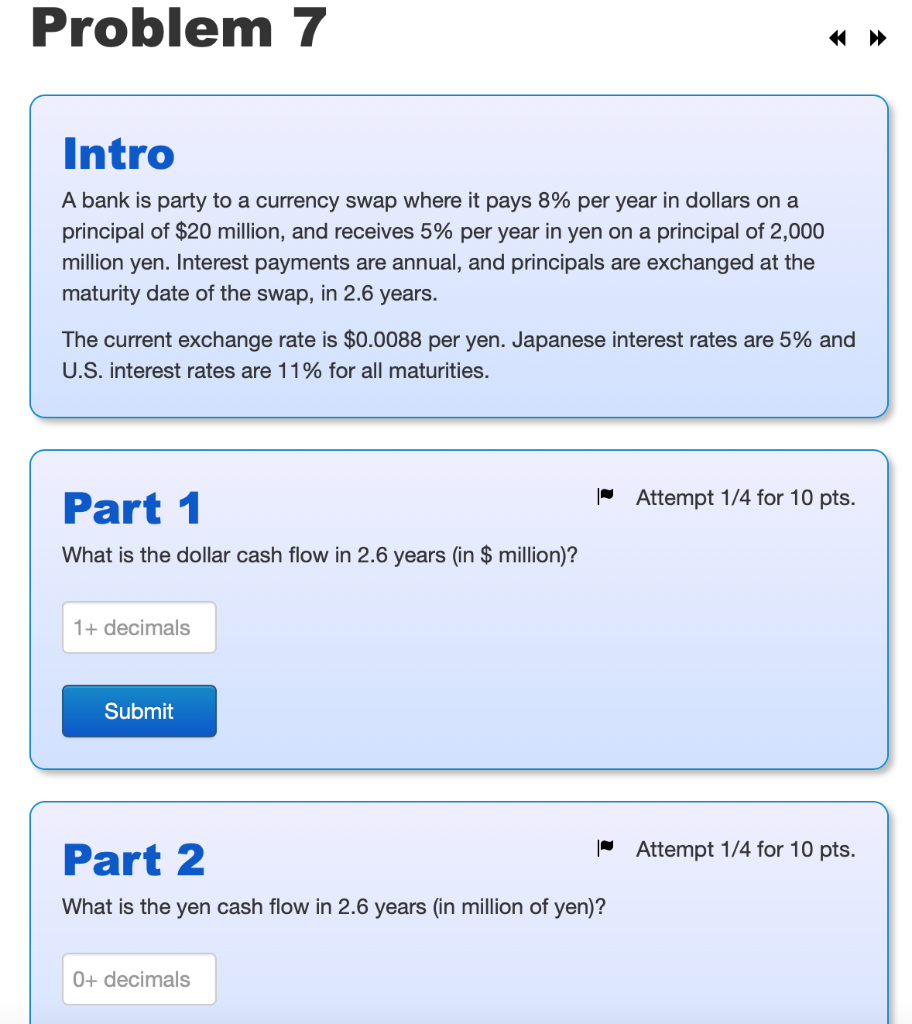

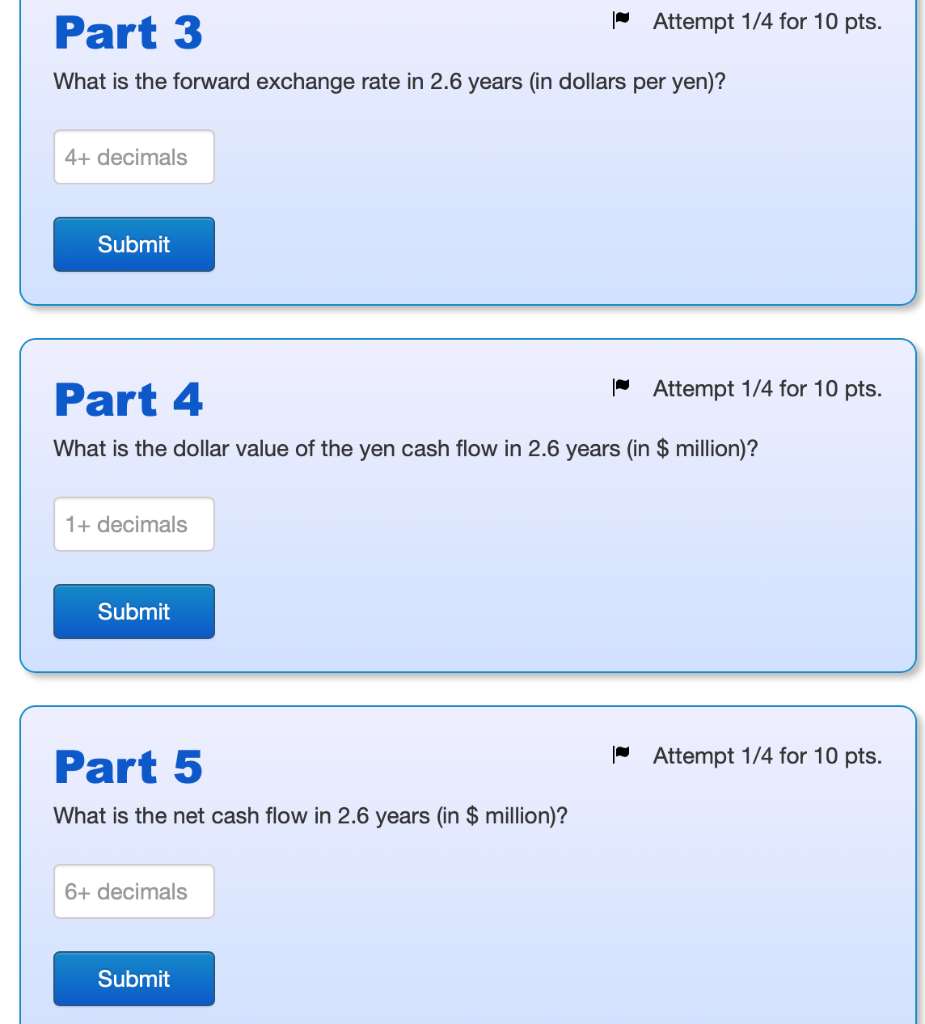

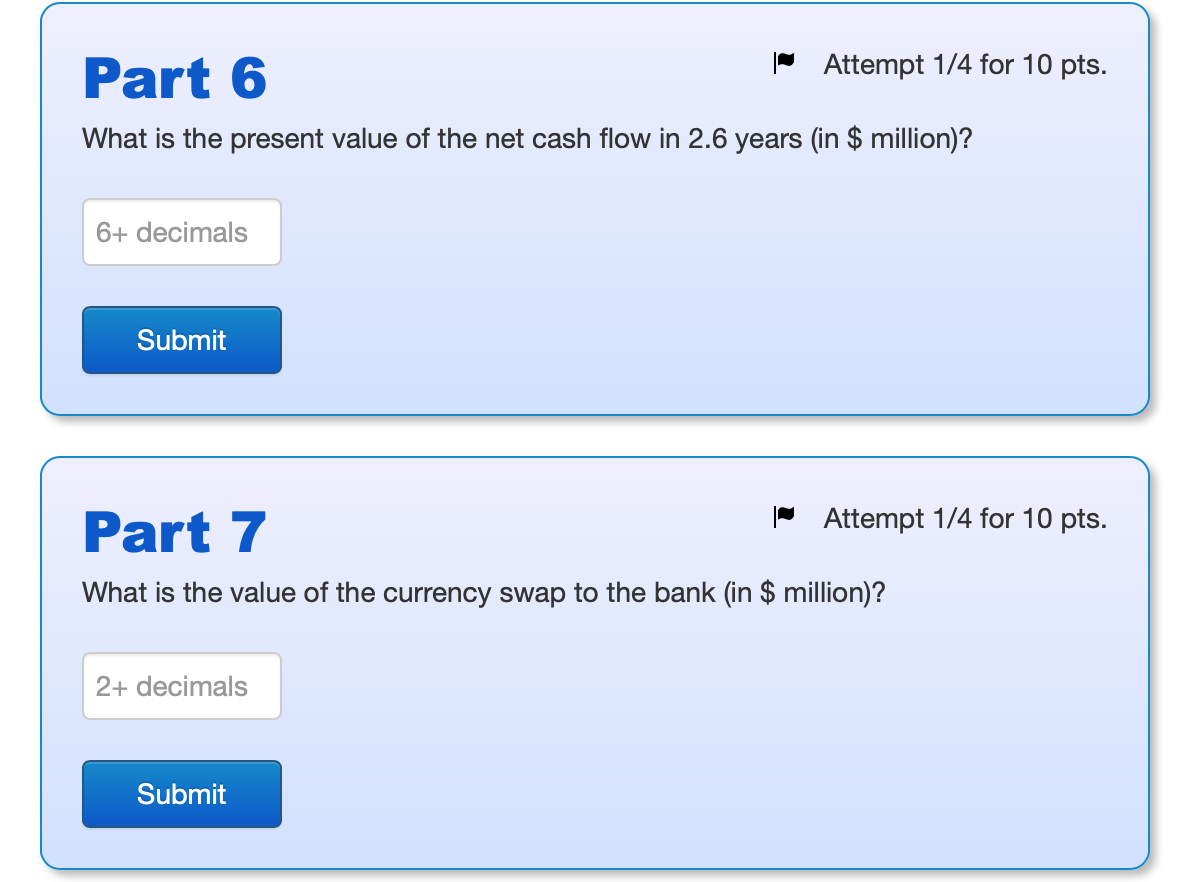

Problem 7 Intro A bank is party to a currency swap where it pays 8% per year in dollars on a principal of $20 million, and receives 5% per year in yen on a principal of 2,000 million yen. Interest payments are annual, and principals are exchanged at the maturity date of the swap, in 2.6 years. The current exchange rate is $0.0088 per yen. Japanese interest rates are 5% and U.S. interest rates are 11% for all maturities. |Attempt 1/4 for 10 pts. Part 1 What is the dollar cash flow in 2.6 years (in $ million)? 1+ decimals Submit | Attempt 1/4 for 10 pts. Part 2 What is the yen cash flow in 2.6 years (in million of yen)? 0+ decimals Part 3 | Attempt 1/4 for 10 pts. What is the forward exchange rate in 2.6 years (in dollars per yen)? 4+ decimals Submit Part 4 | Attempt 1/4 for 10 pts. What is the dollar value of the yen cash flow in 2.6 years (in $ million)? 1+ decimals Submit | Attempt 1/4 for 10 pts. Part 5 What is the net cash flow in 2.6 years (in $ million)? 6+ decimals Submit Part 6 | Attempt 1/4 for 10 pts. What is the present value of the net cash flow in 2.6 years (in $ million)? 6+ decimals Submit Part 7 | Attempt 1/4 for 10 pts. What is the value of the currency swap to the bank (in $ million)? 2+ decimals Submit Problem 7 Intro A bank is party to a currency swap where it pays 8% per year in dollars on a principal of $20 million, and receives 5% per year in yen on a principal of 2,000 million yen. Interest payments are annual, and principals are exchanged at the maturity date of the swap, in 2.6 years. The current exchange rate is $0.0088 per yen. Japanese interest rates are 5% and U.S. interest rates are 11% for all maturities. |Attempt 1/4 for 10 pts. Part 1 What is the dollar cash flow in 2.6 years (in $ million)? 1+ decimals Submit | Attempt 1/4 for 10 pts. Part 2 What is the yen cash flow in 2.6 years (in million of yen)? 0+ decimals Part 3 | Attempt 1/4 for 10 pts. What is the forward exchange rate in 2.6 years (in dollars per yen)? 4+ decimals Submit Part 4 | Attempt 1/4 for 10 pts. What is the dollar value of the yen cash flow in 2.6 years (in $ million)? 1+ decimals Submit | Attempt 1/4 for 10 pts. Part 5 What is the net cash flow in 2.6 years (in $ million)? 6+ decimals Submit Part 6 | Attempt 1/4 for 10 pts. What is the present value of the net cash flow in 2.6 years (in $ million)? 6+ decimals Submit Part 7 | Attempt 1/4 for 10 pts. What is the value of the currency swap to the bank (in $ million)? 2+ decimals Submit