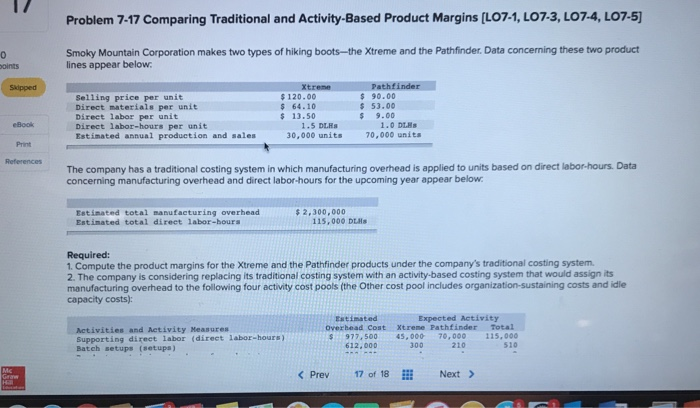

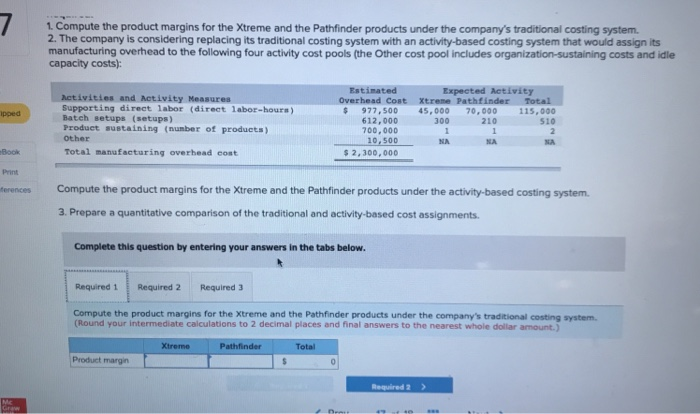

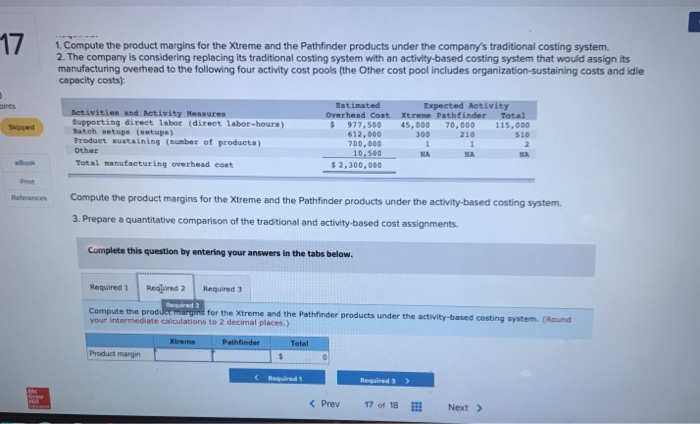

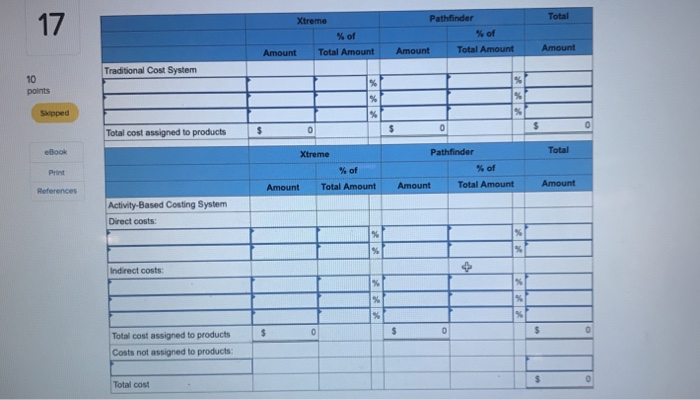

Problem 7-17 Comparing Traditional and Activity-Based Product Margins [LO7-1, LO7-3, LO7-4, LO7-5 Smoky Mountain Corporation makes two types of hiking boots-the Xtreme and the Pathfinder. Data concerning these two product lines appear below oints Selling price per unit Direct materials per unit Direet labor per unit Direct labor-hours per unit Estimated annual production and sales 120.00 $ 64.10 13.50 s 90.00 53.00 $ 9.00 eBook 1.5 DLRs 1.0 DLRs 70,000 units 30,000 units Print The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor-hours for the upcoming year appear below Estinated total manufacturing overhead Estinated total direet labor-hours 2,300,000 115,000 DEHS Required: 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs) Estimated Expected Activity overbead Cost Xtreme Pathfinder Total vities and Activity Measures Supporting direet labor (direct labor-hours ) Batch setups (setups) 977,500 45,000 70,000 115,000 612.000 300 210 510 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs): Estimated Expected Activity Overhead Cost Xtreme Pa vities and Activity Measures Supporting direct labor (direct labor-hours ) Batch setups (setups) Produet sustaining (number of products) Other $977,500 45,000 70,000115,000 510 ipped 612,000 700,000 300 210 10,500 --NA NA Book Total manufacturing overhead cost s2,300,000 Print erences Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below Required 1 Required 2 Required 3 Compute the product margins for the Xtreme and the Pathfinder products (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) under the company's traditional costing system. Xtreme Pathfinder Product margin 1. Compute the product margins for the Xtreme and the Pathfinder products under the company's traditional costing system. 2. The company is considering replacing its traditional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools (the Other cost pool includes organization-sustaining costs and idle capacity costs) Expected Activity vities and Activity Measu Supporting direet labor (direct labor-hours) Bateh setupe (setups Product sustaining (number of producta Other Total manufacturing overhead cost Overhead Cost Xtrene Pa 977,500 45,00070,000 300 210 115,000 510 Skipped 612,000 700,000 10,500 2,300,000 NA Print Reterences Compute the product margins for the Xtreme and the Pathfinder products under the activity-based costing system. 3. Prepare a quantitative comparison of the tradtional and activity-based cost assignments Complete this question by entering your answers in the tabs below Required 1ered 2 Required 3 for the Xtreme and the Pathfinder products under the activity-based Compute the your intermediate caiculations to 2 decimal places.) costing system. (Round Product margin Required 3 Prev 7 of 1811: Next> 17 %of %of Traditional Cost System 10 Total cost assigned to products Xtreme %of %of Print Total Amount Activity-Based Costing System Direct costs: Indirect costs: Total cost assigned to products Costs not assigned to products: Total cost