Answered step by step

Verified Expert Solution

Question

1 Approved Answer

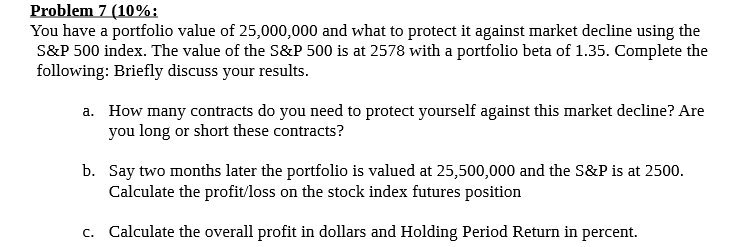

Problem 7 (10%: You have a portfolio value of 25,000,000 and what to protect it against market decline using the S&P 500 index. The

Problem 7 (10%: You have a portfolio value of 25,000,000 and what to protect it against market decline using the S&P 500 index. The value of the S&P 500 is at 2578 with a portfolio beta of 1.35. Complete the following: Briefly discuss your results. a. How many contracts do you need to protect yourself against this market decline? Are you long or short these contracts? b. Say two months later the portfolio is valued at 25,500,000 and the S&P is at 2500. Calculate the profit/loss on the stock index futures position c. Calculate the overall profit in dollars and Holding Period Return in percent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the number of contracts needed to protect against the market decline we first need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started