Question

Problem #7 Medifast a. Calculate Medifasts sustainable growth rate for each year, from 2006 2010. b. During the 2006-2010 period, was Medifast experiencing a fast

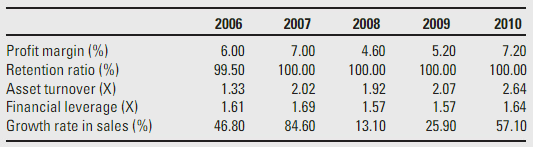

Problem #7 Medifast a. Calculate Medifasts sustainable growth rate for each year, from 2006 2010. b. During the 2006-2010 period, was Medifast experiencing a fast or slow growth problem, and what impact would this have had in the firms cash balances? c. What did Medifast do to improve its sustainable growth rate during this period. Beyond simply mentioning whether a ratio increased or decreased, explain what might cause the change the ratio. d. Referring to 2010 only: i. What value for the profit margin would have brought Medifast into balanced growth? ii. What value for asset turnover would have brought Medifast into balanced growth? iii. What value for financial leverage would have brought Medifast into balanced growth? Additionally, what % of assets was financed with equity given the leverage ratio of 1.6, and what % of assets would have been financed with equity given your leverage ratio consistent with balanced growth?

Problem #7 Medifast a. Calculate Medifasts sustainable growth rate for each year, from 2006 2010. b. During the 2006-2010 period, was Medifast experiencing a fast or slow growth problem, and what impact would this have had in the firms cash balances? c. What did Medifast do to improve its sustainable growth rate during this period. Beyond simply mentioning whether a ratio increased or decreased, explain what might cause the change the ratio. d. Referring to 2010 only: i. What value for the profit margin would have brought Medifast into balanced growth? ii. What value for asset turnover would have brought Medifast into balanced growth? iii. What value for financial leverage would have brought Medifast into balanced growth? Additionally, what % of assets was financed with equity given the leverage ratio of 1.6, and what % of assets would have been financed with equity given your leverage ratio consistent with balanced growth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started