Problem 6-4

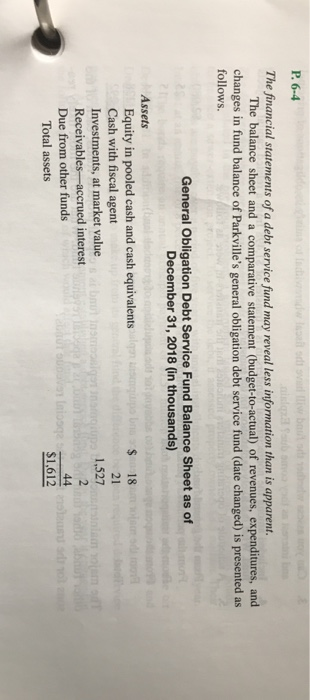

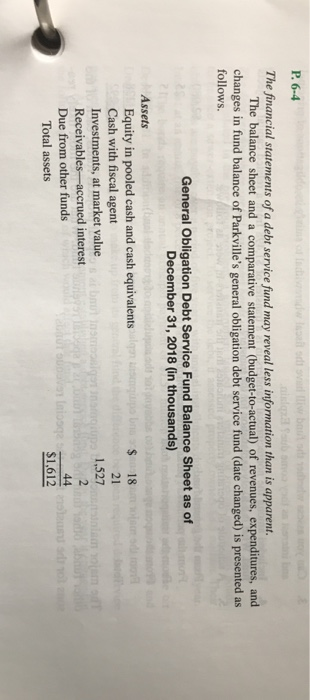

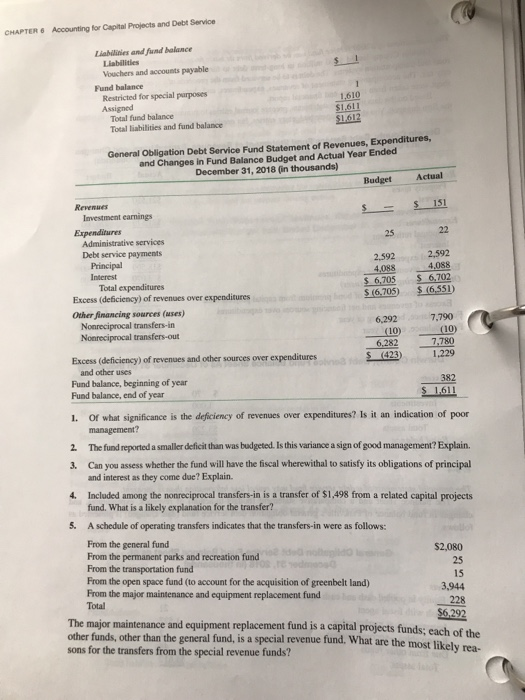

P. 6-4 The financial statements of a debt service fund may reveal less information than is apparent. The balance sheet and a comparative statement (budget-to-actual) of revenues, expenditures, and changes in fund balance of Parkville's general obligation debt service fund (date changed) is presented as follows. General Obligation Debt Service Fund Balance Sheet as of December 31, 2018 (in thousands) Assets Equity in pooled cash and cash equivalents Cash with fiscal agent Investments, at market value Receivables-accrued interest Due from other funds $18 21 1,527 Total assets $1,612 CHAPTER 6 Accounting for Capital Projects and Debt Service Liabilities and fund balance Liabilities Vouchers and accounts payable Fund balance Restricted for special parposes Assigned Total fund balance Total liabilities and fund balance $1.611 S1612 General Obligation Debt Service Fund Statement of Revenues, Expenditures, and Changes in Fund Balance Budget and Actual Year Ended December 31, 2018 (in thousands) Budget Actual Revenues s - s 151 Investment earnings Administrative services Debt service payments 2592 2.592 2,592 4,088 S 6,705S 6,702 $(6.705) $ (6.551) Interest Total expenditures Excess (deficiency) of revenues over expenditures Other financing sources (uses) 6,2927,790 Nonreciprocal transfers-in Nonreciprocal transfers-out 7.780 S 423)1.229 82 Excess (deficiency) of revenues and other sources over expenditures and other uses Fund balance, beginning of year Fund balance, end of year 1. of what significance is the deficiency of revenues over expenditures? Is it an indication of poor 2. The fund reported a smaller deficit than was budgeted. Is this variance a sign of good management? Explain. S 1,611 Can you assess whether the fund will have the fiscal wherewithal to satisfy its obligations of principal and interest as they come due? Explain. 3. 4 Included among the nonreciprocal transfers-in is a transfer of $1,498 from a related capital projects fund. What is a likely explanation for the transfer? A schedule of operating transfers indicates that the transfers-in were as follows: 5. From the general fund From the permanent parks and recreation fund From the transportation fund From the open space fund (to account for the acquisition of greenbelt land) From the major maintenance and equipment replacement fund Total $2,080 25 15 3,944 $6292 The major maintenance and equipment replacement fund is a capital projects funds; each of other funds, other than the general fund, is a special revenue fund. What sons for the transfers from the special revenue funds? the are the most likely rea