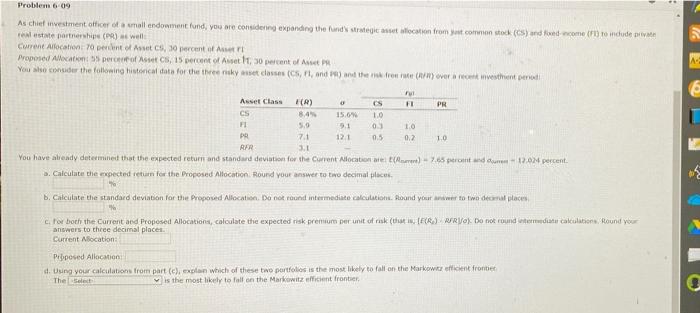

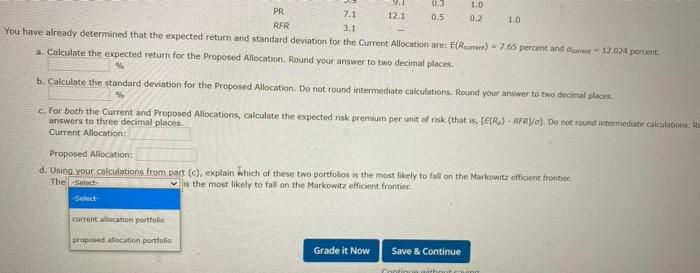

Problem 609 As chief investment officer of a mall endowment fund, you are considering expanding the fund strategic location from a common stock (cs) and come (1) to indude este partnership (PR) well Current Allocation 70 percent of Asset C5, 30 percent of Proposed Action 5 percroftcs, 15 percent of Aust 11,30 percent of Art You she consider the following historical data for the three kysse dasses (CS, Fland) the front e) over a recent inweshent pod Ful Asset Class FR) CS FI PR CS 15.08 1.0 FI 5.9 9.1 03 10 PR 7.1 121 0.5 0.2 10 RAR 3.1 You have already determined that the expected return and standard deviation for the Current location () - 7.65 - 120 percent. .. Calculate the repected return for the Proposed Allocation. Round your answer to two decimal places b. Calculate the standard deviation for the Propoved Allocation. Do not found intermediate calculation. Round your answer to two decimal places c. for both the current and Proposed Allocation, calculate the expected risk premium per unit of risk (the ER) WR). Do not round and calculation Round your answers to three decimal place. Current Abocation: Proposed Allocation d. Using your calculations from part (c), explain which of these two portfolios is the most likely to fall on the Markowitz officient fronti The Set is the most likely to fall on the Markowitz efficient frontier 2.1 0.3 1.0 PR 7.1 12.1 0.5 0.2 10 RER You have already determined that the expected return and standard deviation for the Current Allocation are: E(Roman) - 7.65 percent and 12.024 percent 3.1 a. Calculate the expected return for the Proposed Allocation. Round your answer to two decimal places. % b. Calculate the standard deviation for the Proposed Allocation. Do not round intermediate calculations. Round your answer to two decimal places c. For both the Current and Proposed Allocations, calculate the expected risk premium per unit of risk (that is, [GR) - RFR/). Do not round intermediate calculations. Re answers to three decimal places. Current Allocation: Proposed Allocation: d. Using your calculations from part (c), explain which of these two portfolios is the most likely to fall on the Markowitz efficient frontier The select is the most likely to fall on the Markowitz efficient frontier -Select current location portfolio proposed allocation portfolio Grade it Now Save & Continue