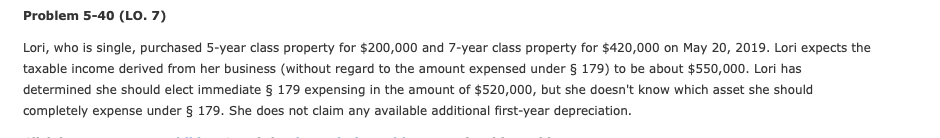

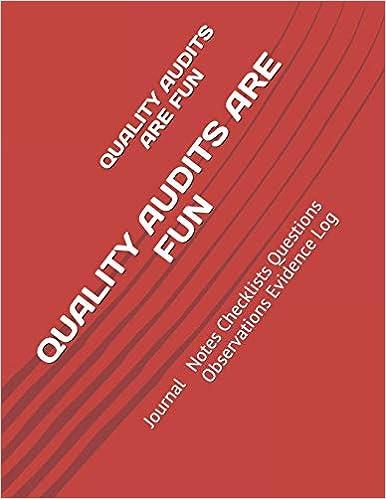

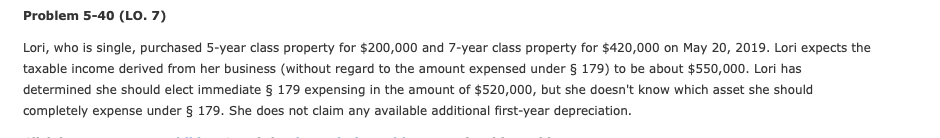

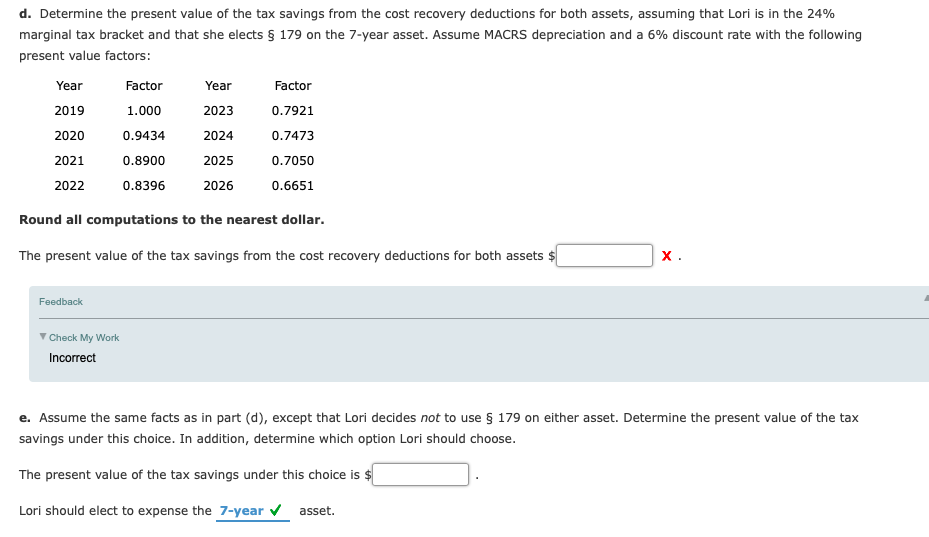

Problem 5-40 (LO. 7) Lori, who is single, purchased 5-year class property for $200,000 and 7-year class property for $420,000 on May 20, 2019. Lori expects the taxable income derived from her business (without regard to the amount expensed under $ 179) to be about $550,000. Lori has determined she should elect immediate $ 179 expensing in the amount of $520,000, but she doesn't know which asset she should completely expense under $ 179. She does not claim any available additional first-year depreciation. d. Determine the present value of the tax savings from the cost recovery deductions for both assets, assuming that Lori is in the 24% marginal tax bracket and that she elects 179 on the 7-year asset. Assume MACRS depreciation and a 6% discount rate with the following present value factors: Factor Year Factor 0.7921 1.000 Year 2019 2020 2021 2022 0.9434 0.8900 0.8396 2023 2024 2025 2026 0.7473 0.7050 0.6651 Round all computations to the nearest dollar. The present value of the tax savings from the cost recovery deductions for both assets $ Feedback Check My Work Incorrect e. Assume the same facts as in part (d), except that Lori decides not to use 179 on either asset. Determine the present value of the tax savings under this choice. In addition, determine which option Lori should choose. The present value of the tax savings under this choice is $ Lori should elect to expense the 7-year asset. Problem 5-40 (LO. 7) Lori, who is single, purchased 5-year class property for $200,000 and 7-year class property for $420,000 on May 20, 2019. Lori expects the taxable income derived from her business (without regard to the amount expensed under $ 179) to be about $550,000. Lori has determined she should elect immediate $ 179 expensing in the amount of $520,000, but she doesn't know which asset she should completely expense under $ 179. She does not claim any available additional first-year depreciation. d. Determine the present value of the tax savings from the cost recovery deductions for both assets, assuming that Lori is in the 24% marginal tax bracket and that she elects 179 on the 7-year asset. Assume MACRS depreciation and a 6% discount rate with the following present value factors: Factor Year Factor 0.7921 1.000 Year 2019 2020 2021 2022 0.9434 0.8900 0.8396 2023 2024 2025 2026 0.7473 0.7050 0.6651 Round all computations to the nearest dollar. The present value of the tax savings from the cost recovery deductions for both assets $ Feedback Check My Work Incorrect e. Assume the same facts as in part (d), except that Lori decides not to use 179 on either asset. Determine the present value of the tax savings under this choice. In addition, determine which option Lori should choose. The present value of the tax savings under this choice is $ Lori should elect to expense the 7-year asset