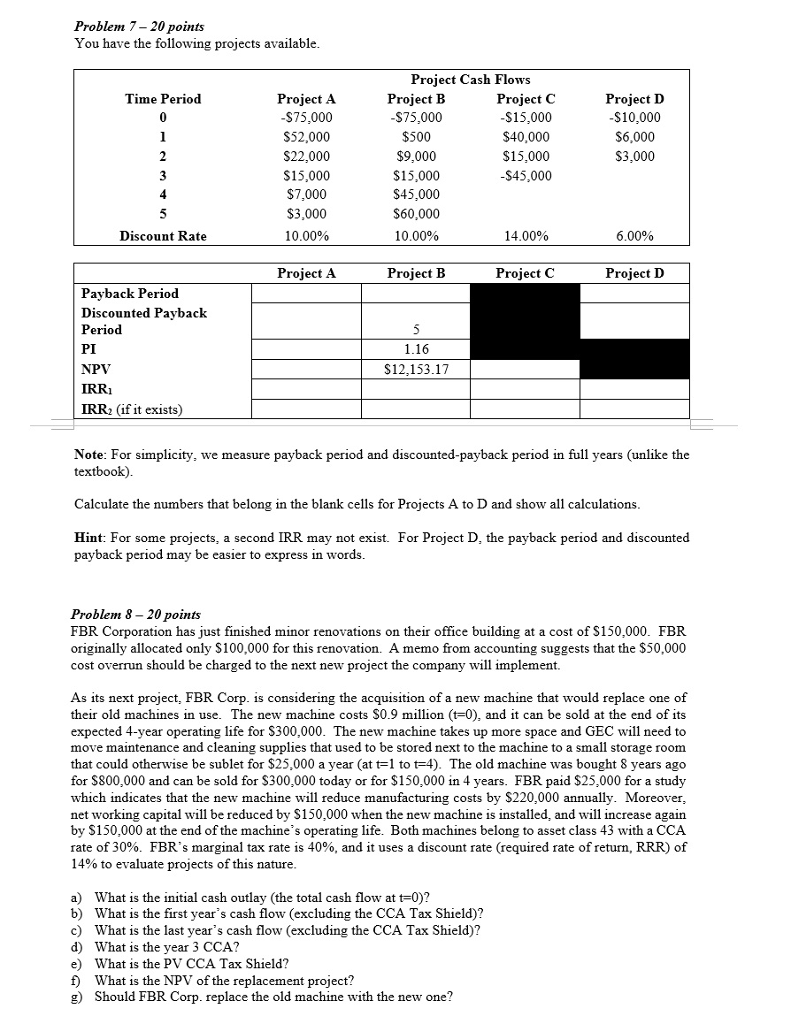

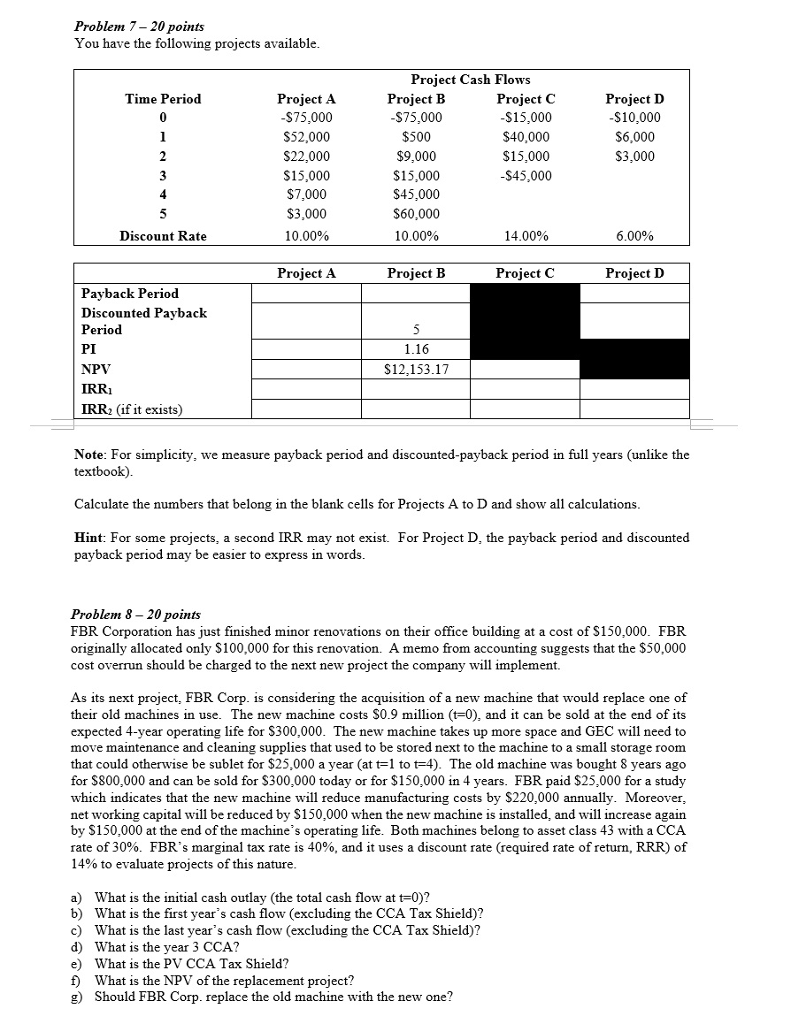

Problem 7-20 points You have the following projects available Project Cash Flow:s Time Period 0 Project A $75,000 S52,000 S22,000 $15,000 $7,000 $3,000 1 0.00% Project B S75,000 $500 $9,000 $15,000 $45,000 $60,000 10.00% Project C S15,000 $40,000 $15,000 S45,000 Project D $10,000 S6,000 $3,000 3 Discount Rate 14.00% 6.00% Project A Project B Project O Project D Payback Period Discounted Paybaclk Period PI NPV IRRi IRR2 (if it exists) 1.16 S12,153.17 Note: For simplicity, we measure payback period and discounted-payback period in full years (unlike the textbook) Calculate the numbers that belong in the blank cells for Projects A to D and show all calculations Hint: For some projects, a second IRR may not exist. For Project D, the payback period and discounted payback period may be easier to express in words. Problem 8 - 20 points FBR Corporation has just finished minor renovations on their office building at a cost of S150,000. FBR originally allocated only S100,000 for this renovation. A memo from accounting suggests that the S50,000 cost overrun should be charged to the next new project the company will implement. As its next project, FBR Corp. is considering the acquisition of a new machine that would replace one of their old machines in use. The new machine costs S0.9 million (t-0), and it can be sold at the end of its expected 4-year operating life for S300,000. The new machine takes up more space and GEC will need to move maintenance and cleaning supplies that used to be stored next to the machine to a small storage room that could otherwise be sublet for $25,000 a year (at t1 to t4). The old machine was bought 8 years ago for $800,000 and can be sold for S300,000 today or for $150,000 in 4 years. FBR paid $25,000 for a study which indicates that the new machine will reduce manufacturing costs by $220,000 annually. Moreover net working capital will be reduced by S150,000 when the new machine is installed, and will increase again by $150,000 at the end of the machine's operating life. Both machines belong to asset class 43 with a CCA rate of 30%. FBR's marginal tax rate is 40%, and it uses a discount rate (required rate of return, RRR) of 14% to evaluate projects of this nature a) b) c) d) e) f) g) What is the initial cash outlay (the total cash flow at t-0)? What is the first year's cash flow (excluding the CCA Tax Shield)? What is the last year's cash flow (excluding the CCA Tax Shield)? What is the year 3 CCA? What is the PV CCA Tax Shield? What is the NPV of the replacement project? Should FBR Corp. replace the old machine with the new one