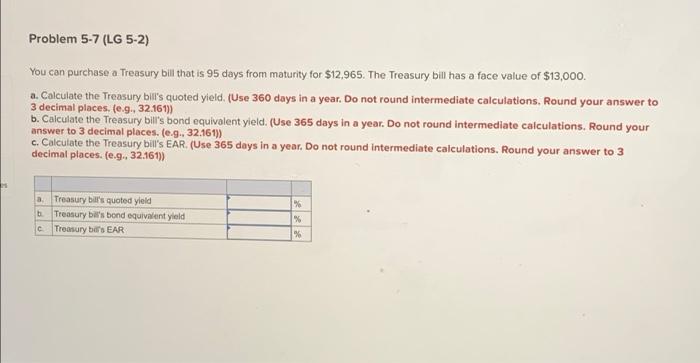

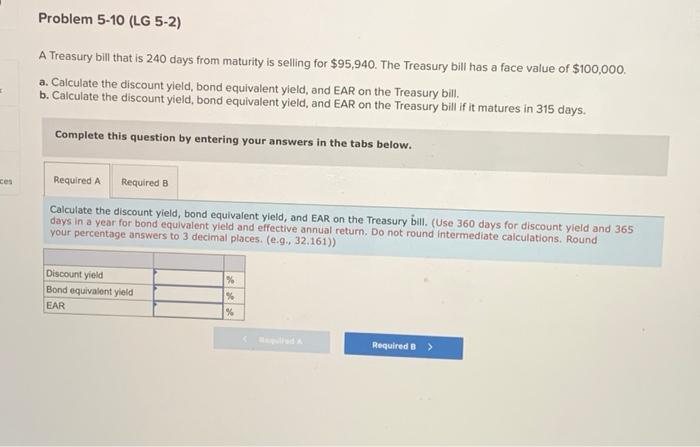

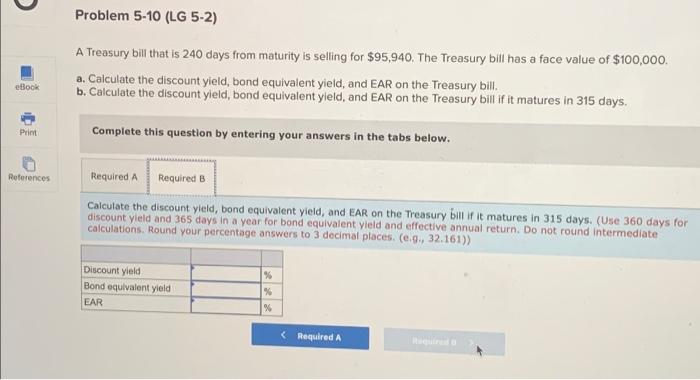

Problem 5-7 (LG 5-2) You can purchase a Treasury bill that is 95 days from maturity for $12,965. The Treasury bill has a face value of $13,000. a. Calculate the Treasury bill's quoted yield. (Use 360 days in a year. Do not round intermediate calculations. Round your answer to 3 decimal places. (e.g., 32.161)) b. Calculate the Treasury bill's bond equivalent yield. (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 3 decimal places. (e.g., 32.161) c. Calculate the Treasury bills EAR. (Use 365 days in a year. Do not round Intermediate calculations. Round your answer to 3 decimal places. (0.9., 32.161)) 3. Treasury bill's quoted yield Treasury bef's bond equivalent yield c. Treasury be's EAR % % % Problem 5-10 (LG 5-2) A Treasury bill that is 240 days from maturity is selling for $95,940. The Treasury bill has a face value of $100,000 a. Calculate the discount yield, bond equivalent yield, and EAR on the Treasury bill. b. Calculate the discount yield, bond equivalent yield, and EAR on the Treasury bill if it matures in 315 days. Complete this question by entering your answers in the tabs below. ces Required A Required B Calculate the discount yield, bond equivalent yield, and EAR on the Treasury bill. (Use 360 days for discount yield and 365 days in a year for bond equivalent yield and effective annual return. Do not round intermediate calculations. Round your percentage answers to 3 decimal places. (e.g., 32.161)) Discount yield Bond equivalent yield EAR % % % Required B > Problem 5-10 (LG 5-2) A Treasury bill that is 240 days from maturity is selling for $95,940. The Treasury bill has a face value of $100,000 a. Calculate the discount yield, bond equivalent yield, and EAR on the Treasury bill. b. Calculate the discount yield, bond equivalent yield, and EAR on the Treasury bill if it matures in 315 days. eBook Print Complete this question by entering your answers in the tabs below. References Required A Required B Calculate the discount yield, bond equivalent yield, and EAR on the Treasury but if it matures in 315 days. (Use 360 days for discount yield and 365 days in a year for bond equivalent yield and effective annual return. Do not round intermediate calculations. Round your percentage answers to 3 decimal places. (0.9., 32.161)) Discount yield Bond equivalent yield EAR % %