Question 3 (4 points) Yoyo's is an ice cream manufacturer with an annual sales volume of 4,000 units. It costs them $2 dollars per

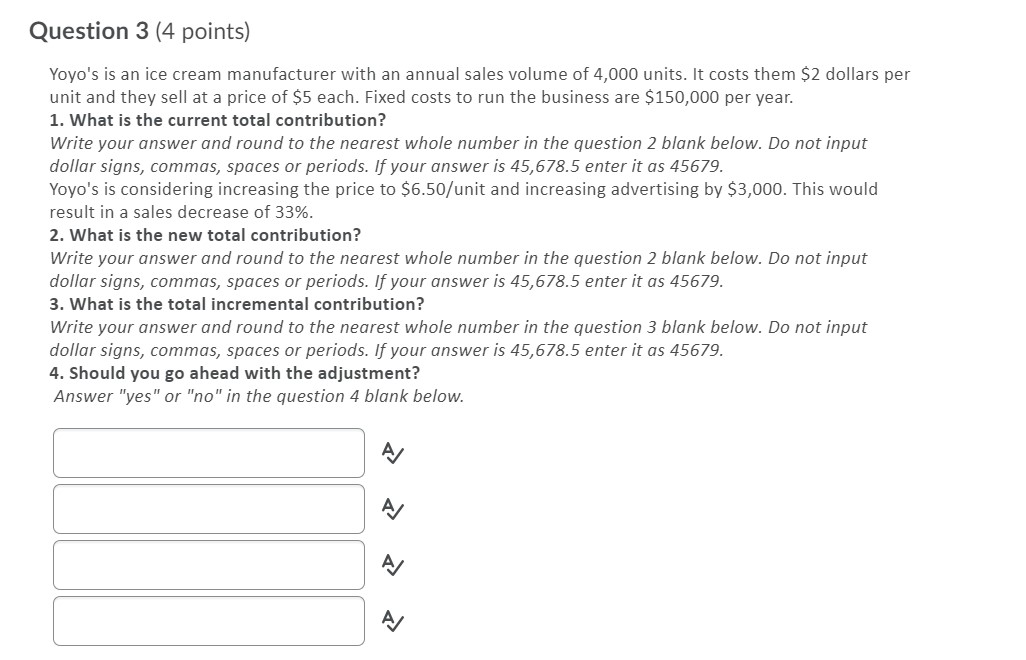

Question 3 (4 points) Yoyo's is an ice cream manufacturer with an annual sales volume of 4,000 units. It costs them $2 dollars per unit and they sell at a price of $5 each. Fixed costs to run the business are $150,000 per year. 1. What is the current total contribution? Write your answer and round to the nearest whole number in the question 2 blank below. Do not input dollar signs, commas, spaces or periods. If your answer is 45,678.5 enter it as 45679. Yoyo's is considering increasing the price to $6.50/unit and increasing advertising by $3,000. This would result in a sales decrease of 33%. 2. What is the new total contribution? Write your answer and round to the nearest whole number in the question 2 blank below. Do not input dollar signs, commas, spaces or periods. If your answer is 45,678.5 enter it as 45679. 3. What is the total incremental contribution? Write your answer and round to the nearest whole number in the question 3 blank below. Do not input dollar signs, commas, spaces or periods. If your answer is 45,678.5 enter it as 45679. 4. Should you go ahead with the adjustment? Answer "yes" or "no" in the question 4 blank below. A A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the current total contribution we need to subtract the total cost from the total reve...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started