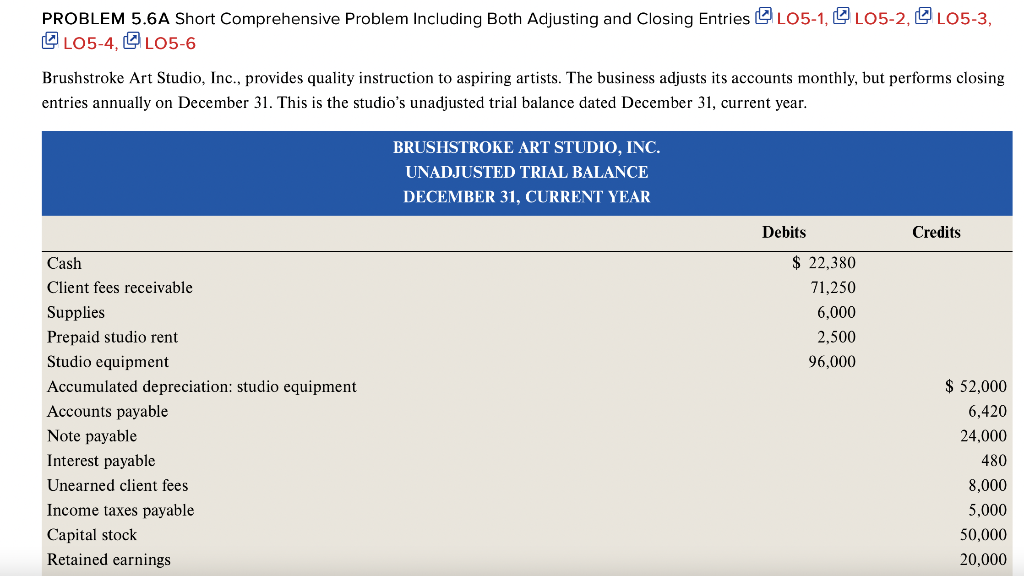

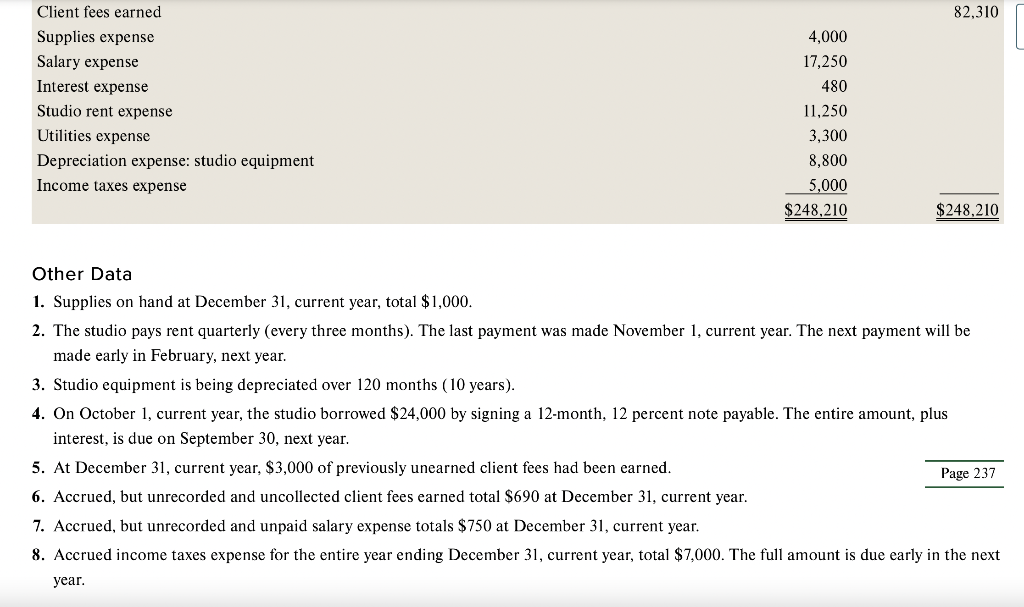

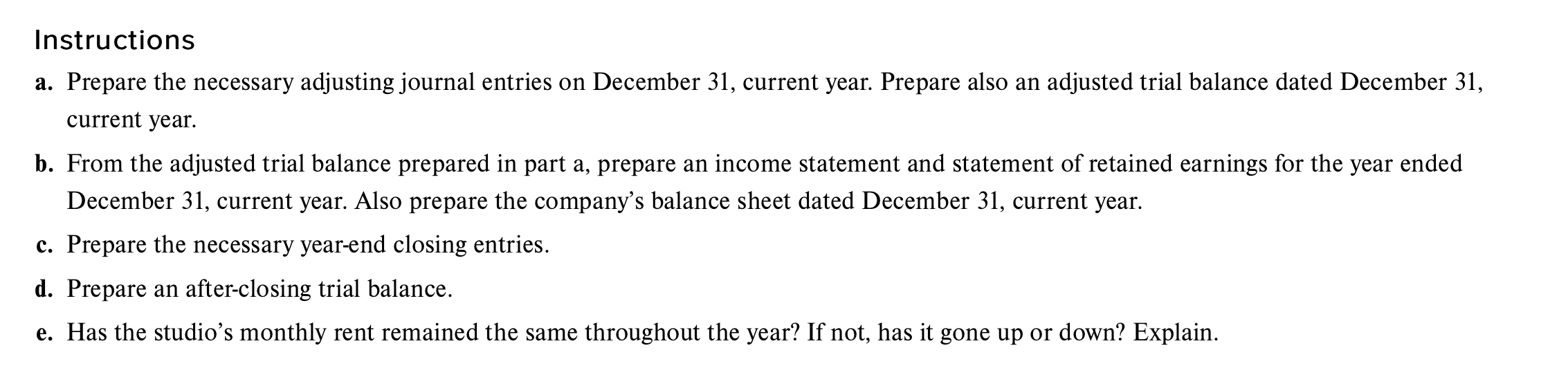

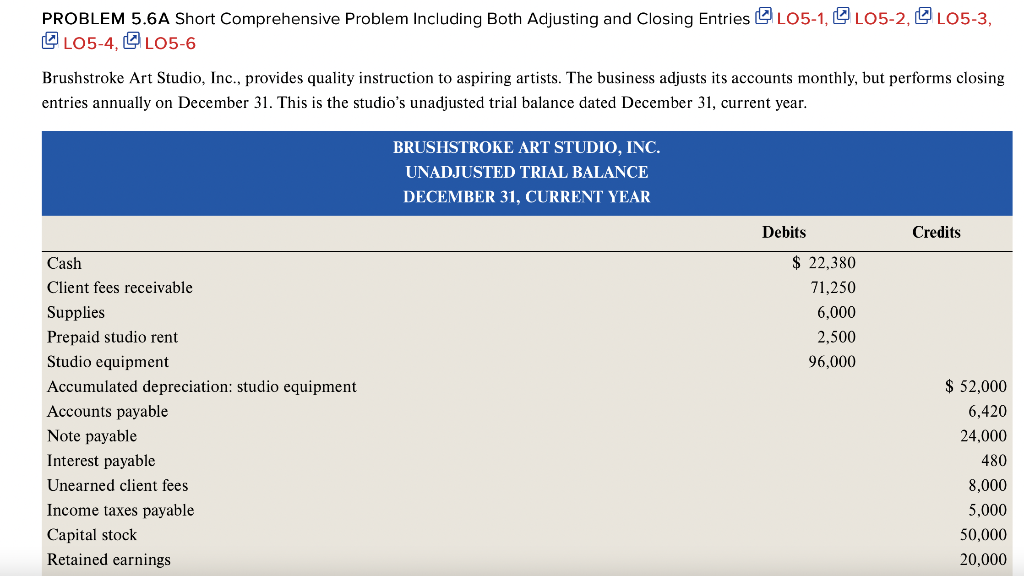

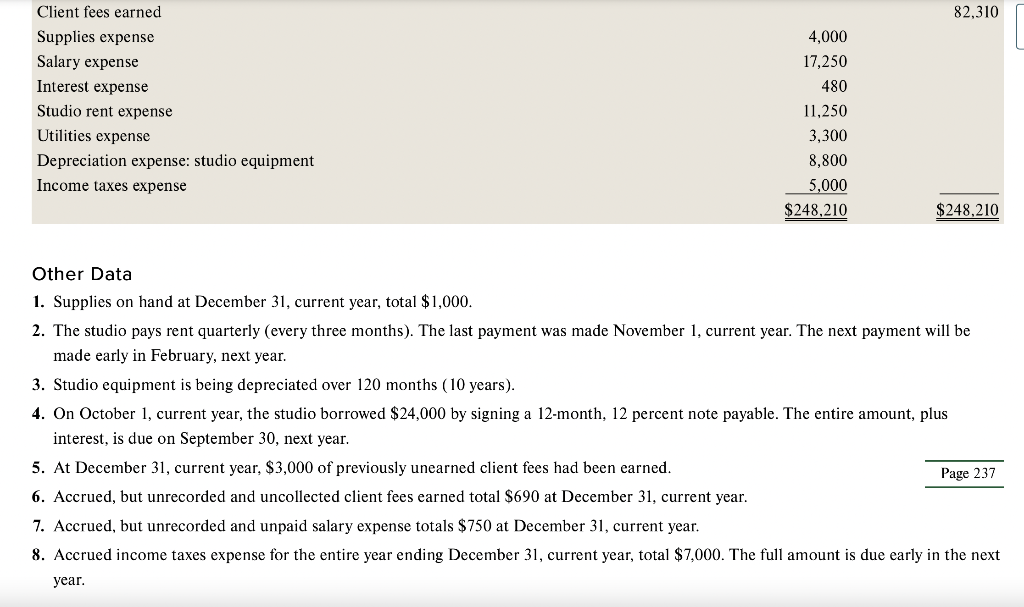

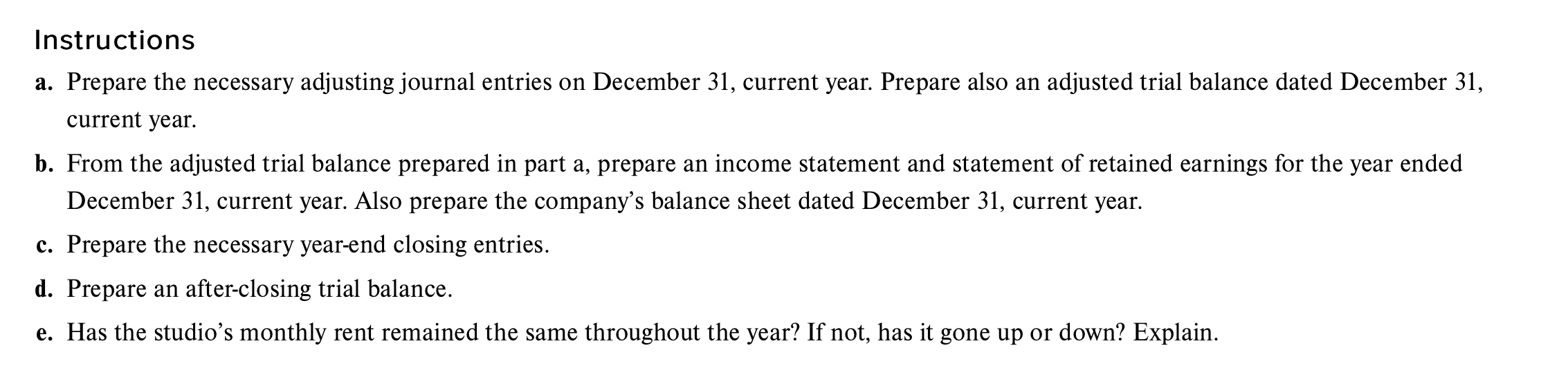

PROBLEM 5.6A Short Comprehensive Problem Including Both Adjusting and Closing Entries O L05-1, L05-2, L05-3, OL05-4, O L05-6 Brushstroke Art Studio, Inc., provides quality instruction to aspiring artists. The business adjusts its accounts monthly, but performs closing entries annually on December 31. This is the studio's unadjusted trial balance dated December 31, current year. BRUSHSTROKE ART STUDIO, INC. UNADJUSTED TRIAL BALANCE DECEMBER 31, CURRENT YEAR Debits Credits $ 22,380 71,250 6,000 2,500 96,000 Cash Client fees receivable Supplies Prepaid studio rent Studio equipment Accumulated depreciation: studio equipment Accounts payable Note payable Interest payable Unearned client fees Income taxes payable Capital stock Retained earnings $ 52,000 6,420 24,000 480 8,000 5,000 50,000 20,000 82,310 Client fees earned Supplies expense Salary expense Interest expense Studio rent expense Utilities expense Depreciation expense: studio equipment Income taxes expense 4,000 17,250 480 11,250 3,300 8,800 5,000 $248,210 $248,210 Other Data 1. Supplies on hand at December 31, current year, total $1,000. 2. The studio pays rent quarterly (every three months). The last payment was made November 1, current year. The next payment will be made early in February, next year. 3. Studio equipment is being depreciated over 120 months (10 years). 4. On October 1, current year, the studio borrowed $24,000 by signing a 12-month, 12 percent note payable. The entire amount, plus interest, is due on September 30, next year. 5. At December 31, current year, $3,000 of previously unearned client fees had been earned. Page 237 6. Accrued, but unrecorded and uncollected client fees earned total $690 at December 31, current year. 7. Accrued, but unrecorded and unpaid salary expense totals $750 at December 31, current year. 8. Accrued income taxes expense for the entire year ending December 31, current year, total $7,000. The full amount is due early in the next year. Instructions a. Prepare the necessary adjusting journal entries on December 31, current year. Prepare also an adjusted trial balance dated December 31, current year. b. From the adjusted trial balance prepared in part a, prepare an income statement and statement of retained earnings for the year ended December 31, current year. Also prepare the company's balance sheet dated December 31, current year. c. Prepare the necessary year-end closing entries. d. Prepare an after-closing trial balance. e. Has the studio's monthly rent remained the same throughout the year? If not, has it gone up or down? Explain