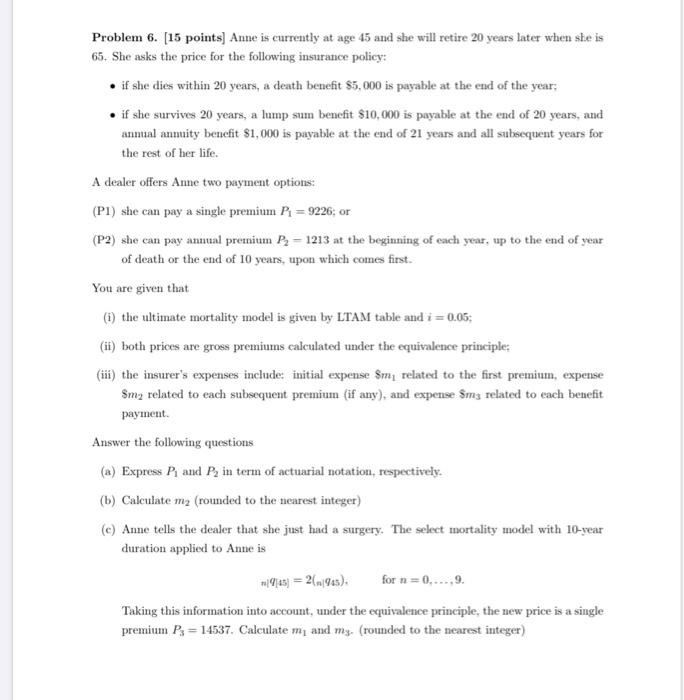

Problem 6. (15 points) Anne is currently at age 45 and she will retire 20 years later when she is 65. She asks the price for the following insurance policy: if she dies within 20 years, a death benefit $5,000 is payable at the end of the year; if she survives 20 years, a lump sum benefit $10,000 is payable at the end of 20 years, and annual annuity benefit $1,000 is payable at the end of 21 years and all subsequent years for the rest of her life. A dealer offers Anne two payment options: (P1) she can pay a single premium P = 9226; or (P2) she can pay annual premium P = 1213 at the beginning of each year, up to the end of year of death or the end of 10 years, upon which comes first. You are given that (i) the ultimate mortality model is given by LTAM table and i = 0.05; (ii) both prices are gross premiums calculated under the equivalence principle; (iii) the insurer's expenses include: initial expense Sm related to the first premium, expense $m2 related to each subsequent premium (if any), and expense Sm3 related to each benefit payment. Answer the following questions (a) Express P and P, in term of actuarial notation, respectively. (b) Calculate m2 (rounded to the nearest integer) (c) Anne tells the dealer that she just had a surgery. The select mortality model with 10-year duration applied to Anne is 1945] = 2(1945), for n = 0,...,9. Taking this information into account, under the equivalence principle, the new price is a single premium P3 = 14537. Calculate m, and m3. (rounded to the nearest integer) Problem 6. (15 points) Anne is currently at age 45 and she will retire 20 years later when she is 65. She asks the price for the following insurance policy: if she dies within 20 years, a death benefit $5,000 is payable at the end of the year; if she survives 20 years, a lump sum benefit $10,000 is payable at the end of 20 years, and annual annuity benefit $1,000 is payable at the end of 21 years and all subsequent years for the rest of her life. A dealer offers Anne two payment options: (P1) she can pay a single premium P = 9226; or (P2) she can pay annual premium P = 1213 at the beginning of each year, up to the end of year of death or the end of 10 years, upon which comes first. You are given that (i) the ultimate mortality model is given by LTAM table and i = 0.05; (ii) both prices are gross premiums calculated under the equivalence principle; (iii) the insurer's expenses include: initial expense Sm related to the first premium, expense $m2 related to each subsequent premium (if any), and expense Sm3 related to each benefit payment. Answer the following questions (a) Express P and P, in term of actuarial notation, respectively. (b) Calculate m2 (rounded to the nearest integer) (c) Anne tells the dealer that she just had a surgery. The select mortality model with 10-year duration applied to Anne is 1945] = 2(1945), for n = 0,...,9. Taking this information into account, under the equivalence principle, the new price is a single premium P3 = 14537. Calculate m, and m3. (rounded to the nearest integer)