Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1. Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary shares of Fazli Company. On that date,

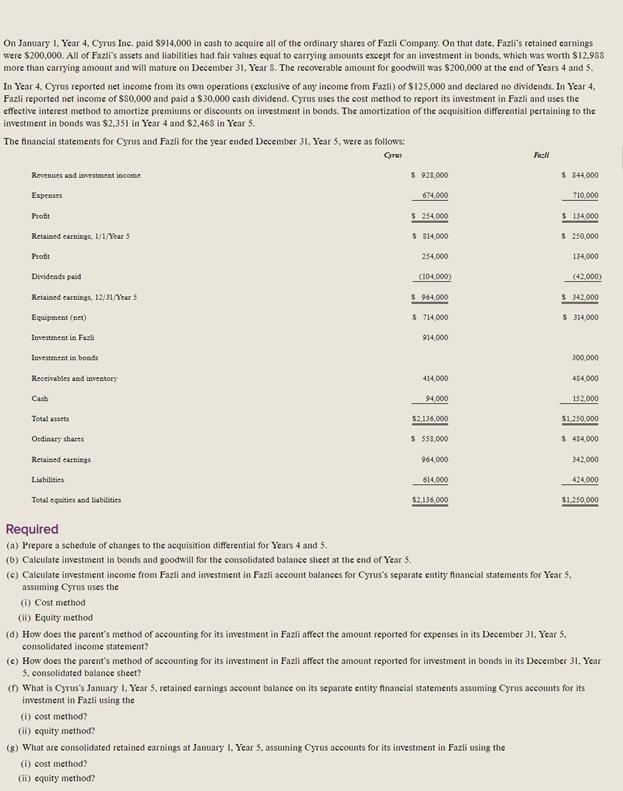

On January 1. Year 4, Cyrus Inc. paid $914,000 in cash to acquire all of the ordinary shares of Fazli Company. On that date, Fazli's retained carnings were $200,000. All of Fazli's assets and liabilities had fair values equal to carrying amounts except for an investment in bonds, which was worth S12.988 more than carrying amount and will mature on December 31, Year S. The recoverable amount for goodwill was $200,000 at the end of Years 4 and 5. In Year 4. Cyrus reported net income from its own operations (exclusive of any income from Fazli) of S125,000 and declared no dividends. In Year 4, Fazli reported net income of SS0.000 and paid a $30,000 cash dividend. Cyrus uses the cost method to report its investment in Fazli and uses the effective interest method to amortize premiums or discounts on investment in bonds. The amortization of the acquisition differential pertaining to the investment in bonds was $2.351 in Year 4 and $2,468 in Year 5. The financial statements for Cyrus and Fazli for the year ended December 31, Year 5, were as follows: Grun Fazl $ 928,000 S 4,000 Revenues and investment income Expenses 674,000 710,000 Profit $ 254.000 S 114,000 Retained carnings, 1/1/Year 5 $ 814,000 S 250,000 Proit 254,000 134,000 Dividends paid (104.000) (42,000) Retained earnings, 12/31/Year 5 $ 964.000 S 42,000 Equipment (net) S 714,000 $ 314,000 Investment in Fazli 914,000 Investment in bonda 300,000 Receivables and inventory 414,000 484,000 Cash 94,000 152.000 Tetal assets $2,136,000 $1,250,000 Ordinary shares $ 558.000 S 454.000 Retained carnings 964,000 342,000 Liabilities 614.000 424,000 Total equities and liabilities $2.136,000 $1.250.000 Required (a) Prepare a schedule of changes to the acquisition differential for Years 4 and s. (b) Calculate investment in bonds and goodwill for the consolidated balance shieet at the end of Year 5. (6) Caleulate investment income from Fazli and investment in Fazli account balances for Cyrus's separate entity financial statements for Year 5. assuming Cyrus uses the (i) Cost method (ii) Equity method (d) How does the parent's method of accounting for its investment in Fazli affect the amount reported for expenses in its December 31, Year 5. consolidated income statement? (e) How does the parent's method of accounting for its investment in Fazli affect the amount reported for investment in bonds in its December 31, Year 5. consolidated balance sheet? (n What is Cyrus's January 1. Year 5, retained earnings account balance on its separate entity financial statements assuming Cyrus accounts for its investment in Fazli using the (i) cost method? (ii) equity method? (8) What are consolidated retained earnings at Jauary 1. Year 5. assuming Cyrus accounts for its investment in Fazli using the (i) cost method? (ii) equity method?

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Schedule of changes to acquisition Asset Beginning Balance Year 4 Changes End Balance Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started