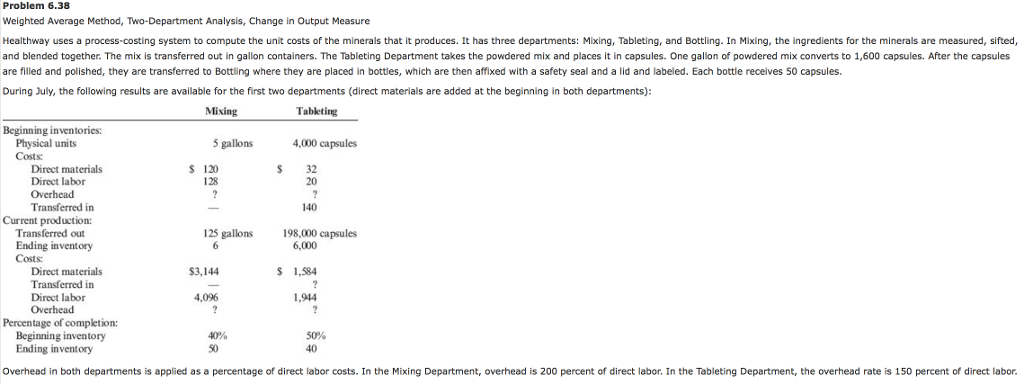

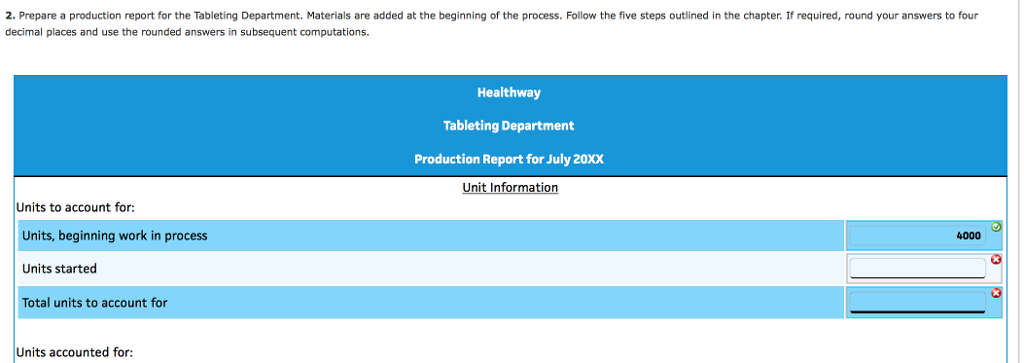

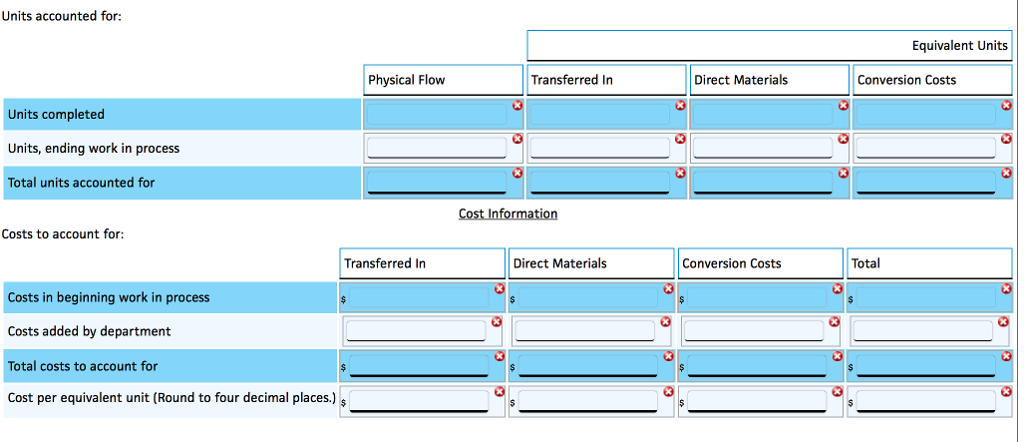

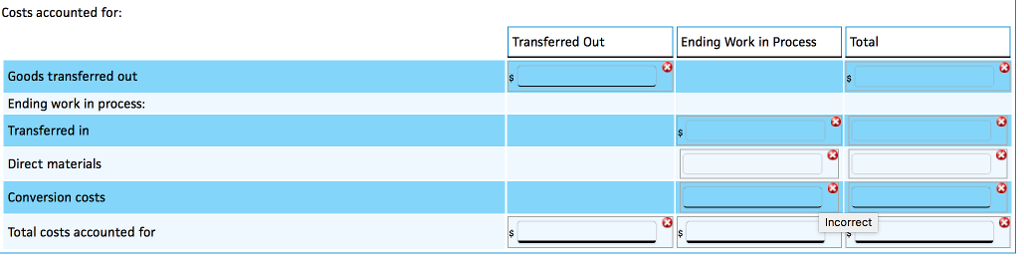

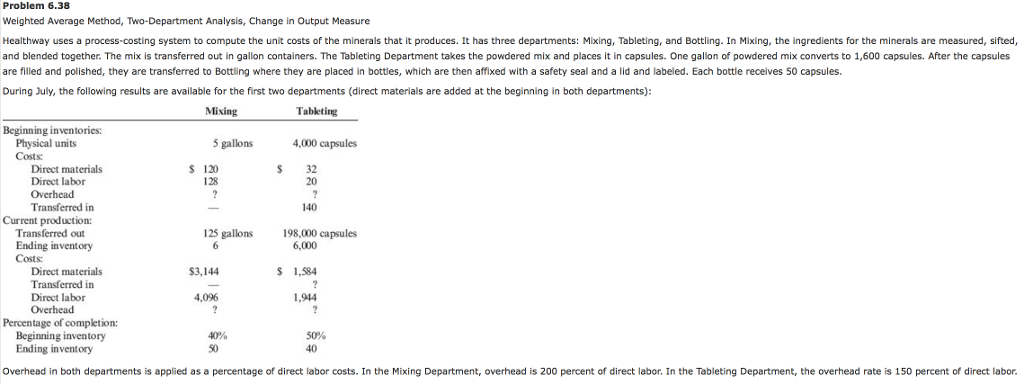

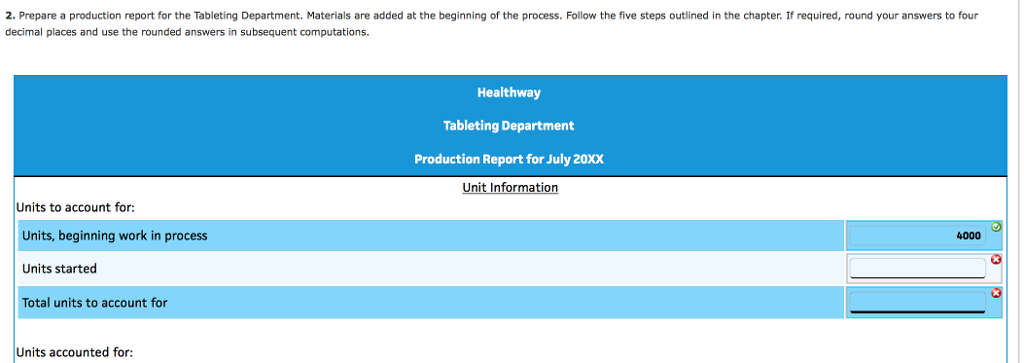

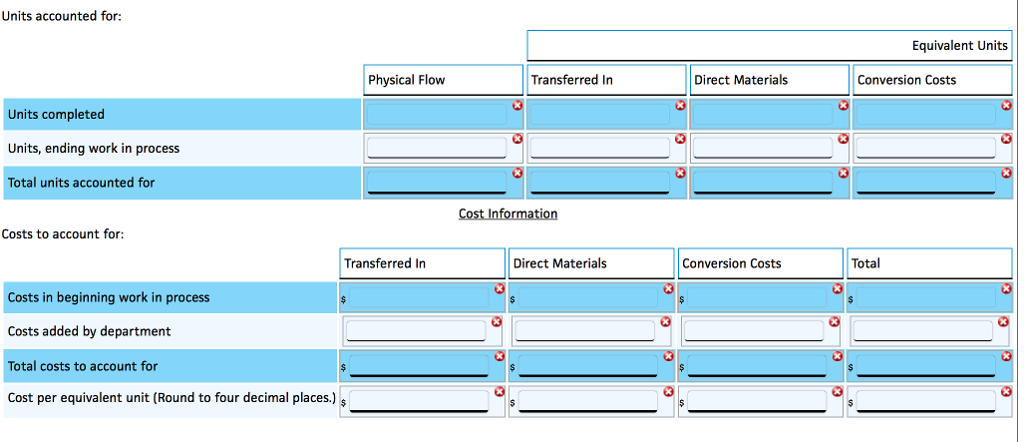

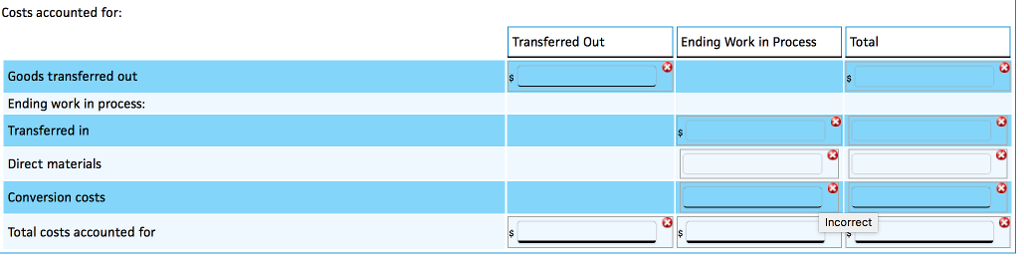

Problem 6.38 Weighted Average Method, Two Department Analysis, Change in Output Measure Healthway uses a process costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bot ng. In Mixing, the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Mixing Tableting Beginning inventories: 5 gallons Physical units 4,000 capsules 120 32 Direct materials Direct labor 128 Overhead Transferred in Current production: Transferred out 25 gallons 98,000 capsules Ending inventory 6.000 Costs: 1,584 Direct materials $3,144 Transferred in Direct labor 4,096 1,944 Overhead Percentage of completion: Beginning inventory 50% Ending inventory 40 Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor. Problem 6.38 Weighted Average Method, Two Department Analysis, Change in Output Measure Healthway uses a process costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bot ng. In Mixing, the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules. During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments): Mixing Tableting Beginning inventories: 5 gallons Physical units 4,000 capsules 120 32 Direct materials Direct labor 128 Overhead Transferred in Current production: Transferred out 25 gallons 98,000 capsules Ending inventory 6.000 Costs: 1,584 Direct materials $3,144 Transferred in Direct labor 4,096 1,944 Overhead Percentage of completion: Beginning inventory 50% Ending inventory 40 Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor