Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem # 7 : Allocation of Proceeds between Bond and Warrants On December 1 , 2 0 2 0 , Grey Company issued at 1

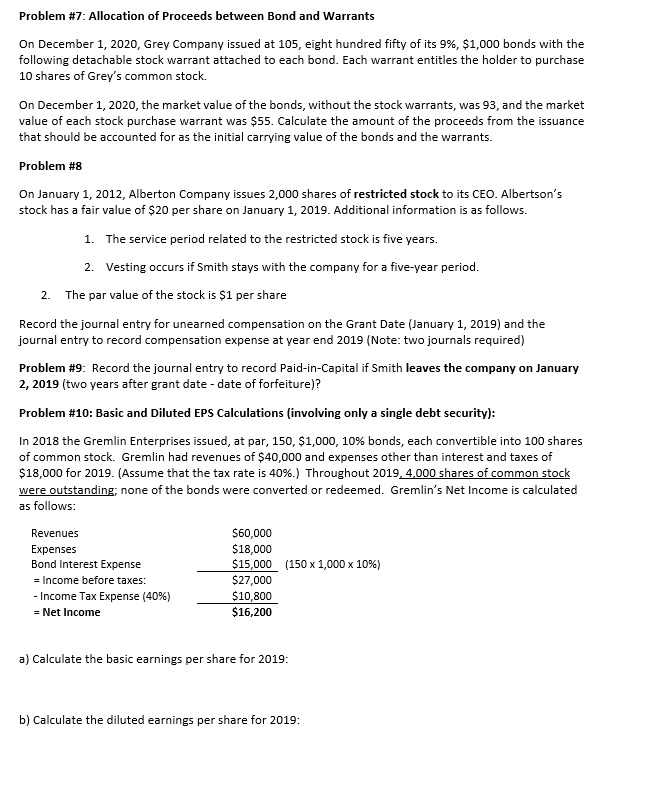

Problem #: Allocation of Proceeds between Bond and Warrants

On December Grey Company issued at eight hundred fifty of its $ bonds with the

following detachable stock warrant attached to each bond. Each warrant entitles the holder to purchase

shares of Grey's common stock.

On December the market value of the bonds, without the stock warrants, was and the market

value of each stock purchase warrant was $ Calculate the amount of the proceeds from the issuance

that should be accounted for as the initial carrying value of the bonds and the warrants.

Problem #

On January Alberton Company issues shares of restricted stock to its CEO. Albertson's

stock has a fair value of $ per share on January Additional information is as follows.

The service period related to the restricted stock is five years.

Vesting occurs if Smith stays with the company for a fiveyear period.

The par value of the stock is $ per share

Record the journal entry for unearned compensation on the Grant Date January and the

journal entry to record compensation expense at year end Note: two journals required

Problem #: Record the journal entry to record PaidinCapital if Smith leaves the company on January

two years after grant date date of forfeiture

Problem #: Basic and Diluted EPS Calculations involving only a single debt security:

In the Gremlin Enterprises issued, at par, $ bonds, each convertible into shares

of common stock. Gremlin had revenues of $ and expenses other than interest and taxes of

$ for Assume that the tax rate is Throughout shares of common stock

were outstanding; none of the bonds were converted or redeemed. Gremlin's Net Income is calculated

as follows:

a Calculate the basic earnings per share for :

b Calculate the diluted earnings per share for :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started