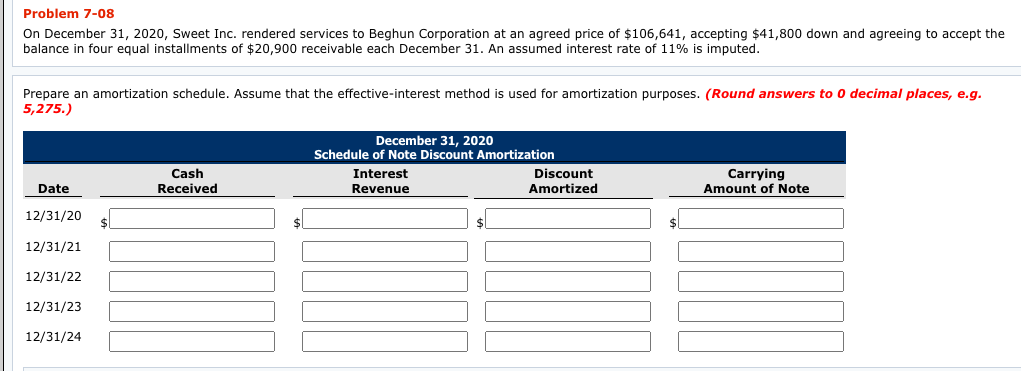

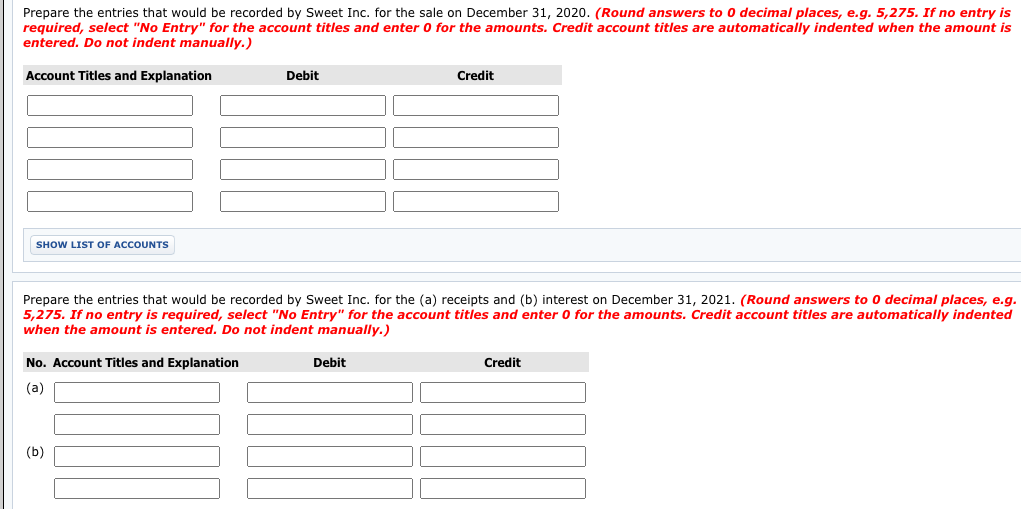

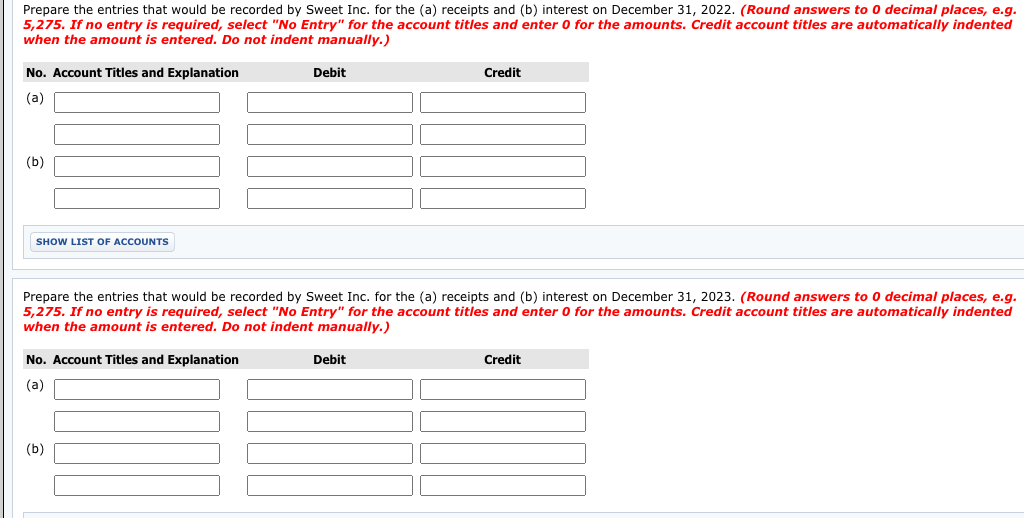

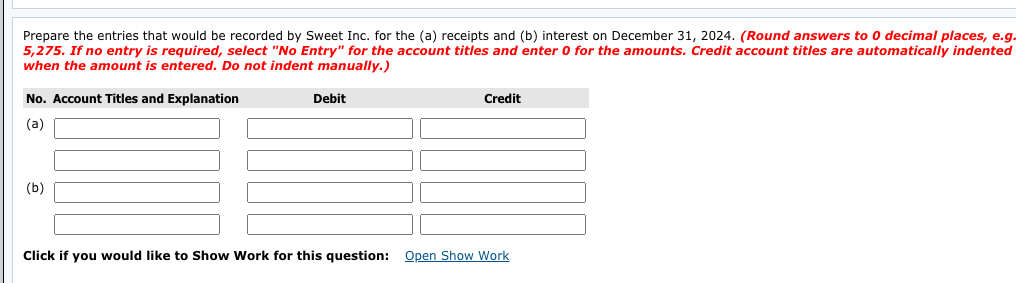

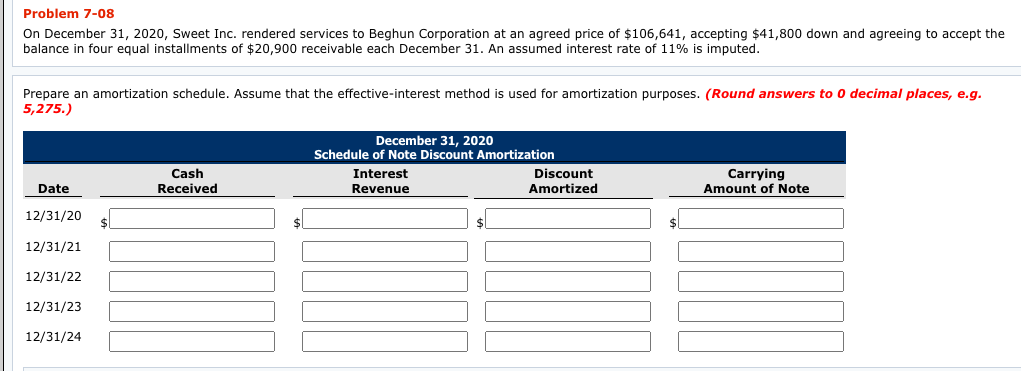

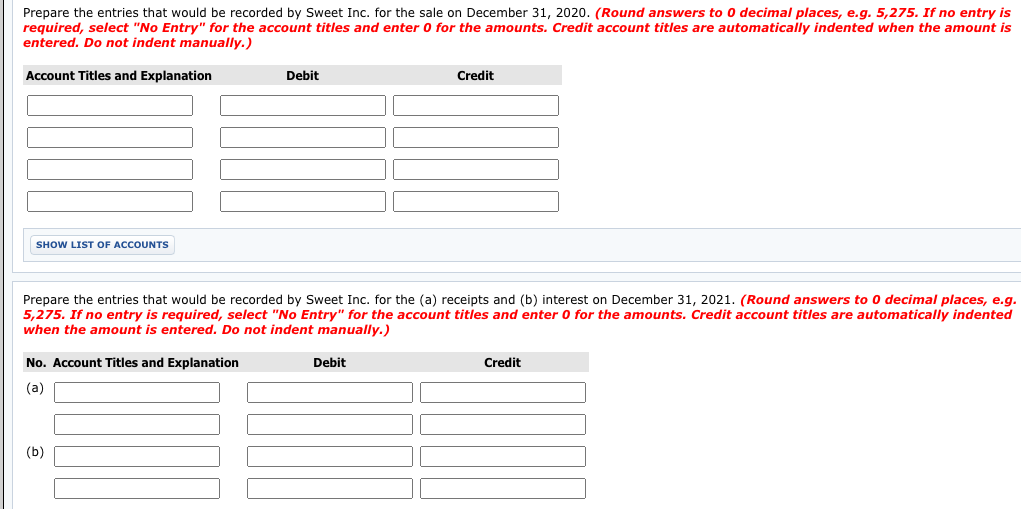

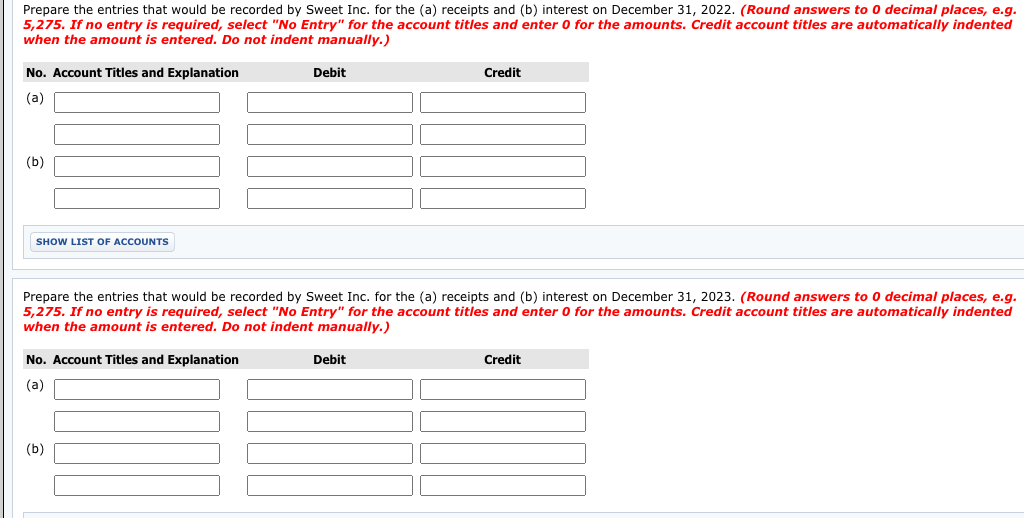

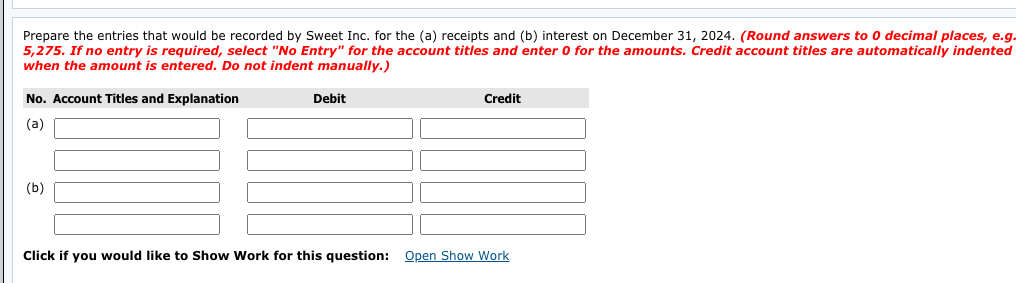

Problem 7-08 On December 31, 2020, Sweet Inc. rendered services to Beghun Corporation at an agreed price of $106,641, accepting $41,800 down and agreeing to accept the balance in four equal installments of $20,900 receivable each December 31. An assumed interest rate of 11% is imputed. Prepare an amortization schedule. Assume that the effective-interest method is used for amortization purposes. (Round answers to 0 decimal places, e.g. 5,275.) December 31, 2020 Schedule of Note Discount Amortization Cash Interest Discount Carrying Date Received Revenue Amortized Amount of Note 12/31/20 $ 12/31/21 12/31/22 12/31/23 12/31/24 Prepare the entries that would be recorded by Sweet Inc. for the sale on December 31, 2020. (Round answers to o decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS Prepare the entries that would be recorded by Sweet Inc. for the (a) receipts and (b) interest on December 31, 2021. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) (b) Prepare the entries that would be recorded by Sweet Inc. for the (a) receipts and (b) interest on December 31, 2022. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) (b) SHOW LIST OF ACCOUNTS Prepare the entries that would be recorded by Sweet Inc. for the (a) receipts and (b) interest on December 31, 2023. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Debit Credit No. Account Titles and Explanation (a) (b) Prepare the entries that would be recorded by Sweet Inc. for the (a) receipts and (b) interest on December 31, 2024. (Round answers to 0 decimal places, e.g. 5,275. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) (b) Click if you would like to Show Work for this question: Open Show Work