Answered step by step

Verified Expert Solution

Question

1 Approved Answer

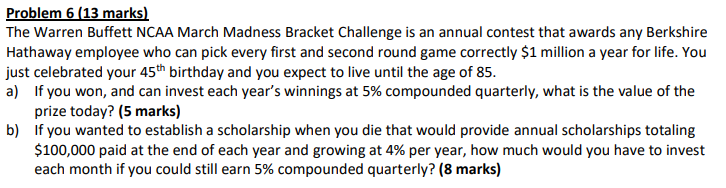

Problem 6 (13 marks) The Warren Buffett NCAA March Madness Bracket Challenge is an annual contest that awards any Berkshire Hathaway employee who can

Problem 6 (13 marks) The Warren Buffett NCAA March Madness Bracket Challenge is an annual contest that awards any Berkshire Hathaway employee who can pick every first and second round game correctly $1 million a year for life. You just celebrated your 45th birthday and you expect to live until the age of 85. a) If you won, and can invest each year's winnings at 5% compounded quarterly, what is the value of the prize today? (5 marks) b) If you wanted to establish a scholarship when you die that would provide annual scholarships totaling $100,000 paid at the end of each year and growing at 4% per year, how much would you have to invest each month if you could still earn 5% compounded quarterly? (8 marks)

Step by Step Solution

★★★★★

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this problem stepbystep a Calculating the value of the prize if you won the March Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started