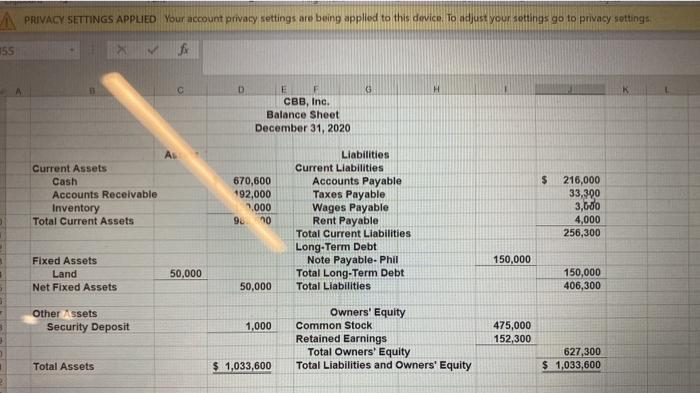

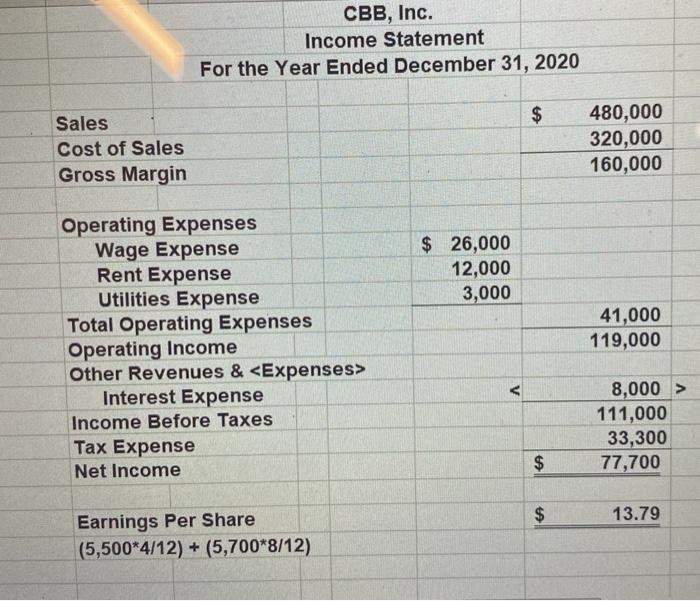

Problem 5-5 Beamer Biz Year 3, 2021 (See website for beginning balances) During the third year she paid the money she owed for last year's merchandise and received the money due her from last year's sales. Also, during the third year she bought 15 Beamers and sold four. The Beamers cost her $46,000 each and she sold them for $66,000 apiece. Terms for purchasing and selling the Beamers remain the same. She paid rent of $17,000, which represented the current year's rent plus the rent she owed at the end of the prior year plus January of next year's rent. She paid cash wages of $30,000 and utilities of $3,000. She issued 100 new shares of common stock on September 1st for $10,000 in exchange for a billboard sign which she expects to last 10 years and then be worth $1,000. On October 1" she took out a three-year insurance policy for $10,800. She expenses the insurance at $300 per month. She paid her annual interest to Uncle Phil. She paid the taxes she owed at the end of last year. At the end of the year she owed wages of $3,000 and taxes for the year (tax rate remains 30%). At December 31, she paid a dividend of $12,000. So how did she do the third year? (Prepare Journal Entries, T-Accounts, and Financial Statements) PRIVACY SETTINGS APPLIED Your account privacy settings are being applied to this device to adjust your settings go to privacy settings 155 G H E F CBB, Inc. Balance Sheet December 31, 2020 AL $ Current Assets Cash Accounts Receivable Inventory Total Current Assets 670,600 192,000 1.000 9 no Liabilities Current Liabilities Accounts Payable Taxes Payable Wages Payable Rent Payable Total Current Liabilities Long-Term Debt Note Payable. Phil Total Long-Term Debt Total Liabilities 216,000 33,300 3,000 4,000 256,300 150,000 Fixed Assets Land Net Fixed Assets 50,000 150,000 406,300 50,000 Other Assets Security Deposit 1,000 Owners' Equity Common Stock Retained Earnings Total Owners' Equity Total Liabilities and Owners' Equity 475,000 152,300 627,300 $ 1,033,600 Total Assets $ 1,033,600 CBB, Inc. Income Statement For the Year Ended December 31, 2020 $ Sales Cost of Sales Gross Margin 480,000 320,000 160,000 $ 26,000 12,000 3,000 Operating Expenses Wage Expense Rent Expense Utilities Expense Total Operating Expenses Operating Income Other Revenues &

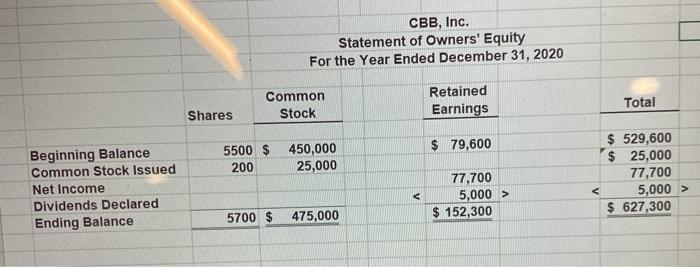

Interest Expense Income Before Taxes Tax Expense Net Income 41,000 119,000 111,000 33,300 77,700 $ $ 13.79 Earnings Per Share (5,500*4/12) + (5,700*8/12) CBB, Inc. Statement of Owners' Equity For the Year Ended December 31, 2020 Common Stock Retained Earnings Total Shares $ 79,600 5500 $ 450,000 200 25,000 Beginning Balance Common Stock Issued Net Income Dividends Declared Ending Balance $ 529,600 $ 25,000 77,700 5,000 > $ 627,300 $ 152,300