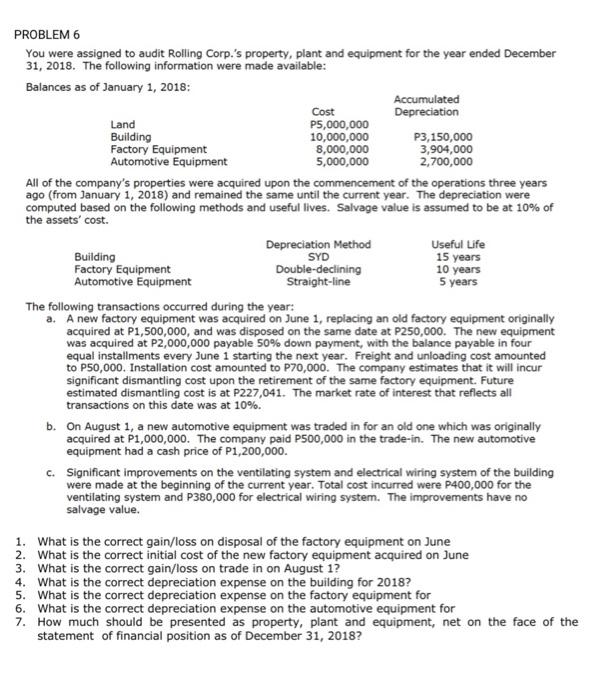

PROBLEM 6 You were assigned to audit Rolling Corp.'s property, plant and equipment for the year ended December 31, 2018. The following information were made available: Balances as of January 1, 2018: Accumulated Cost Depreciation Land P5,000,000 Building 10,000,000 P3,150,000 Factory Equipment 8,000,000 3,904,000 Automotive Equipment 5,000,000 2,700,000 All of the company's properties were acquired upon the commencement of the operations three years ago (from January 1, 2018) and remained the same until the current year. The depreciation were computed based on the following methods and useful lives. Salvage value is assumed to be at 10% of the assets' cost. Depreciation Method Useful Life Building SYD 15 years Factory Equipment Double-declining 10 years Automotive Equipment Straight-line 5 years The following transactions occurred during the year: a. A new factory equipment was acquired on June 1, replacing an old factory equipment originally acquired at P1,500,000, and was disposed on the same date at P250,000. The new equipment was acquired at P2,000,000 payable 50% down payment, with the balance payable in four equal installments every June 1 starting the next year. Freight and unloading cost amounted to P50,000. Installation cost amounted to P70,000. The company estimates that it will incur significant dismantling cost upon the retirement of the same factory equipment. Future estimated dismantling cost is at P227,041. The market rate of interest that reflects all transactions on this date was at 10%. b. On August 1, a new automotive equipment was traded in for an old one which was originally acquired at P1,000,000. The company paid P500,000 in the trade-in. The new automotive equipment had a cash price of P1,200,000. c. Significant improvements on the ventilating system and electrical wiring system of the building were made at the beginning of the current year. Total cost incurred were P400,000 for the ventilating system and P380,000 for electrical wiring system. The improvements have no salvage value. 1. What is the correct gain/loss on disposal of the factory equipment on June 2. What is the correct initial cost of the new factory equipment acquired on June 3. What is the correct gain/loss on trade in on August 1? 4. What is the correct depreciation expense on the building for 2018? 5. What is the correct depreciation expense on the factory equipment for 6. What is the correct depreciation expense on the automotive equipment for 7. How much should be presented as property, plant and equipment, net on the face of the statement of financial position as of December 31, 2018