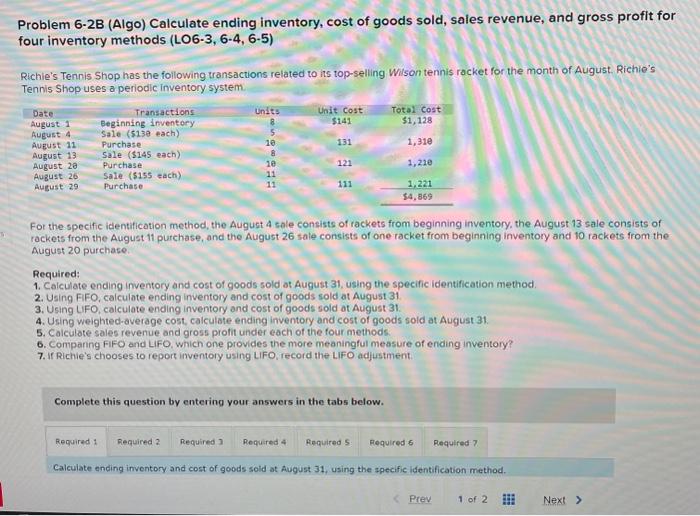

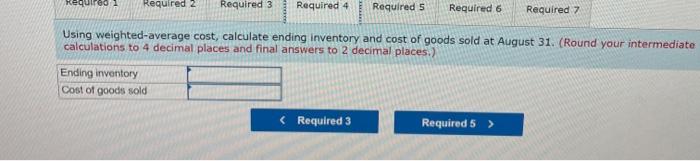

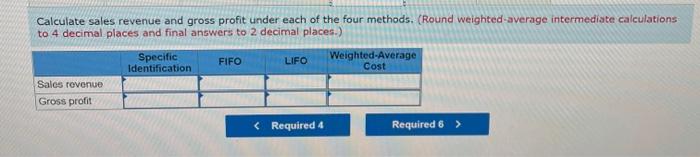

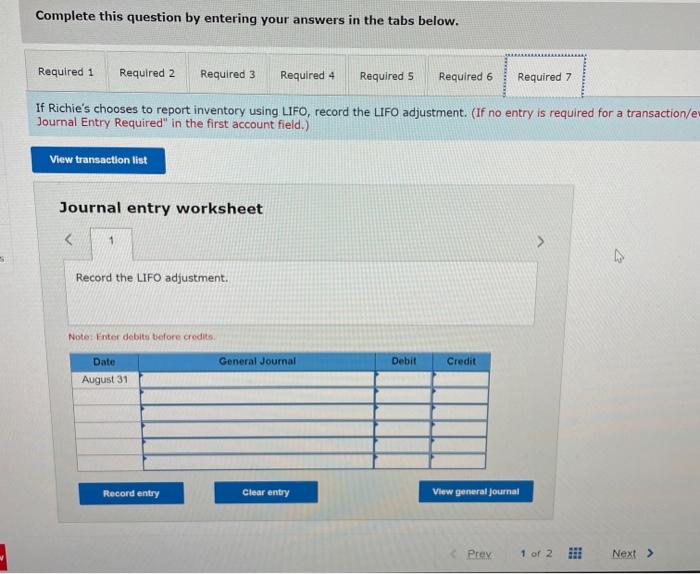

Problem 6.2B (Algo) Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4, 6-5) Richie's Tennis Shop has the following transactions related to ins top-selling Wilson tennis racket for the month of August. Richie's Tennis Shop uses a periodic inventory system. For the specific identification method, the August 4 sole consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. Required: 1. Calculate ending inventory and cost of goods sold ot August 31, using the speeific identification method. 2. Using FIFO, calculate ending inventory and cost of goods sold at August 31 3. Using UFO, calculate ending inventory and cost of goods sold at August 31 . 4. Using weighted-average cost, calculate ending inventory and cost of goods sold at August 31. 5. Calculate sales revenue and gross profit under each of the four methods. 6. Companing FIFO and LiFO, which one provides the more meaningful measure of ending inventory? 7. If Richie's chooses to report inventory using LIFO, record the LIFO adjustment. Complete this question by entering your answers in the tabs below. Calculate encing inventory and cost of goods sold at August 31, using the specific lidentification method. Calculate ending inventory and cost of goods sold at August 31 , using the specific identification method. Using FIFO, calculate ending inventory and cost of goods sold at August 31 . Ising LIFO, calculate ending inventory and cost of goods sold at August 31. Using weighted-average cost, calculate ending inventory and cost of goods sold at August 31 . (Round your intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Calculate sales revenue and gross profit under each of the four methods. (Round weighted-average intermediate calculations to 4 decimal places and final answers to 2 decimal places.) Comparing FIFO and LIFO, which one provides the more meaningful measure of ending inventory? Comparing FFFO and LIFO, which orte provides the more meaningful maasure of ending inventory? R Required 5 Complete this question by entering your answers in the tabs below. If Richie's chooses to report inventory using LIFO, record the LIFO adjustment. (If no entry is required for a transaction/e Journal Entry Required" in the first account field.) Journal entry worksheet