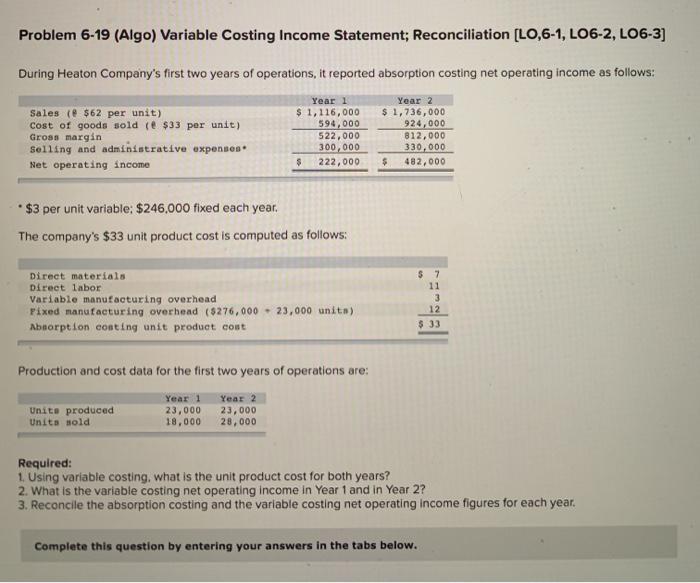

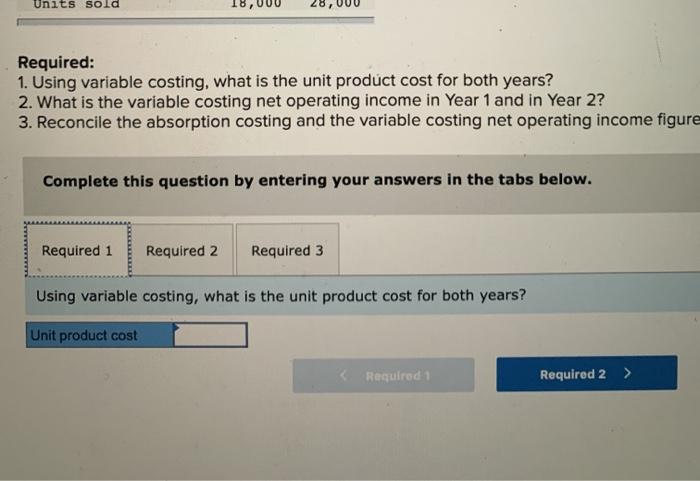

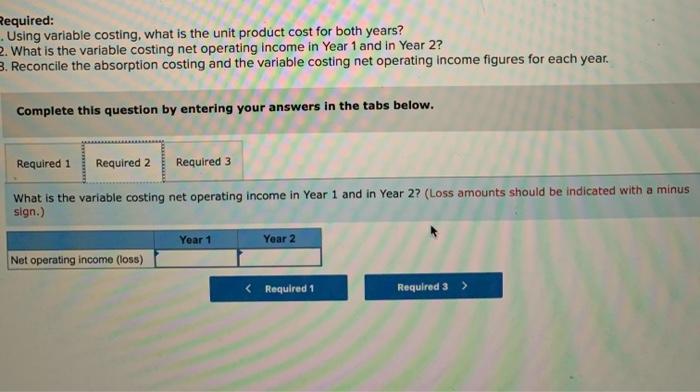

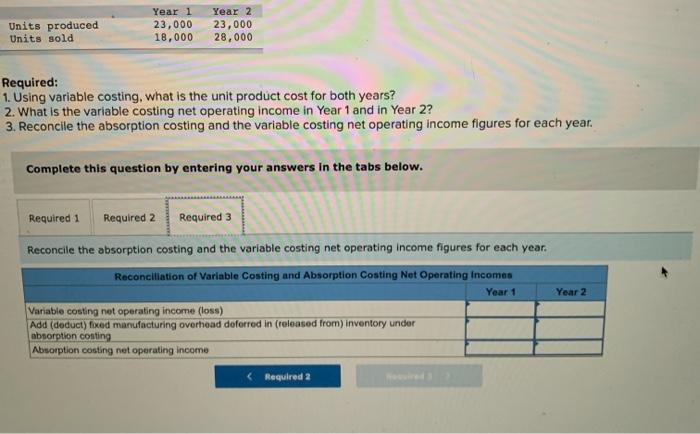

Problem 6-19 (Algo) Variable Costing Income Statement; Reconciliation (L0,6-1, LO6-2, LO6-3) During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Sales ( $62 per unit) Cost of goods sold te $33 per unit) Gross margin Solling and administrative expenses Net operating income Year 1 $ 1,116,000 594,000 522,000 300,000 $ 222,000 Year 2 $ 1,736,000 924,000 812,000 330,000 $ 482,000 $3 per unit variable: $246.000 fixed each year. The company's $33 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($276,000 - 23,000 units) Absorption conting unit product cost $ 7 11 3 12 $ 33 Production and cost data for the first two years of operations are: Unite produced Units hold Year 1 23,000 18,000 Year 2 23,000 28,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Units sold Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figure Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using variable costing, what is the unit product cost for both years? Unit product cost Units produced Units sold Year 1 23,000 18,000 Year 2 23,000 28,000 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Year 2 Reconcile the absorption costing and the variable costing net operating income figures for each year. Reconciliation of Variable Costing and Absorption Costing Net Operating Incomen Year 1 Variable costing not operating income (loss) Ada (deduct) fixed manufacturing overhead doforred in (released from) inventory under absorption conting Absorption costing net operating income