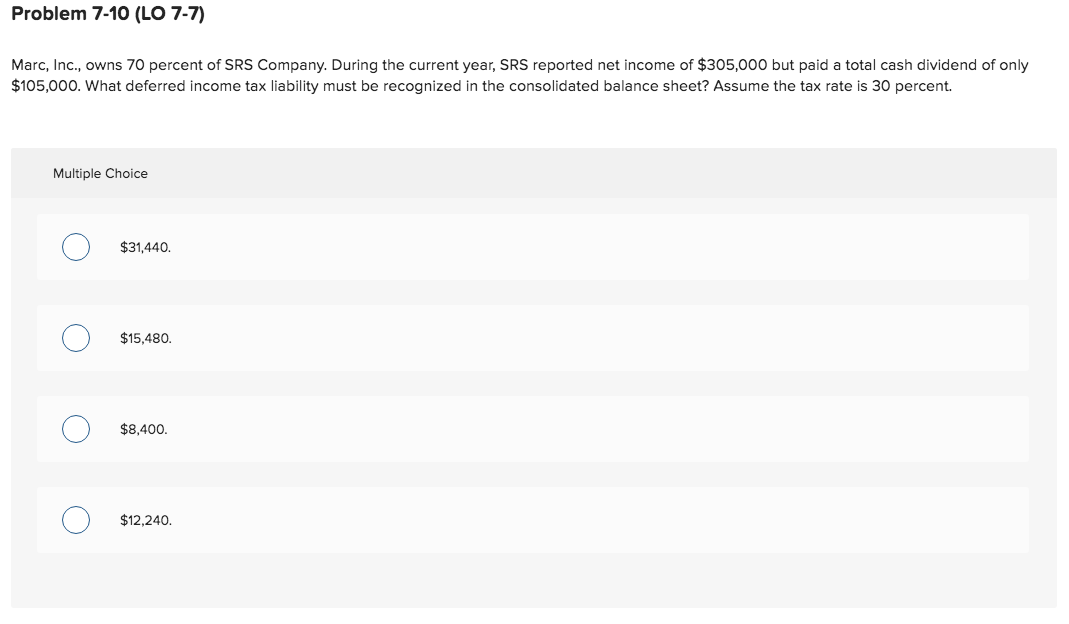

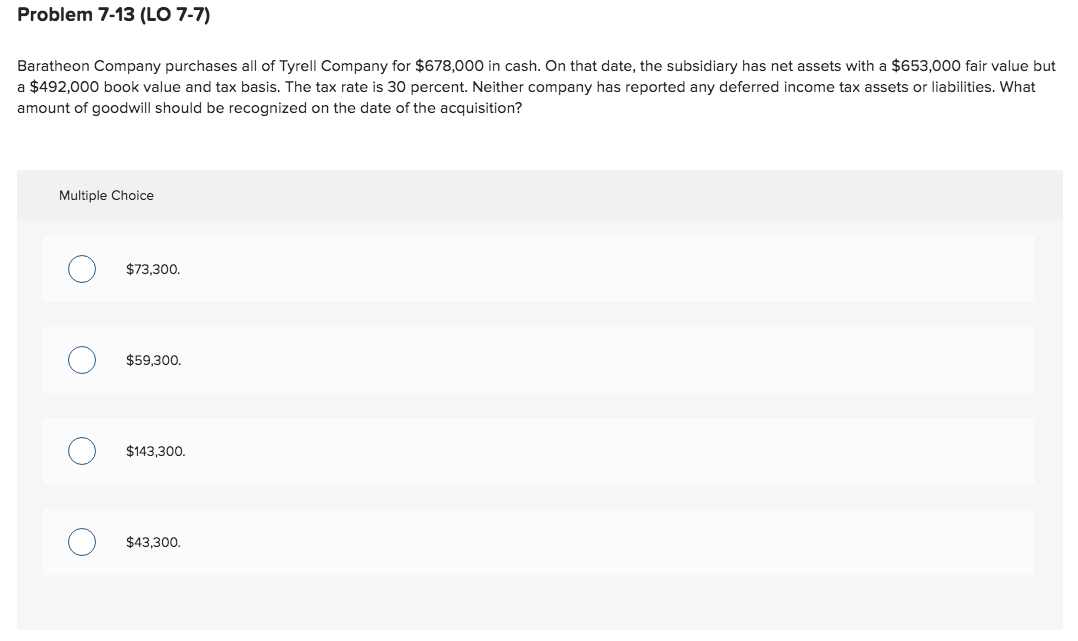

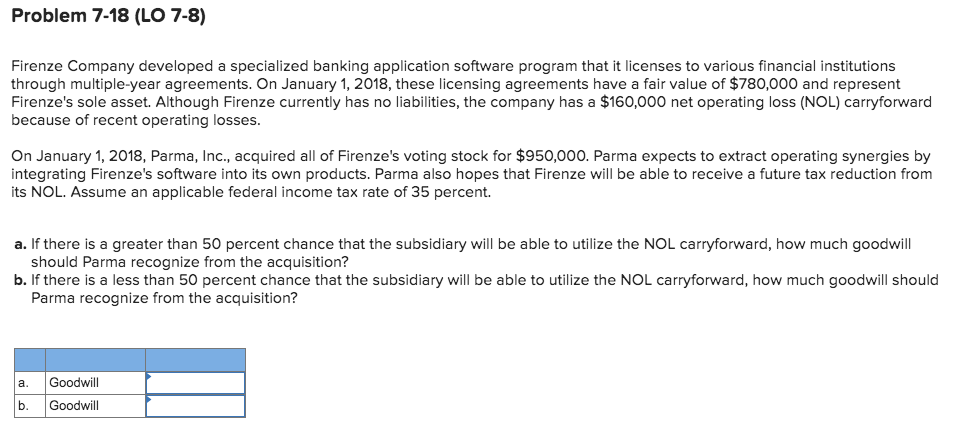

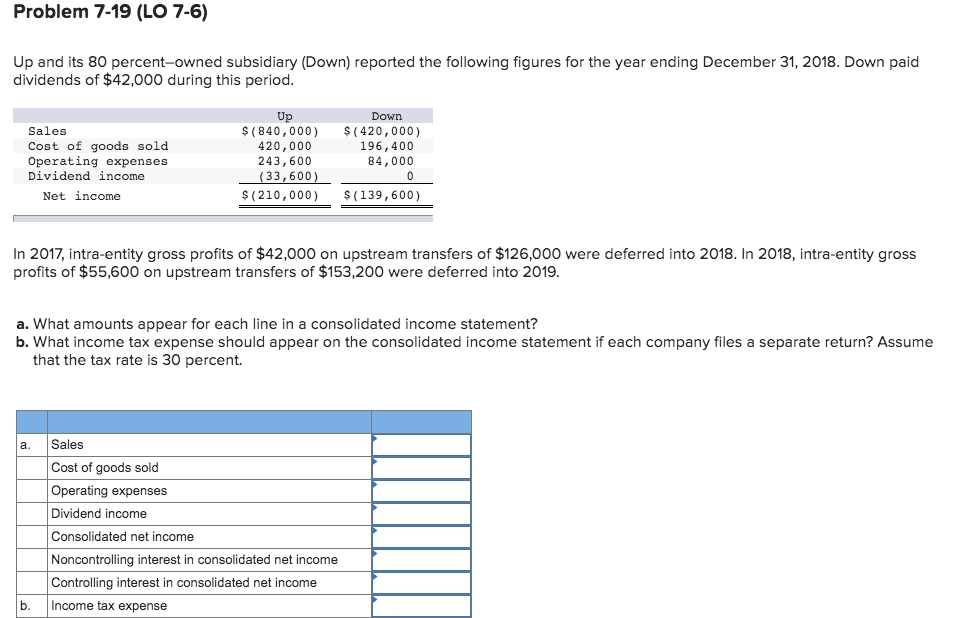

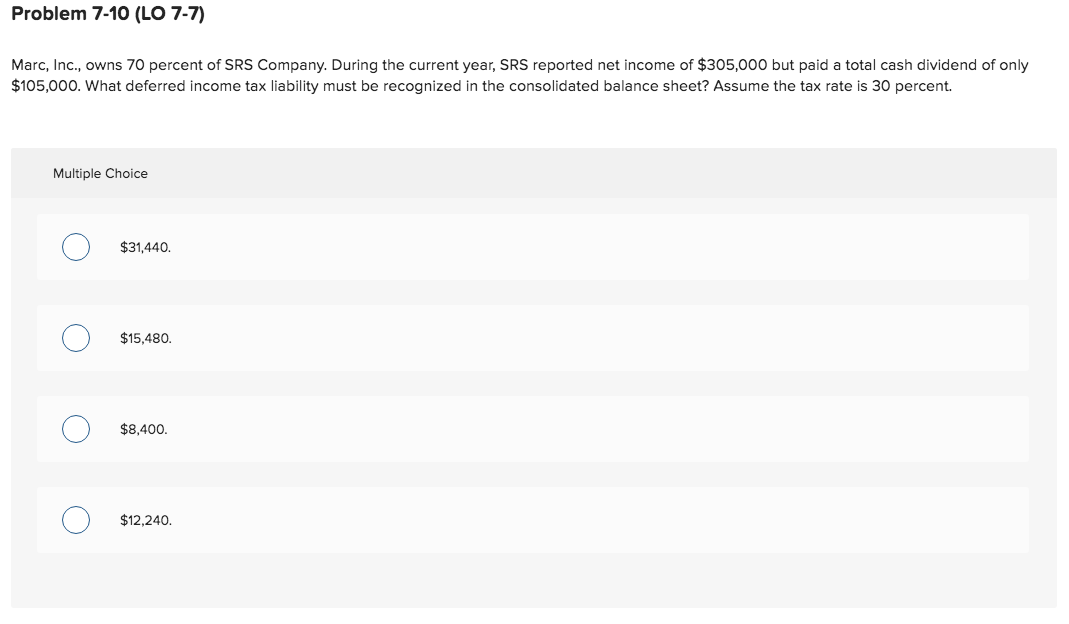

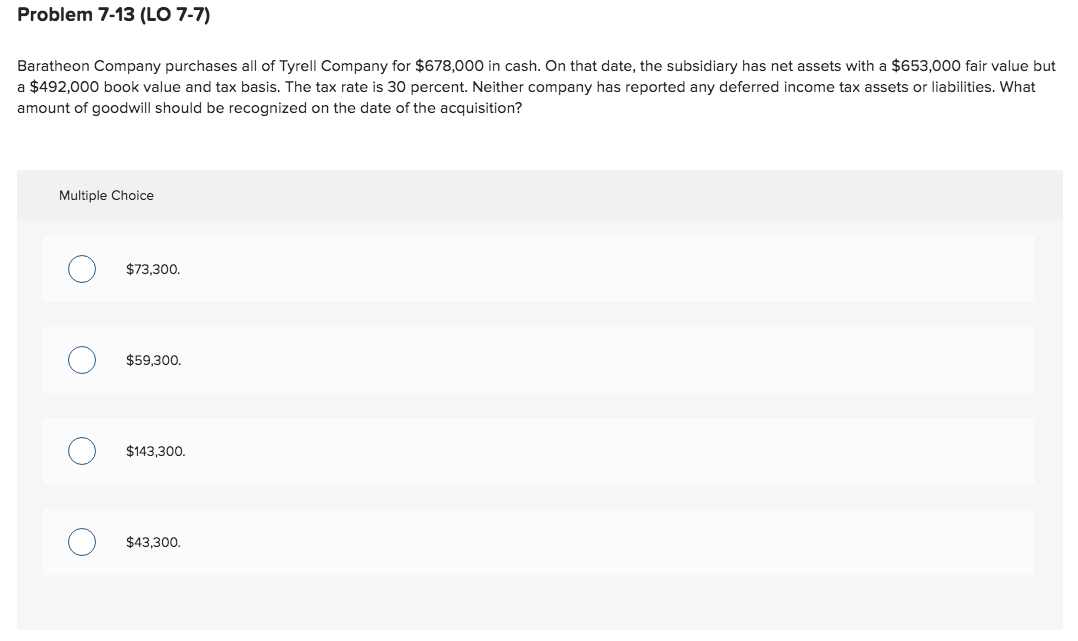

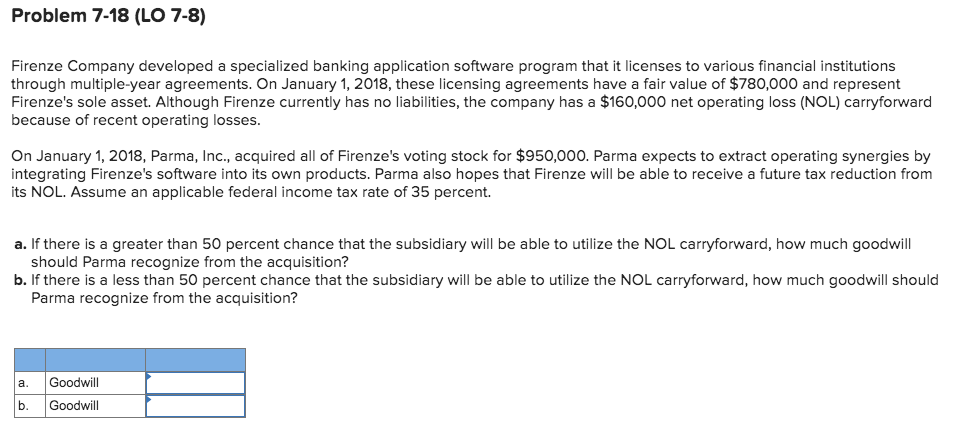

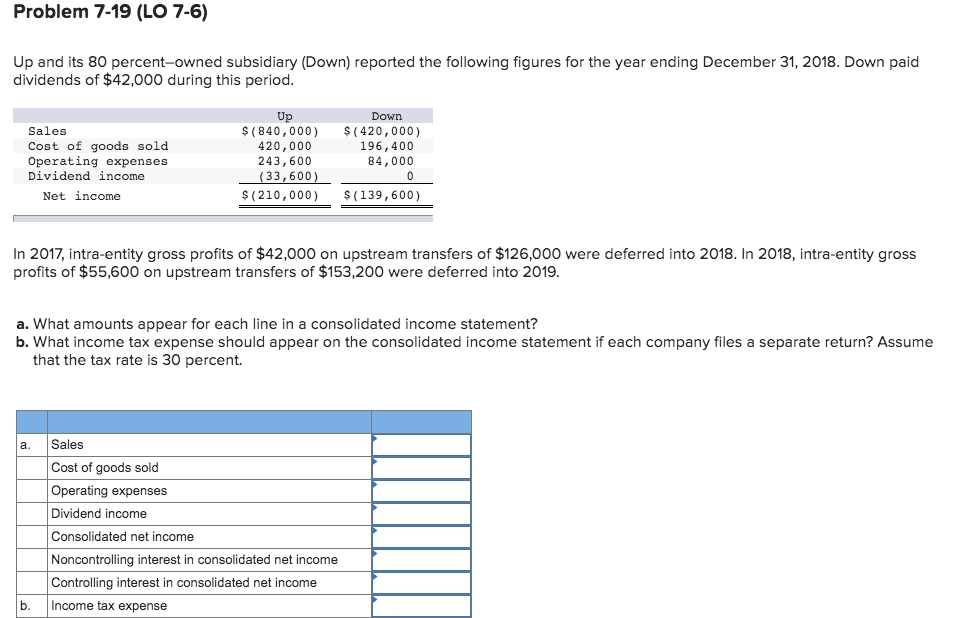

Problem 7-10 (LO 7-7) Marc, Inc., owns 70 percent of SRS Company. During the current year, SRS reported net income of $305,000 but paid a total cash dividend of only $105,000. What deferred income tax liability must be recognized in the consolidated balance sheet? Assume the tax rate is 30 percent. Multiple Choice $31,440. $15,480. O $8,400. $8,400. $12,240. Problem 7-13 (LO 7-7) Baratheon Company purchases all of Tyrell Company for $678,000 in cash. On that date, the subsidiary has net assets with a $653,000 fair value but a $492,000 book value and tax basis. The tax rate is 30 percent. Neither company has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition? Multiple Choice O $73,300. O $59,300. O $143,300. O $43,300. Problem 7-18 (LO 7-8) Firenze Company developed a specialized banking application software program that it licenses to various financial institutions through multiple-year agreements. On January 1, 2018, these licensing agreements have a fair value of $780,000 and represent Firenze's sole asset. Although Firenze currently has no liabilities, the company has a $160,000 net operating loss (NOL) carryforward because of recent operating losses. On January 1, 2018, Parma, Inc., acquired all of Firenze's voting stock for $950,000. Parma expects to extract operating synergies by integrating Firenze's software into its own products. Parma also hopes that Firenze will be able to receive a future tax reduction from its NOL. Assume an applicable federal income tax rate of 35 percent. a. If there is a greater than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? b. If there is a less than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? a. b. Goodwill Goodwill Problem 7-19 (LO 7-6) Up and its 80 percent-owned subsidiary (Down) reported the following figures for the year ending December 31, 2018. Down paid dividends of $42,000 during this period. Sales Cost of goods sold Operating expenses Dividend income Net income Up $(840,000) 420,000 243,600 (33,600) $(210,000) Down $ ( 420,000) 196,400 84,000 $ (139, 600) In 2017, intra-entity gross profits of $42,000 on upstream transfers of $126,000 were deferred into 2018. In 2018, intra-entity gross profits of $55,600 on upstream transfers of $153,200 were deferred into 2019. a. What amounts appear for each line in a consolidated income statement? b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume that the tax rate is 30 percent. Sales Cost of goods sold Operating expenses Dividend income Consolidated net income Noncontrolling interest in consolidated net income Controlling interest in consolidated net income Income tax expense Problem 7-10 (LO 7-7) Marc, Inc., owns 70 percent of SRS Company. During the current year, SRS reported net income of $305,000 but paid a total cash dividend of only $105,000. What deferred income tax liability must be recognized in the consolidated balance sheet? Assume the tax rate is 30 percent. Multiple Choice $31,440. $15,480. O $8,400. $8,400. $12,240. Problem 7-13 (LO 7-7) Baratheon Company purchases all of Tyrell Company for $678,000 in cash. On that date, the subsidiary has net assets with a $653,000 fair value but a $492,000 book value and tax basis. The tax rate is 30 percent. Neither company has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition? Multiple Choice O $73,300. O $59,300. O $143,300. O $43,300. Problem 7-18 (LO 7-8) Firenze Company developed a specialized banking application software program that it licenses to various financial institutions through multiple-year agreements. On January 1, 2018, these licensing agreements have a fair value of $780,000 and represent Firenze's sole asset. Although Firenze currently has no liabilities, the company has a $160,000 net operating loss (NOL) carryforward because of recent operating losses. On January 1, 2018, Parma, Inc., acquired all of Firenze's voting stock for $950,000. Parma expects to extract operating synergies by integrating Firenze's software into its own products. Parma also hopes that Firenze will be able to receive a future tax reduction from its NOL. Assume an applicable federal income tax rate of 35 percent. a. If there is a greater than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? b. If there is a less than 50 percent chance that the subsidiary will be able to utilize the NOL carryforward, how much goodwill should Parma recognize from the acquisition? a. b. Goodwill Goodwill Problem 7-19 (LO 7-6) Up and its 80 percent-owned subsidiary (Down) reported the following figures for the year ending December 31, 2018. Down paid dividends of $42,000 during this period. Sales Cost of goods sold Operating expenses Dividend income Net income Up $(840,000) 420,000 243,600 (33,600) $(210,000) Down $ ( 420,000) 196,400 84,000 $ (139, 600) In 2017, intra-entity gross profits of $42,000 on upstream transfers of $126,000 were deferred into 2018. In 2018, intra-entity gross profits of $55,600 on upstream transfers of $153,200 were deferred into 2019. a. What amounts appear for each line in a consolidated income statement? b. What income tax expense should appear on the consolidated income statement if each company files a separate return? Assume that the tax rate is 30 percent. Sales Cost of goods sold Operating expenses Dividend income Consolidated net income Noncontrolling interest in consolidated net income Controlling interest in consolidated net income Income tax expense