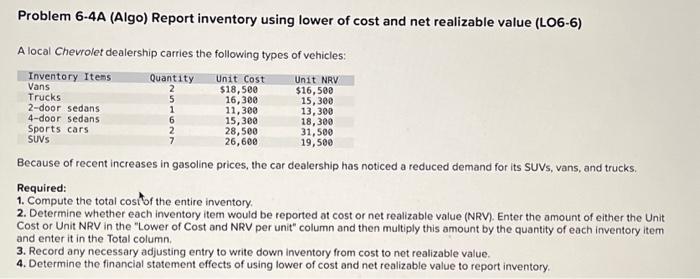

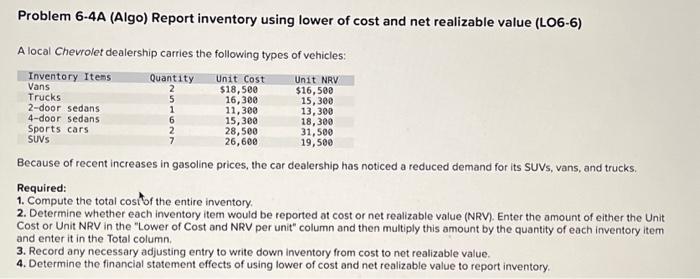

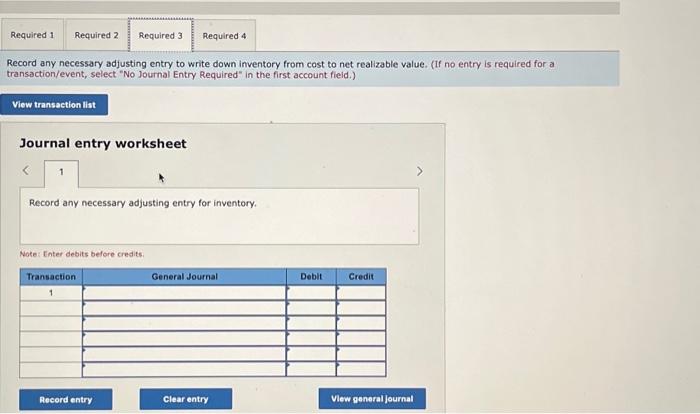

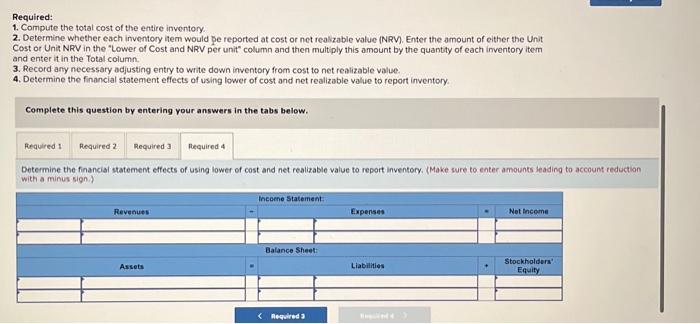

Problem 6-4A (Algo) Report inventory using lower of cost and net realizable value (LO6-6) A local Chevrolet dealership carries the following types of vehicles: Quantity 2 5 1 6 Inventory Items Vans Trucks 2-door sedans 4-door sedans Sports cars SUVS Unit Cost $18,500 16,300 11,300 15,300 28,500 26,600 2 7 Unit NRV $16,500 15,300 13,300 18,300 31,500 19,500 Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory.

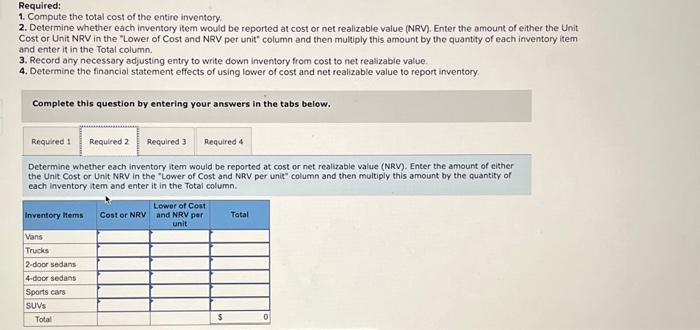

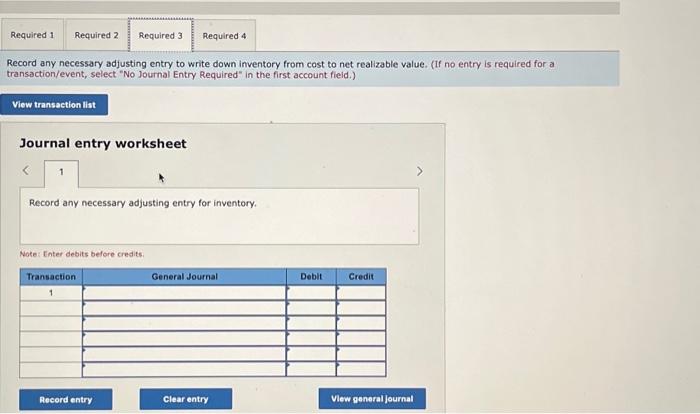

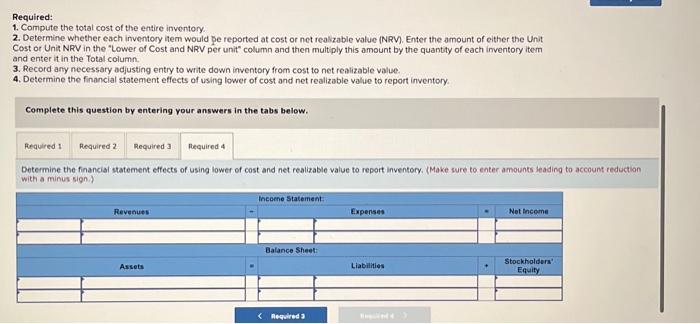

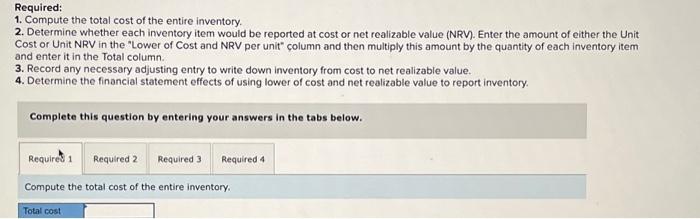

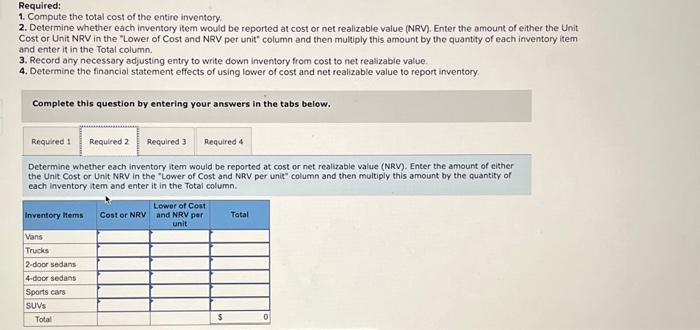

Problem 6.4A (Algo) Report inventory using lower of cost and net realizable value (LO6-6) A local Chewrolet dealership carries the following types of vehicles: Because of recent increases in gasoline prices, the car dealership has noticed a reduced demand for its SUVs, vans, and trucks. Required: 1. Compute the total costof the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Compute the total cost of the entire inventory. Record any necessary adjusting entry to write down inventory from cost to net realizable value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account fieid.) Journal entry worksheet Record any necessary adjusting entry for inventory. Note: Enter debits before credits. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net reasizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unit NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. Required: 1. Compute the total cost of the entire inventory. 2. Determine whether each inventory item would be reported at cost or net realizable value (NRV). Enter the amount of either the Unit Cost or Unia NRV in the "Lower of Cost and NRV per unit" column and then multiply this amount by the quantity of each inventory item and enter it in the Total column. 3. Record any necessary adjusting entry to write down inventory from cost to net realizable value. 4. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. Complete this question by entering your answers in the tabs below. Determine the financial statement effects of using lower of cost and net realizable value to report inventory. (Make sure to enter amounts seadin with a minus sign.)