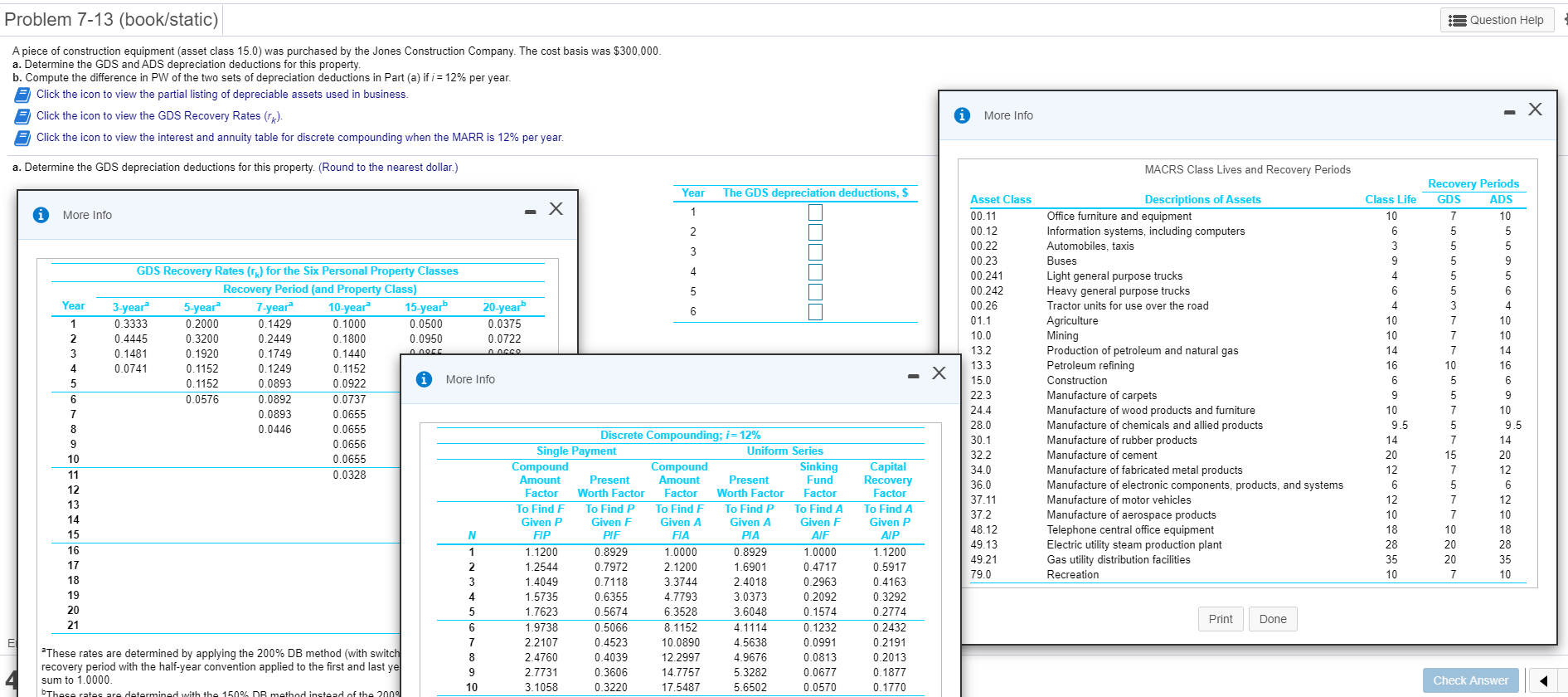

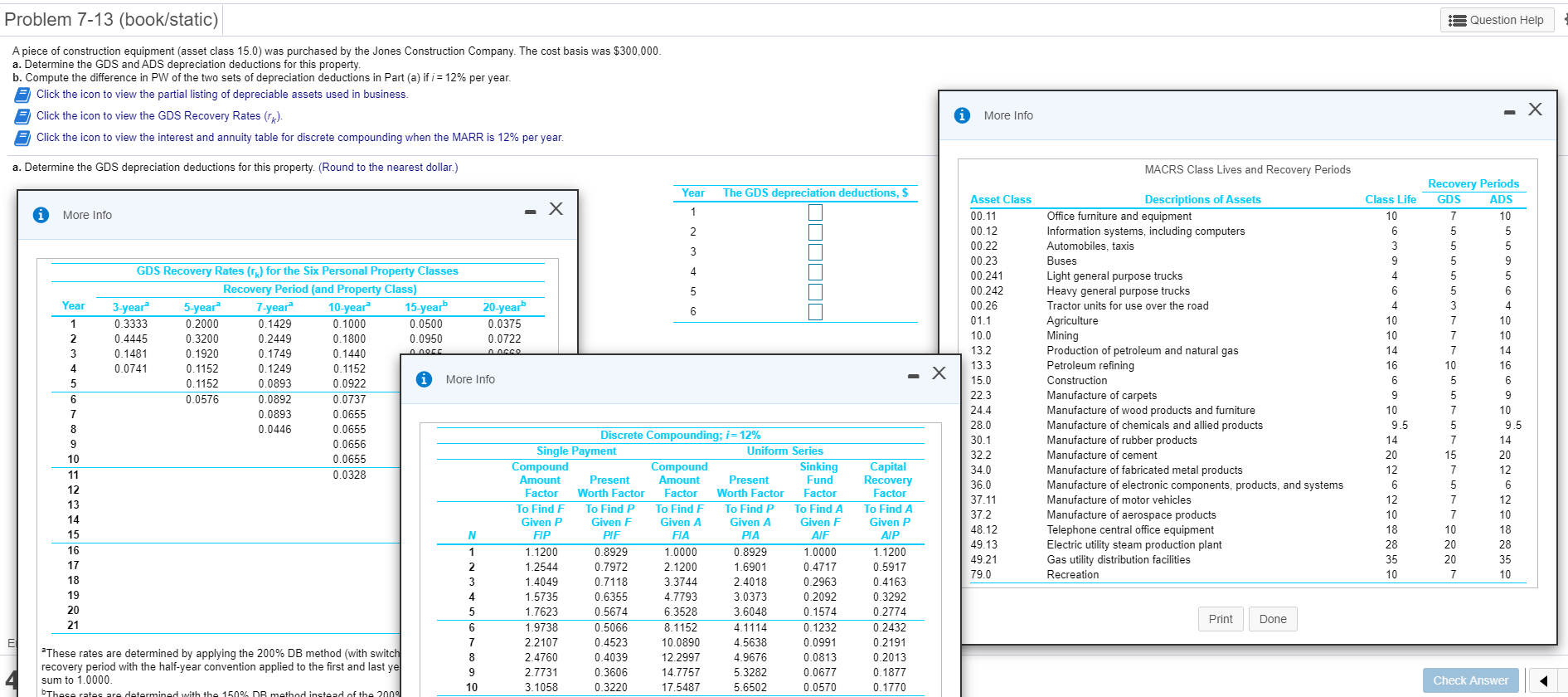

Problem 7-13 (book/static) Question Help A piece of construction equipment (asset class 15.0) was purchased by the Jones Construction Company. The cost basis was $300,000 a. Determine the GDS and ADS depreciation deductions for this property. b. Compute the difference in PW of the two sets of depreciation deductions in Part (a) if i = 12% per year. Click the icon to view the partial listing of depreciable assets used in business. Click the icon to view the GDS Recovery Rates (k). Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. More Info a. Determine the GDS depreciation deductions for this property. (Round to the nearest dollar.) MACRS Class Lives and Recovery Periods Year The GDS depreciation deductions, $ - X More Info 1 DOO000 4 X 3 GDS Recovery Rates (ru) for the Six Personal Property Classes Recovery Period (and Property Class) 5 Year 3-year 5-year 7-year 10-year 15-year 20-year 6 1 0.3333 0.2000 0.1429 0.1000 0.0500 0.0375 2 0.4445 0.3200 0.2449 0.1800 0.0950 0.0722 3 0.1481 0.1920 0.1749 0.1440 4 0.0741 0.1152 0.1249 0.1152 1152 0.0893 0.0922 More Info 6 0.0576 0.0892 0.0737 7 0.0893 0.0655 8 0.0446 0.0655 Discrete Compounding; i = 12% 9 0.0656 Single Payment Uniform Series 10 0.0655 Compound Compound Sinking 11 0.0328 Amount Present Amount Present Fund 12 Factor Worth Factor Factor Worth Factor Factor 13 To Find F To Find P To Find F To Find P To Find A 14 Given P Given F Given A Given A Given F N FIP PIF FIA PIA AIF 16 1.1200 0.8929 1.0000 0.8929 1.0000 17 2 1.2544 0.7972 2.1200 1.6901 0.4717 18 3 1.4049 0.7118 3.3744 2.4018 0.2963 19 4 1.5735 0.6355 4.7793 3.0373 0.2092 20 5 1.7623 0.5674 6.3528 3.6048 0.1574 21 6 1.9738 0.5066 8.1152 4.1114 0.1232 7 2.2107 0.4523 10.0890 4.5638 0.0991 *These rates are determined by applying the 200% DB method (with switch 8 2.4760 0.4039 12.2997 4.9676 0.0813 recovery period with the half-year convention applied to the first and last ye 9 2.7731 0.3606 14.7757 5.3282 0.0677 sum to 1.0000 10 These rates are determined with the 1500 DR method instead of the 2000 3.1058 0.3220 17.5487 5.6502 0.0570 Asset Class 00.11 00.12 00.22 00.23 00.241 00.242 00.26 01.1 10.0 13.2 13.3 15.0 22.3 24.4 28.0 30.1 32.2 34.0 36.0 37.11 37.2 48.12 49.13 49.21 79.0 Descriptions of Assets Office furniture and equipment Information systems, including computers Automobiles, taxis Buses Light general purpose trucks Heavy general purpose trucks Tractor units for use over the road Agriculture Mining Production of petroleum and natural gas Petroleum refining Construction Manufacture of carpets Manufacture of wood products and furniture Manufacture of chemicals and allied products Manufacture of rubber products Manufacture of cement Manufacture of fabricated metal products Manufacture of electronic components, products, and systems Manufacture of motor vehicles Manufacture of aerospace products Telephone central office equipment Electric utility steam production plant Gas utility distribution facilities Recreation Class Life 10 6 3 9 4 6 4 10 10 14 16 6 9 10 9.5 14 20 12 6 12 10 18 28 35 10 Recovery Periods GDS ADS 7 10 5 5 5 5 5 9 5 5 5 6 4 7 10 7 10 7 14 10 16 5 6 5 9 7 10 5 9.5 7 14 15 20 7 12 5 6 12 7 10 10 18 20 28 20 35 7 10 7 1 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 Print Done Check