Answered step by step

Verified Expert Solution

Question

1 Approved Answer

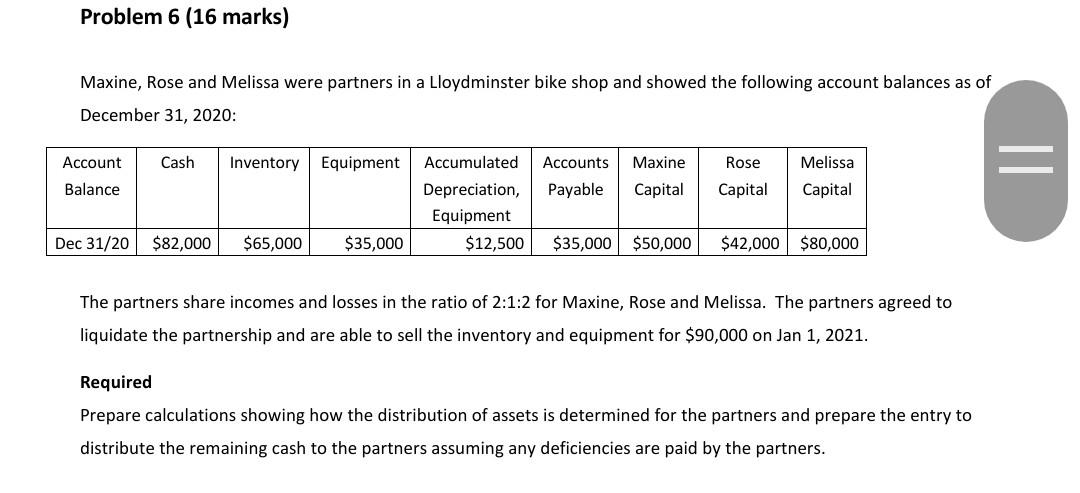

Problem 6 (16 marks) Maxine, Rose and Melissa were partners in a Lloydminster bike shop and showed the following account balances as of December 31,

Problem 6 (16 marks) Maxine, Rose and Melissa were partners in a Lloydminster bike shop and showed the following account balances as of December 31, 2020: Cash Inventory Equipment Rose Account Balance Accounts Payable Maxine Capital Melissa Capital = Capital Accumulated Depreciation, Equipment $12,500 Dec 31/20 $82,000 $65,000 $35,000 $35,000 $50,000 $42,000 $80,000 The partners share incomes and losses in the ratio of 2:1:2 for Maxine, Rose and Melissa. The partners agreed to liquidate the partnership and are able to sell the inventory and equipment for $90,000 on Jan 1, 2021. Required Prepare calculations showing how the distribution of assets is determined for the partners and prepare the entry to distribute the remaining cash to the partners assuming any deficiencies are paid by the partners

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started