Problem 6-5B preparing a bank reconciliation and recording adjustments

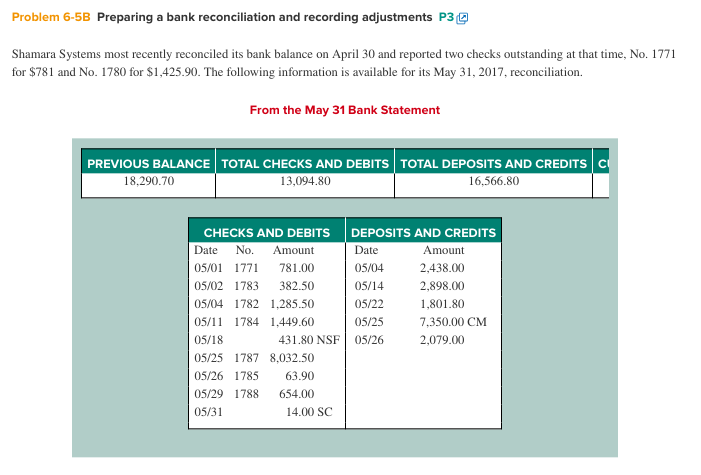

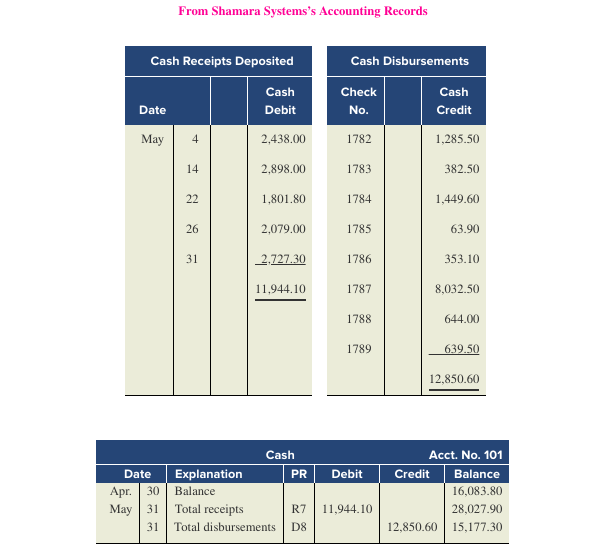

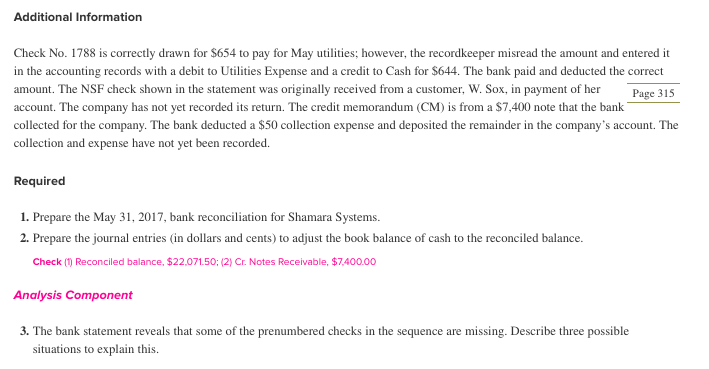

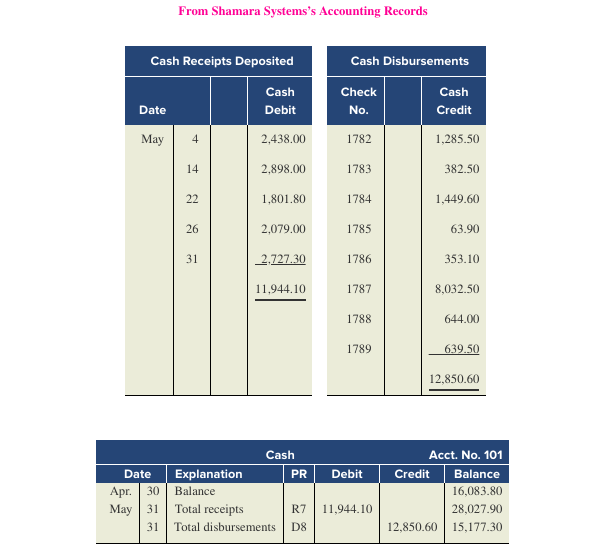

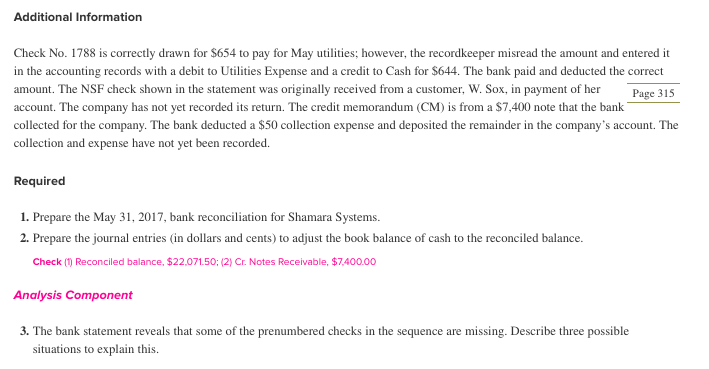

Problem 6-5B Preparing a bank reconciliation and recording adjustments P3 Shamara Systems most recently reconciled its bank balance on Apil 30 and reported two checks outstanding at that time, No. 1771 for $781 and No. 1780 for $1,425.90. The following information is available for its May 31, 2017, reconciliation. From the May 31 Bank Statement PREVIOUS BALANCE TOTAL CHECKS AND DEBITS I TOTAL DEPOSITS AND CREDITS | C 18,290.70 13,094.80 16,566.80 CHECKS AND DEBITS I DEPOSITS AND CREDITS Date No. Amount 05/01 1771 781.00 05/02 1783 382.50 05/04 1782 1,285.50 05/11 1784 1.449.60 05/18 05/25 1787 8,032.50 05/26 1785 63.90 05/29 1788 654.00 05/31 Date 05/04 05/14 05/22 05/25 431.80 NSF 05/26 Amount 2,438.00 2,898.00 1,801.80 7,350.00 CM 2,079.00 14.00 SC From Shamara Systems's Accounting Records Cash Receipts Deposited Cash Disbursements Check Cash Credit Cash Debit 2,438.00 2,898.00 1,801.80 2,079.00 2.727.30 11,944.10 Date May 4 1782 1783 1784 1785 1786 1787 1788 1789 1,285.50 382.50 1,449.60 63.90 353.10 8,032.50 644.00 26 31 12.850.60 Cash Acct. No. 101 Credit Balance 16,083.80 28,027.90 12,850.60 15,177.30 PR Debit Date Explanation Apr. 30Balance May 31Total receipts R7 11.944.10 31 Total disbursements D8 Additional Information Check No. 1788 is correctly drawn for $654 to pay for May utilities; however, the recordkeeper misread the amount and entered it in the accounting records with a debit to Utilities Expense and a credit to Cash for $644. The bank paid and deducted the correct amount. The NSF check shown in the statement was originally received from a customer, W. Sox, in payment of her account. The company has not yet recorded its return. The credit memorandum (CM) is from a $7,400 note that the bank collected for the company. The bank deducted a $50 collection expense and deposited the remainder in the company's account. The collection and expense have not yet been recorded Page Required 1. Prepare the May 31, 2017, bank reconciliation for Shamara Systems. 2. Prepare the journal entries (in dollars and cents) to adjust the book balance of cash to the reconciled balance. Check () Reconciled balance, $22,071.50; (2) Cr. Notes Receivable, $7,400.00 Analysis Component 3. The bank statement reveals that some of the prenumbered checks in the sequence are missing. Describe three possible situations to explain this