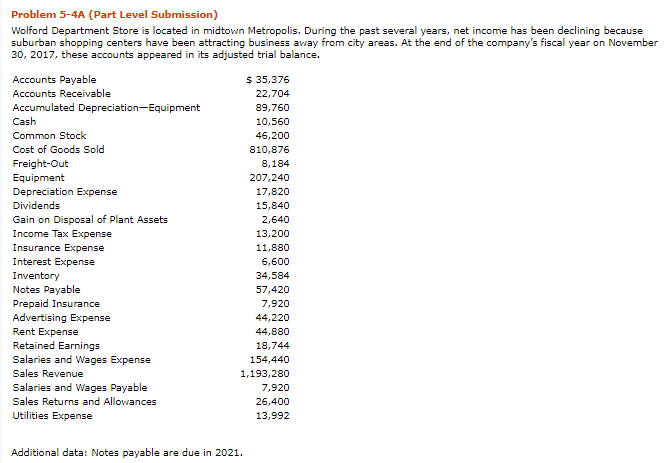

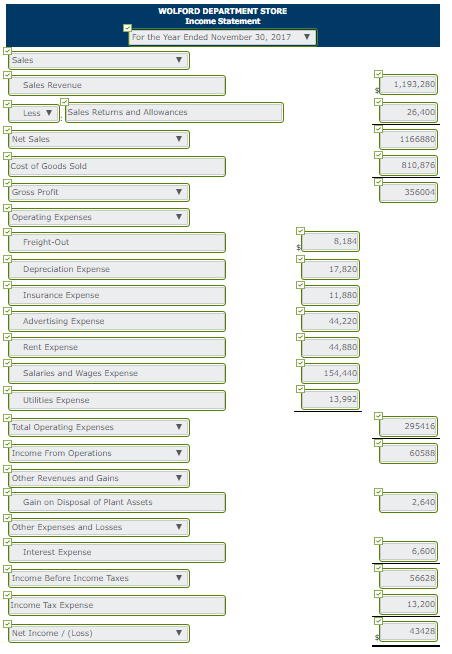

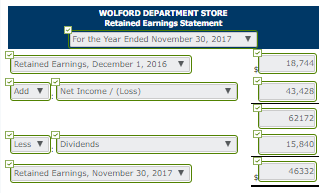

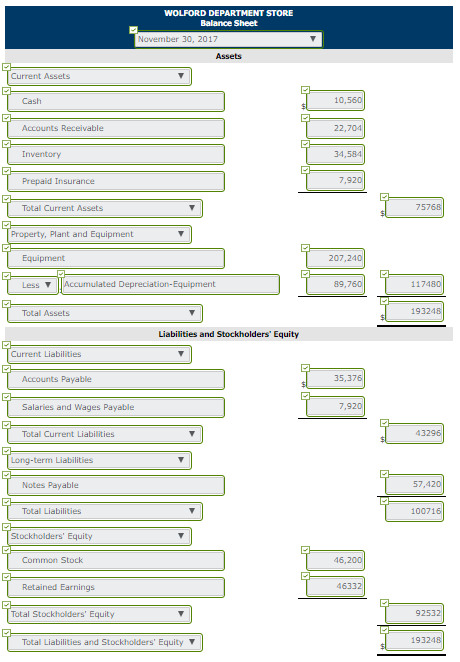

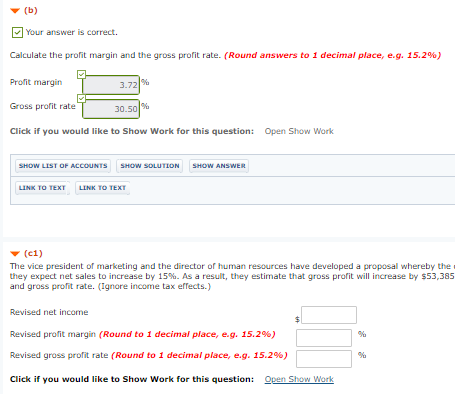

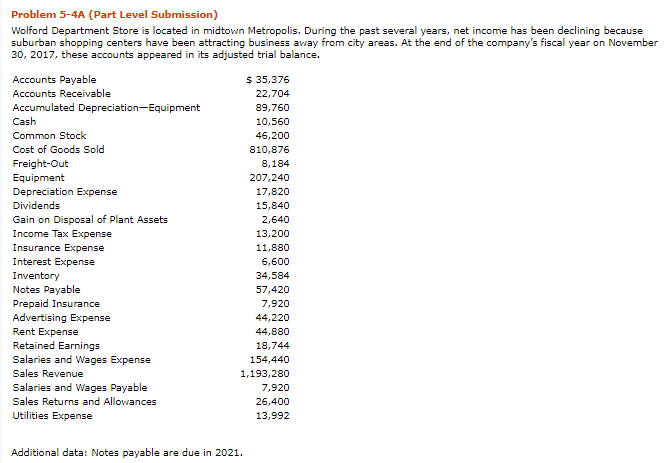

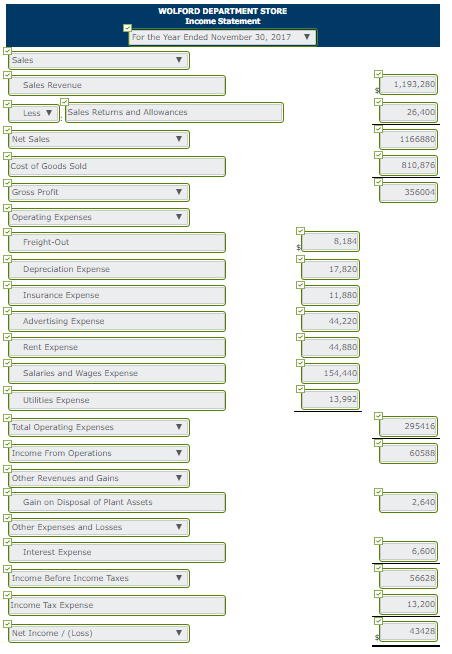

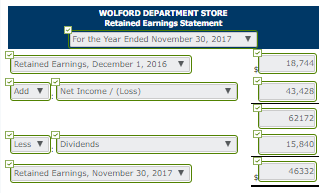

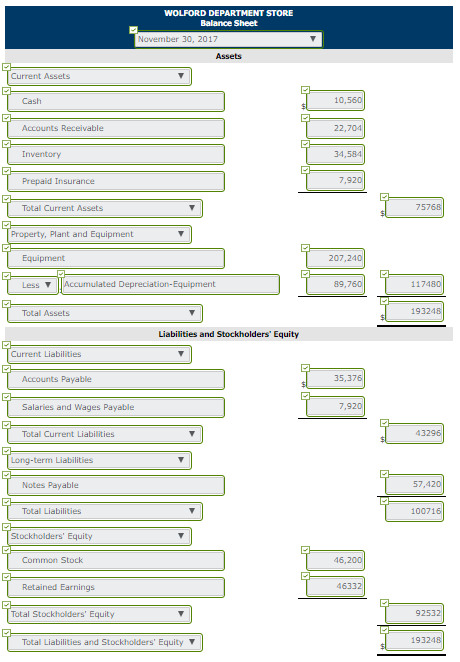

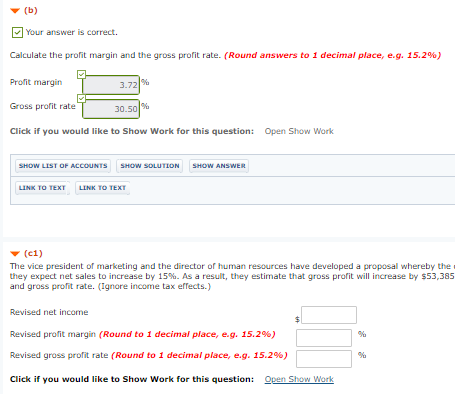

Problem 5-4A (Part Level Submission) Wolford Department Store is located in midtown Metropolis. During the past several years, net income has been declining because suburban shopping centers have been attracting business away from city areas. At the end of the company's fiscal year on November 30, 2017, these accounts appeared in its adjusted trial balance. Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Cash Common Stock Cost of Goods Sold Freig Equipment Depreciation Expense $ 35,376 22,704 89,760 10,560 46,200 810,876 8,184 207,240 17,820 15,840 2,640 13,200 11,880 6,600 34,584 57,420 7,920 44,220 44,880 18,744 154,440 1,193,280 7,920 26,400 13,992 Gain on Disposal of Plant Assets Income Tax Expense Interest Expense Notes Payable Prepaid Insurance Advertising Expense Rent Expense Retained Earnings Salaries and Wages Expense Sales Revenue Salaries and Wages Payable Sales Returns and Allowances Utilities Expense Additional data: Notes payable are due in 2021 WOLFORD DEPARTMENT STORE Income Statement For the Year Ended November 30, 2017 Sales Revenue 1,193,280 Less | es Returns and Allowances 1166880 Gross Profit Freight-Out 8,184 Depreciation Expense 17,820 11,880 Advertising Expense Rent Expense Salaries and Wages Expense 154,440 Utilities Expense 95416 Income From Operations ther Revenues and Gains 2,640 Other Expenses and Losses Interest Expense 6,600 Income Before Income Taxes Income Tax Expense 13,200 43428 Net Income (Loss) WLFORD DBPARTMENT 8TORB Retained Earnings Statement For the Year Ended November 30, 201 8,744 AddNet Income/ (Loss) 3,428 6217 Less Dividends 15,840 Retained Earnings, November 30, 2017 WOLFORD DEPARTMENT STORE Balance Sheet November 30, 2017 Assets Current Assets Cash 10,560 Accounts Receivable 22,704 34,584 Prepaid Insurance 7,920 Total Current Assets 75768 Property, Plant and Equipment 207,240 9,760 117480 Total Assets 93248 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable 35,376 Salaries and Wages Payable 7,920 Total Current Liabilities 43296 Notes Payable Total Liabilities Stockholders' Equity Common Stock 46,200 Retained Earnings 46332 Total Stockholders' Equity 92532 Total Liabilities and Stockholders' Equity 93248 (b) y] Your answer is correct. Calculate the profit margin and the gross profit rate. (Round answers to 1 decimal place, eg, 15.2%) Profit margin Gross profit rate Click if you would like to Show Work for this question: Open Show Work LFA 30.501% LIST OF ACCOUNTS SHOW (c1) The vice president of marketing and the director of human resources have developed a proposal whereby the they expect net sales to increase by 15%. As a result, they estimate that gross profit will increase by $53,385 and gross profit rate. (Ignore income tax effects.) Revised net income Revised profit margin (Round to 1 decimal place, e.g. 15.2%) Revised gross profit rate (Round to 1 decimal place, eg. 15.2%) Click if you would like to Show Work for this question: Open Show Work