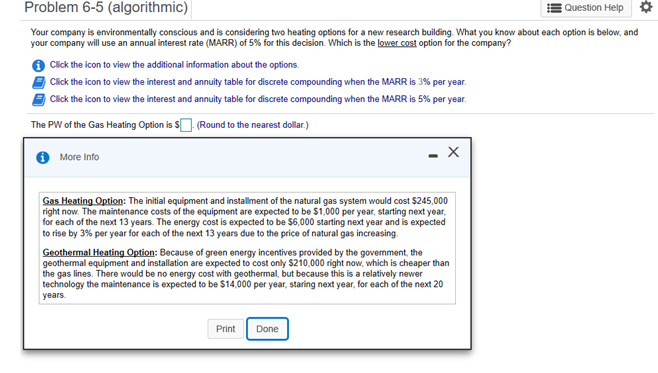

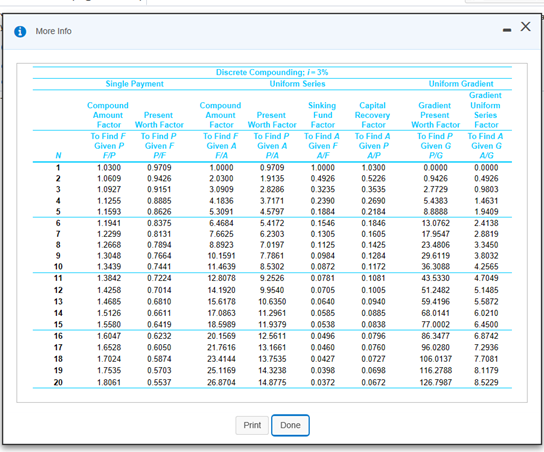

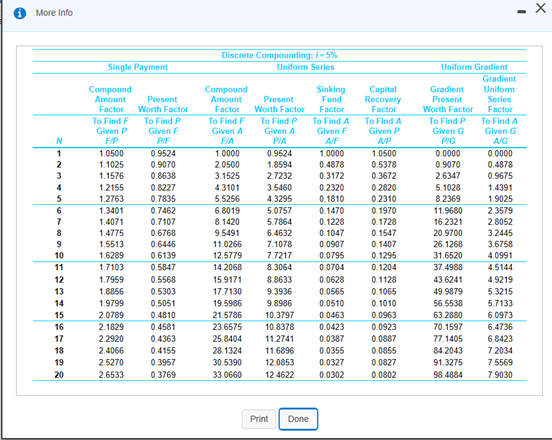

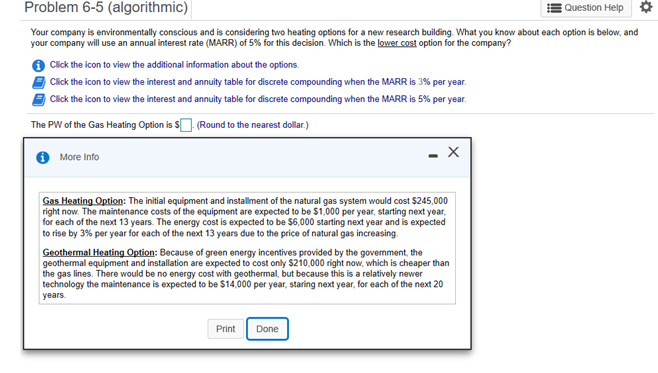

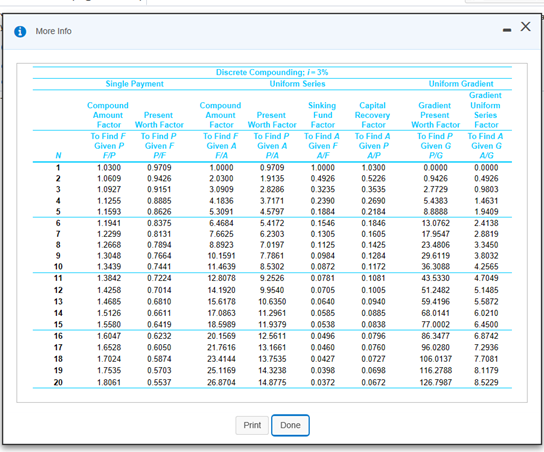

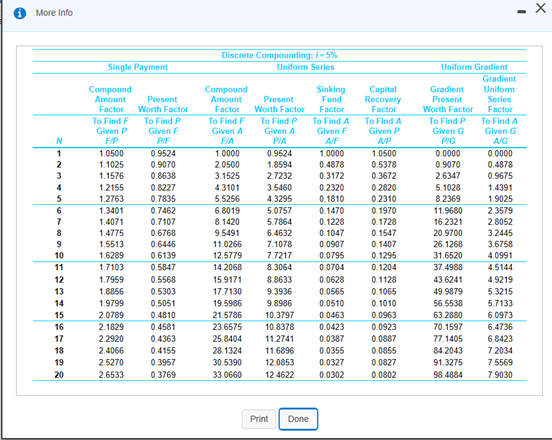

Problem 6-5 (algorithmic) 5 Question Help Your company is environmentally conscious and is considering two heating options for a new research building. What you know about each option is below, and your company will use an annual interest rate (MARR) of 5% for this decision. Which is the lower cost option for the company? Click the icon to view the additional information about the options Click the icon to view the interest and annuity table for discrete compounding when the MARR is 3% per year Click the icon to view the interest and annuity table for discrete compounding when the MARR is 5% per year The PW of the Gas Heating Option is $ (Round to the nearest dollar) More Info - X Gas Heating Option: The initial equipment and installment of the natural gas system would cost $245,000 right now The maintenance costs of the equipment are expected to be $1.000 per year, starting next year. for each of the next 13 years. The energy cost is expected to be $6,000 starting next year and is expected to rise by 3% per year for each of the next 13 years due to the price of natural gas increasing Geothermal Heating Option: Because of green energy incentives provided by the government, the geothermal equipment and installation are expected to cost only $210,000 right now, which is cheaper than the gas lines. There would be no energy cost with geothermal, but because this is a relatively newer technology the maintenance is expected to be $14,000 per year, staring next year, for each of the next 20 years. Print Done 0 More Info Single Payment Discrete Compounding: 1-3% Uniform Series Compound Amount Factor To Find F Given Present Worth Factor To Find Given F PF AF 10300 0.9709 10609 0.9426 1 0927 0.9151 1.1255 0.8885 1.1593 0 8626 1 1941 0.8375 1.2299 08131 1.2668 07894 1,3048 07664 1.3439 07441 1.3842 0.7224 1.4258 0.7014 1 4685 0.6810 5126 0 6611 1.5580 0.6419 1.6047 0.6232 16528 0.6050 1.7024 0.5874 1.7535 0.5703 1 80610 5537 Compound Sinking Capital Amount Present Fund Recovery Factor Worth Factor Factor Factor To Find To Find P To Find A To Find A Given A Given A Given Given P PA 1 0000 0.9709 1 0000 10300 20300 1.9135 0 4926 0.5226 30909 2.8286 0.3235 0 3535 4 1836 3.7171 0.2390 0.2690 5 3091 45797 02184 6.4684 5.4172 0.1546 0.1846 7.6625 62303 0.1305 0.1605 8.8923 70197 1125 0.1425 10 15917 .7861 0.0984 0 1284 11.4639 85302 00972 0 1172 12 8078 9.2526 0.0781 0.1081 14.1920 99540 0.0705 0.1005 15 6178 10.6350 00640 0.0940 17.0863 11 2961 0.0585 0.0885 18.5989 11.9379 0.0538 0.0838 20.1569 12 5611 0.0496 00796 21.7616 13 1661 00450 0 0760 23.4144 13.7535 0.0427 0.0727 25.1169 143238 00398 00698 26 8704 148775003720 0672 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find To Find A Given G Given G PYG 0.0000 0.0000 09426 0.4925 2.7729 09803 5.4383 1.4631 88888 19409 13.0762 24138 17.9547 2.8819 23.4806 3.3450 29 6119 3.8032 36 3088 42565 43.5330 4.7049 51 2482 5.1485 59.4196 5.5872 68,0141 6.0210 77.0002 6 4500 86.3477 6 8742 96 0280 72936 106.0137 7.7081 116 2788 8.1179 126.7987 8.5229 18 19 20 Print Done More Info Discrete Compounding: -5% Uniform Series Single Payment Capital Recovery Factor To Find A Given P AF AP AG Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F FAP PE 1.0500 09524 1.1025 0.9070 1.1576 0.8638 1.2155 0.8227 1.2763 0.7835 1.3401 0.7462 1.4071 0.7107 1.4775 0.6768 1.5513 06446 16289 0.6139 1.7103 0.5847 1.79590 .5568 1.8856 0.5303 1.9799 0.5051 2.0789 0.4810 2 1829 0.4581 2.2920 0.4363 2.4066 0.4155 25270 0.3957 2.6533 0.3769 Compound Amount Factor To Find F Given A FIA 10000 2.0500 3.1525 4 3101 5.5256 6.8019 8.1420 9 5491 11.0266 12.5779 14 2068 15.9171 17.7130 19 5986 21.5786 23.6575 25.8404 28.1324 30.5390 33,0660 Sinking Present Fund Worth Factor Factor To Find P To Find A Given Given F PYA 0.9524 1.0000 1.8594 04878 2.7232 0.3172 3.5460 0 2320 4.3295 0.1810 5.0757 0.1470 5.7864 0.1228 6 4632 01047 7 1078 0 0907 7.7217 0.0795 8.3064 0.0704 8.8633 0.0628 9.3936 00565 9.6986 00510 10.3797 0.0463 10.8378 0.0423 11.2741 0.0387 11.6896 0.0355 1208530 0327 12.4622 0.0302 2 1.0500 0.5378 0.3672 02820 0.2310 0.1970 0.1728 1547 0.1407 0.1295 0.1204 0.1128 0.1065 0 1010 0.0963 0.0923 0.0887 0.0855 0.0827 00802 Uniform Gradient Gradient Gradient Uniform Present Series Worth Factor Factor To Find To Find A Given G Given G PG 0.0000 00000 0.9070 04878 2.6347 0.9675 5.1028 1.4391 8.2369 1.9025 11.9680 2.3579 16.2321 2.8052 20970032445 26.1268 3.6758 31 6520 4.0991 37.4988 4.5144 43.6241 4.9219 49.9879 5.3215 56.5538 5.7133 63.2880 6.0973 70.1597 6.4736 77.1405 6.8423 842043 7.2034 91,3275 75569 98.4884 7.9030 12 14 15 16 18 19 20 Print Done