Answered step by step

Verified Expert Solution

Question

1 Approved Answer

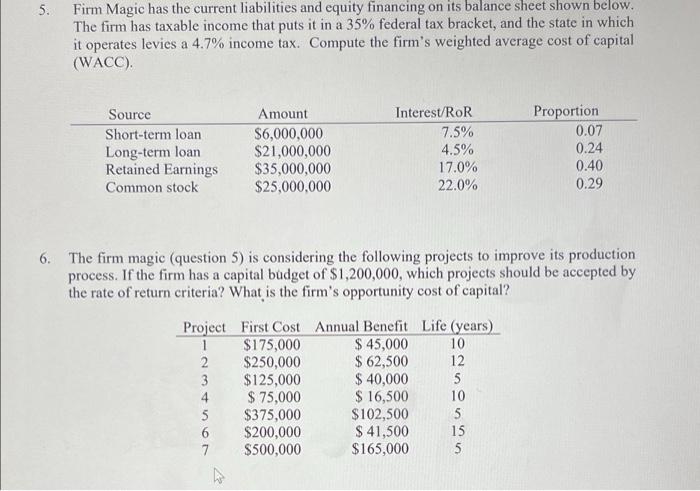

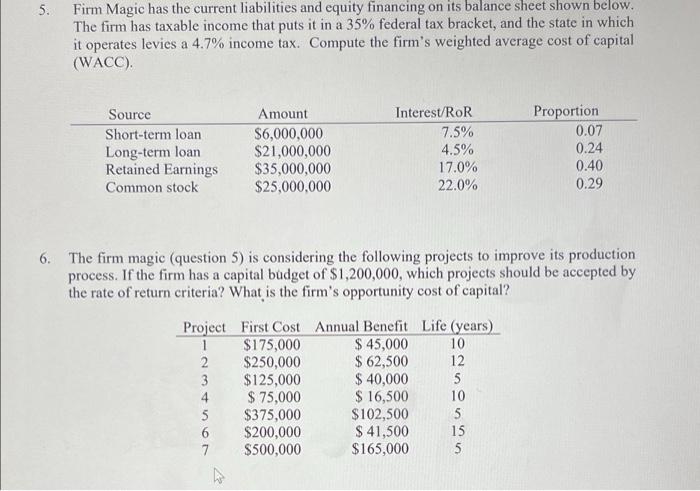

problem 6 pls 5. Firm Magic has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that

problem 6 pls

5. Firm Magic has the current liabilities and equity financing on its balance sheet shown below. The firm has taxable income that puts it in a 35% federal tax bracket, and the state in which it operates levies a 4.7% income tax. Compute the firm's weighted average cost of capital (WACC). Source Short-term loan Long-term loan Retained Earnings Common stock Amount $6,000,000 $21,000,000 $35,000,000 $25,000,000 Interest/ROR 7.5% 4.5% 17.0% 22.0% Proportion 0.07 0.24 0.40 0.29 6. The firm magic (question 5) is considering the following projects to improve its production process. If the firm has a capital budget of $1,200,000, which projects should be accepted by the rate of return criteria? What is the firm's opportunity cost of capital? Project First Cost Annual Benefit Life (years) 1 $175,000 $ 45,000 10 2 $250,000 $62,500 12 3 $125,000 $ 40,000 5 4 $ 75,000 $ 16,500 10 5 $375,000 $102,500 6 $200,000 $ 41,500 15 7 $500,000 $165,000 5 uuuugo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started