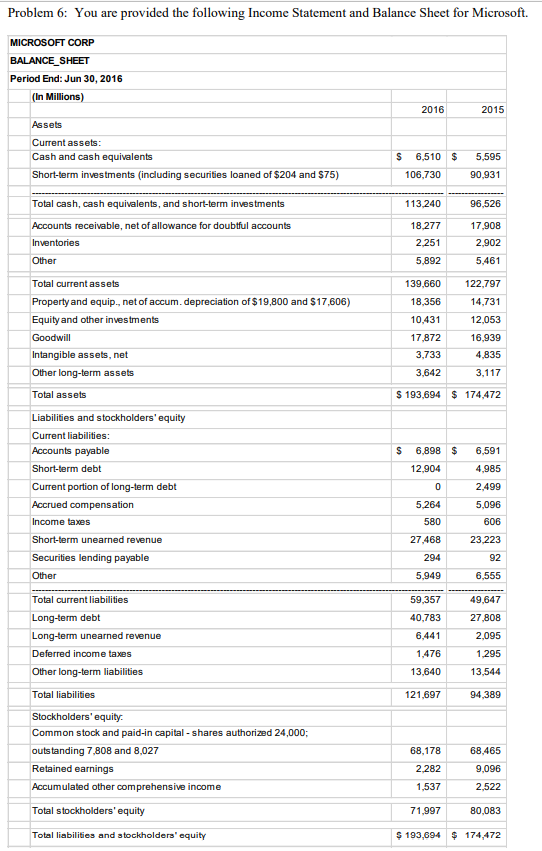

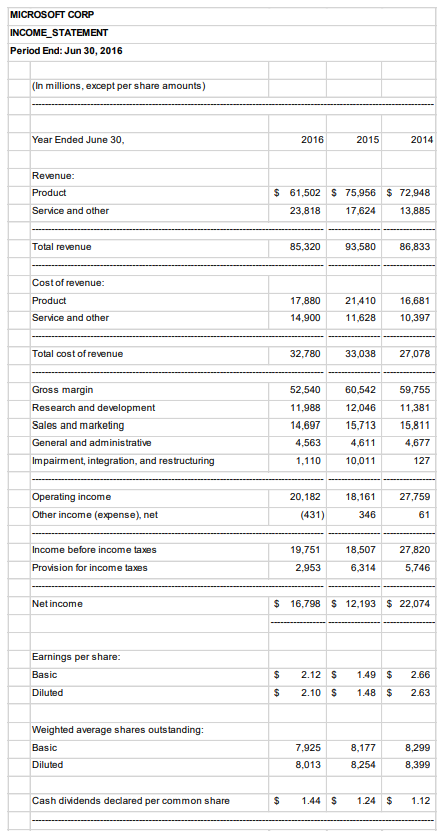

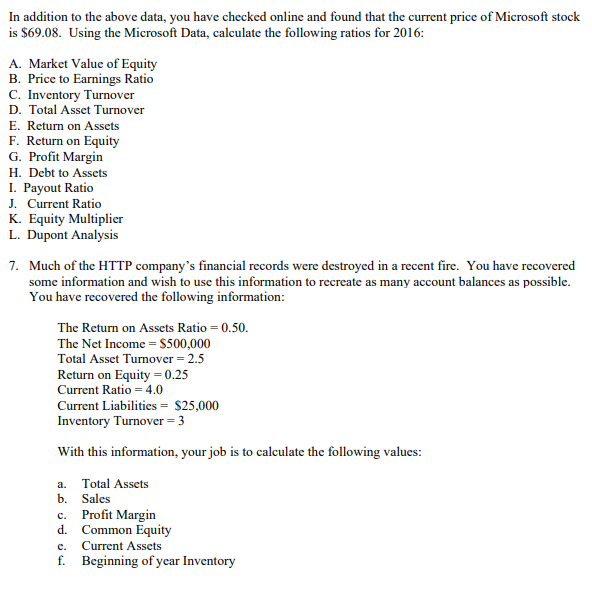

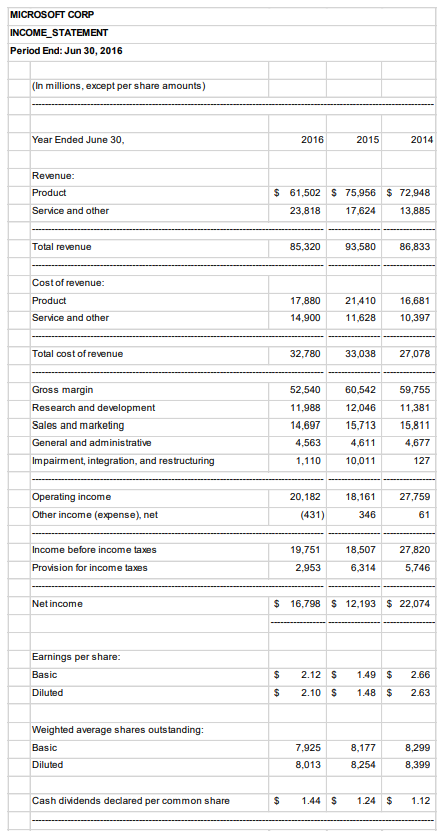

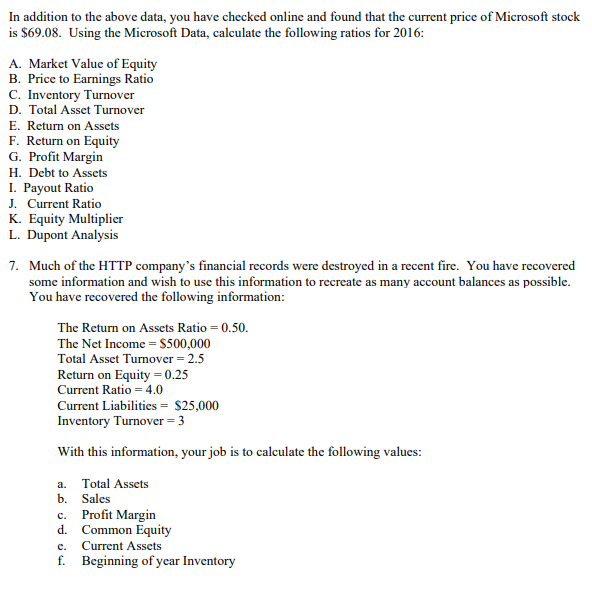

Problem 6: You are provided the following Income Statement and Balance Sheet for Microsoft. MICROSOFT CORP BALANCE_SHEET Period End: Jun 30, 2016 (in Millions) 2016 2015 Assets Current assets: Cash and cash equivalents Short-term investments (including securities loaned of $204 and $75) s 6,510 $ 5,595 106,730 90,931 113,240 96,526 Total cash, cash equivalents, and short-term investments Accounts receivable, net of allowance for doubtful accounts Inventories Other 18,277 2.251 5,892 17,908 2,902 5,461 139,660 122,797 18.356 14,731 12,053 Total current assets Property and equip., net of accum.depreciation of $19,800 and $17,606) Equity and other investments Goodwill Intangible assets, net Other long-term assets 10.431 17,872 3,733 16,939 4,835 3,117 3,642 Total assets $ 193,694 $ 174,472 S 6,591 6,898 $ 12.904 0 Liabilities and stockholders' equity Current liabilities: Accounts payable Short-term debt Current portion of long-term debt Accrued compensation Income taxes Short-term unearned revenue Securities lending payable Other 4,985 2.499 5,096 606 5,264 580 23,223 27,468 294 5,949 92 6,555 49,647 59,357 40,783 6,441 1.476 27,808 2,095 1.295 13,640 13,544 121,697 94,389 Total current liabilities Long-term debt Long-term unearned revenue Deferred income taxes Other long-term liabilities Total liabilities Stockholders' equity. Common stock and paid-in capital - shares authorized 24,000; outstanding 7,808 and 8,027 Retained earnings Accumulated other comprehensive income Total stockholders' equity 68.178 68.465 2.282 1.537 9,096 2.522 71.997 80,083 Total liabilities and stockholders' equity $ 193,694 $ 174,472 MICROSOFT CORP INCOME STATEMENT Period End: Jun 30, 2016 (In millions, except per share amounts) Year Ended June 30, 2016 2015 2014 Revenue: Product Service and other $ 61,502 $ 75,956 $ 72,948 23,818 17,624 13,885 Total revenue 85,320 93.580 86,833 Cost of revenue: Product Service and other 21,410 17,880 14,900 16,681 10,397 11,628 Total cost of revenue 32,780 33,038 27,078 59,755 Gross margin Research and development Sales and marketing General and administrative Impairment, integration, and restructuring 52,540 11,988 14,697 4,563 1,110 60,542 12,046 15,713 4,611 10.011 11,381 15,811 4,677 127 20,182 27,759 Operating income Other income (expense), net 18,161 346 (431) 61 27,820 Income before income taxes Provision for income taxes 19,751 2,953 18,507 6,314 5,746 Net income $ 16,798 $ 12,193 $ 22,074 Earnings per share: Basic $ 2.12 S 1.49 $ 2.66 2.63 Diluted $ 2.10 $ 1.48 $ Weighted average shares outstanding: Basic Diluted 7.925 8.013 8.177 8,254 8,299 8,399 Cash dividends declared per common share $ 1.44 $ 1.24 $ 1.12 In addition to the above data, you have checked online and found that the current price of Microsoft stock is $69.08. Using the Microsoft Data, calculate the following ratios for 2016: A. Market Value of Equity B. Price to Earnings Ratio C. Inventory Turnover D. Total Asset Turnover E. Return on Assets F. Return on Equity G. Profit Margin H. Debt to Assets I. Payout Ratio J. Current Ratio K. Equity Multiplier L. Dupont Analysis 7. Much of the HTTP company's financial records were destroyed in a recent fire. You have recovered some information and wish to use this information to recreate as many account balances as possible. You have recovered the following information: The Return on Assets Ratio = 0.50. The Net Income = $500,000 Total Asset Turnover = 2.5 Return on Equity = 0.25 Current Ratio = 4.0 Current Liabilities = $25,000 Inventory Turnover = 3 With this information, your job is to calculate the following values: a. Total Assets b. Sales c. Profit Margin d. Common Equity Current Assets f. Beginning of year Inventory e