Answered step by step

Verified Expert Solution

Question

1 Approved Answer

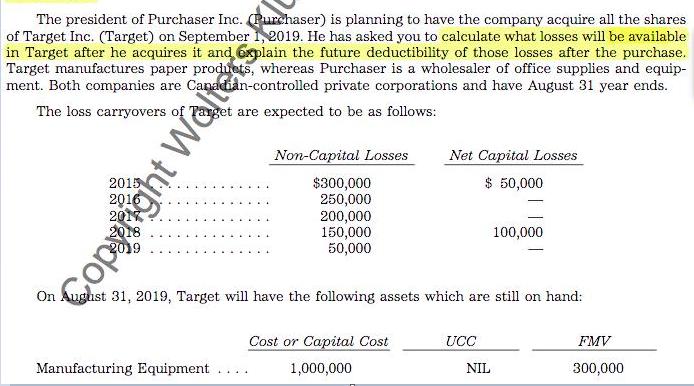

The president of Purchaser Inc. Purchaser) is planning to have the company acquire all the shares of Target Inc. (Target) on September 1,2019. He

![]()

The president of Purchaser Inc. Purchaser) is planning to have the company acquire all the shares of Target Inc. (Target) on September 1,2019. He has asked you to calculate what losses will be available in Target after he acquires it and explain the future deductibility of those losses after the purchase. Target manufactures paper products, whereas Purchaser is a wholesaler of office supplies and equip- ment. Both companies are Canadian-controlled private corporations and have August 31 year ends. The loss carryovers of get are expected to be as follows: Non-Capital Losses Net Capital Losses $ 50,000 $300,000 250,000 200,000 150,000 50,000 2015 100,000 On August 31, 2019, Target will have the following assets which are still on hand: Cost or Capital Cost UCC FMV Manufacturing Equipment 1,000,000 NIL 300,000 ... (ii) the partial amount of all elections/options is utilized so that only enough income is generated to offset most or all of the losses which would otherwise expire on the acquisition of control.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Noncapital losses Net capital losses 2015 300000 50000 2016 250000 2017 200000 2018 25...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started