Question

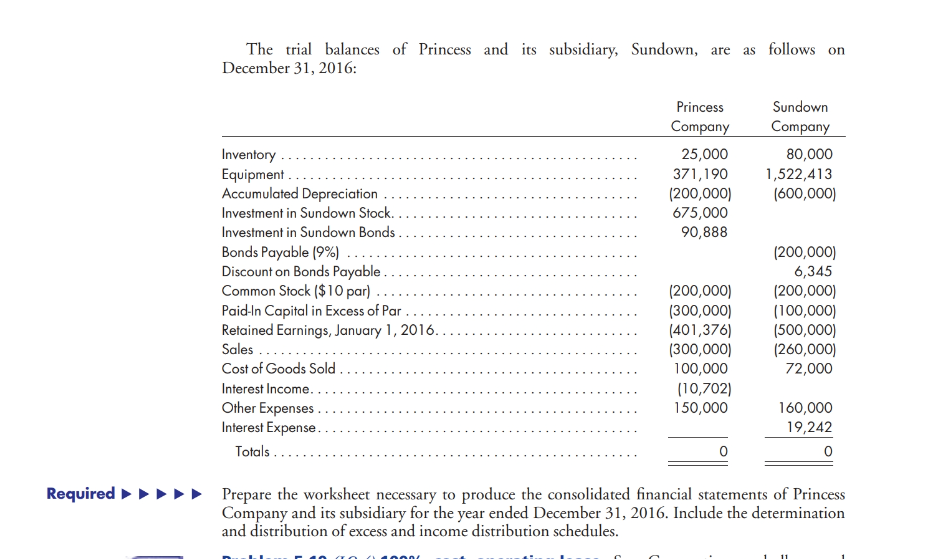

Problem 5-9 (LO 2) 90%, cost, machine, merchandise, effective interest bonds. Princess Company acquired a 90% interest in Sundown Company on January 1, 2011, for

Problem 5-9 (LO 2) 90%, cost, machine, merchandise, effective interest bonds. Princess Company acquired a 90% interest in Sundown Company on January 1, 2011, for $675,000. Any excess of cost over book value was due to goodwill.

Capital balances of Sundown Company on January 1, 2011, were as follows:

Common stock($10par)..................... $200,000

Paid-in capital in excess of par ................ 100,000

Retained earnings .......................... 300,000

Total equity ............................. $600,000

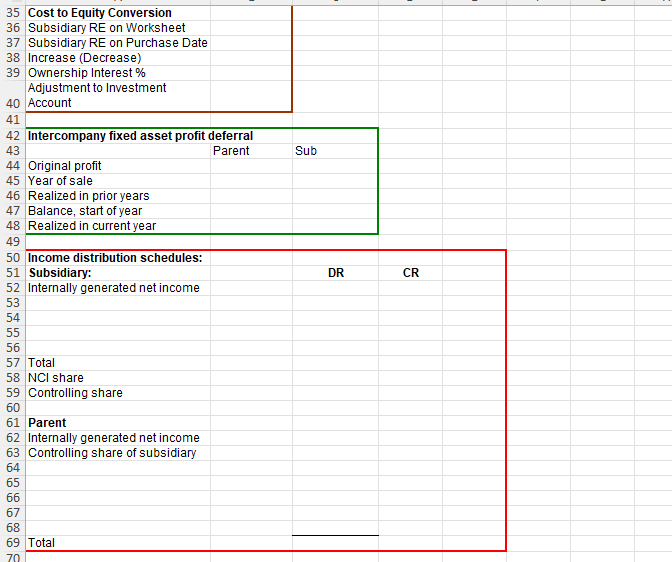

Sundown Company sold a machine to Princess for $30,000 on January 1, 2014. It cost Sun- down $20,000 to build the machine, which had a 5-year remaining life on the date of the sale and is subject to straight-line depreciation.

Princess purchased one-half of the outstanding 9% bonds of Sundown for $89,186 (to yield 12%) on December 31, 2015. The bonds were sold originally by Sundown to yield 10% to out- side parties. The discount on the entire set of bonds was $7,582 on December 31, 2015. The effective interest method of amortization is used.

During 2016, Princess Company sold merchandise to Sundown for $50,000. Princess recorded a 30% gross profit on the sales price. $20,000 of the merchandise purchased from Princess remains unsold at the end of the year.

Below are the requirements; Please answer according to the below requirements to this question.

Please answer all these requirements

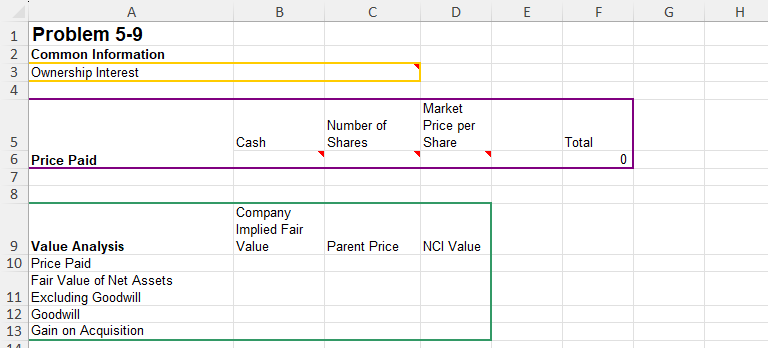

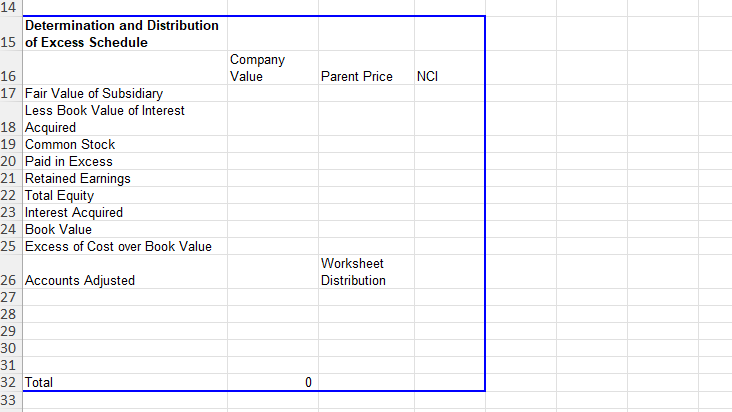

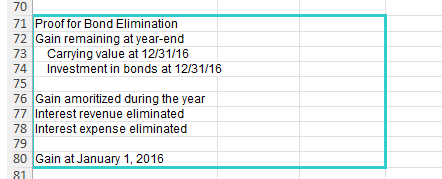

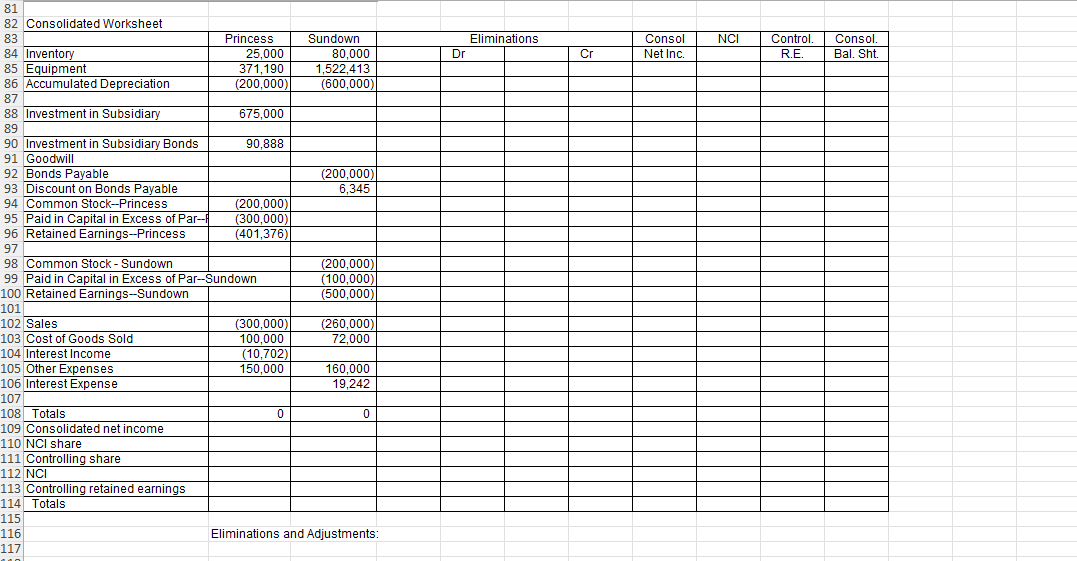

The trial balances of Princess and its subsidiary, Sundown, are as follows on December 31, 2016: Prepare the worksheet necessary to produce the consolidated financial statements of Princess Company and its subsidiary for the year ended December 31, 2016. Include the determination and distribution of excess and income distribution schedules. \begin{tabular}{|l|l|} 70 & \\ 71 & Proof for Bond Elimination \\ 72 & Gain remaining at year-end \\ 73 & Carrying value at 12/31/16 \\ 74 & Investment in bonds at 12/31/16 \\ 75 & \\ 76 & Gain amoritized during the year \\ 77 & Interest revenue eliminated \\ 78 & Interest expense eliminated \\ 79 & \\ 80 & Gain at January 1,2016 \\ \hline \end{tabular} \begin{tabular}{l} 81 \\ 82 Consolidated Worksheet \\ \hline \end{tabular} Eliminations and AdjustmentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started