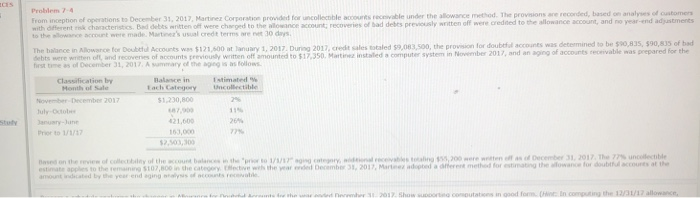

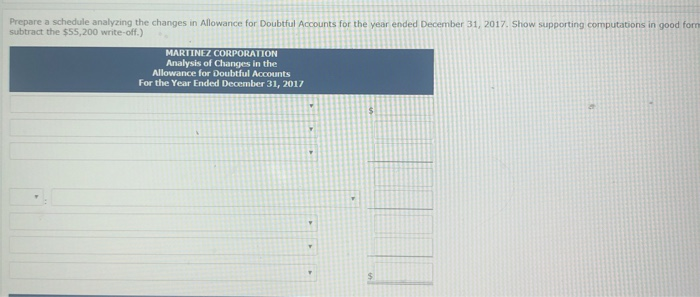

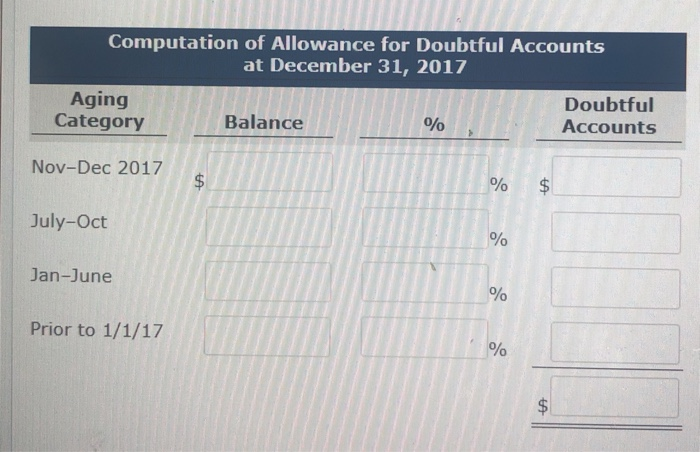

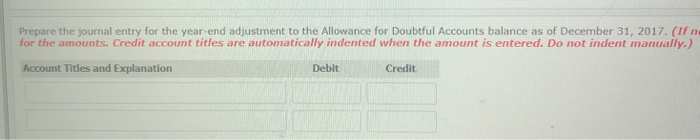

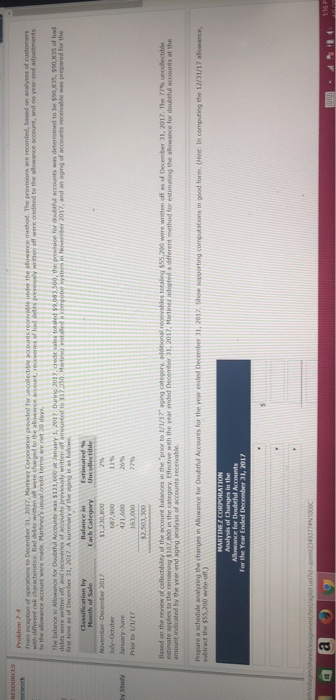

Problem 7 from inception of operations to December 31, 2017, Martinez Corprton proded for uncollecoble accounts recevable under t with different risk characteristics. Bad debes writen off were charged to the allowance account: recoveries of bad debes previcusly written off were credited to the to the alowance account were made. Martinez's usual credt terms are net 30 days the allowance method The provisions ane reconded, based on analyses of customers the provision for doubeful accounts was determined to be $90,835, $90,815 of bad The balance in Allowance for Doubttul Accounts wa $121,600 at lanuary 1, 2017. During 2017, credt sales totaled $9,083,500, t first time as of December 31, 2017. A smary of the aging is as follows of accounts receivable was prepared for the tineg installed a computer system in November 2017, and an aging o stir" ated % Uncllectible Balance in egory November December 2017 uly Octo 1,230,800 11% 26% 77% 87,90 21,600 163,000 Prior to 1/1/ 2,503,3 ,300 for doubtul accounts at estinate appies to the remanine s102 800 jn he cateoony tlectivn wih the year rded Decimb amount indscated by the yeer end aging lss of counts receuolle 31,2017,Martee adtd a aferent methed for estimating the owance os Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2017. Show supporting computations in good form subtract the $55,200 write-off.) MARTINEZ CORPORATION Analysis of Changes in the Allowance for Doubtful Accounts For the Year Ended December 31, 2017 Computation of Allowance for Doubtful Accounts at December 31, 2017 Aging Doubtful Accounts Category Nov-Dec 2017 July-Oct Jan-June Balance 0 0 0 0 0 Prior to 1/1/17 0 0 Prepare the journal entry for the year-end adjustment to the Allowance for Doubtful Accounts balance as of December 31, 2017. (If n for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit D0 deys Prior to 1/1/1 estimate applies to the the 12/31/17 31, 2017 Problem 7 from inception of operations to December 31, 2017, Martinez Corprton proded for uncollecoble accounts recevable under t with different risk characteristics. Bad debes writen off were charged to the allowance account: recoveries of bad debes previcusly written off were credited to the to the alowance account were made. Martinez's usual credt terms are net 30 days the allowance method The provisions ane reconded, based on analyses of customers the provision for doubeful accounts was determined to be $90,835, $90,815 of bad The balance in Allowance for Doubttul Accounts wa $121,600 at lanuary 1, 2017. During 2017, credt sales totaled $9,083,500, t first time as of December 31, 2017. A smary of the aging is as follows of accounts receivable was prepared for the tineg installed a computer system in November 2017, and an aging o stir" ated % Uncllectible Balance in egory November December 2017 uly Octo 1,230,800 11% 26% 77% 87,90 21,600 163,000 Prior to 1/1/ 2,503,3 ,300 for doubtul accounts at estinate appies to the remanine s102 800 jn he cateoony tlectivn wih the year rded Decimb amount indscated by the yeer end aging lss of counts receuolle 31,2017,Martee adtd a aferent methed for estimating the owance os Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2017. Show supporting computations in good form subtract the $55,200 write-off.) MARTINEZ CORPORATION Analysis of Changes in the Allowance for Doubtful Accounts For the Year Ended December 31, 2017 Computation of Allowance for Doubtful Accounts at December 31, 2017 Aging Doubtful Accounts Category Nov-Dec 2017 July-Oct Jan-June Balance 0 0 0 0 0 Prior to 1/1/17 0 0 Prepare the journal entry for the year-end adjustment to the Allowance for Doubtful Accounts balance as of December 31, 2017. (If n for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit D0 deys Prior to 1/1/1 estimate applies to the the 12/31/17 31, 2017