1,031,800 *(a) Prepare a Computation and Allocation Schedule for the difference between book value of equity acquired and the value implied by the purchase price. Non- Parent Entire Share Controlling Value Share sh Attempts: 0 of 10 used *(b) The parts of this question must be completed in order. This part will be available when you complete the part above. *(c) The parts of this question must be completed in order. This part will be available when you complete the part above. *(d) The parts of this question must be completed in order. This part will be available when you complete the part above