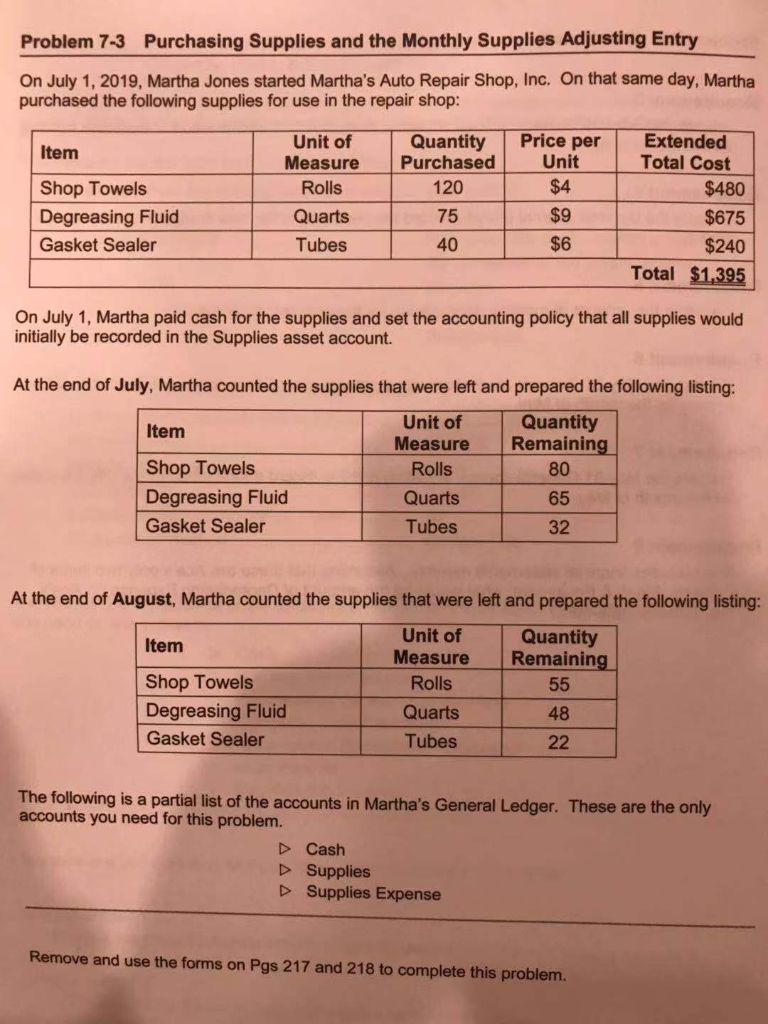

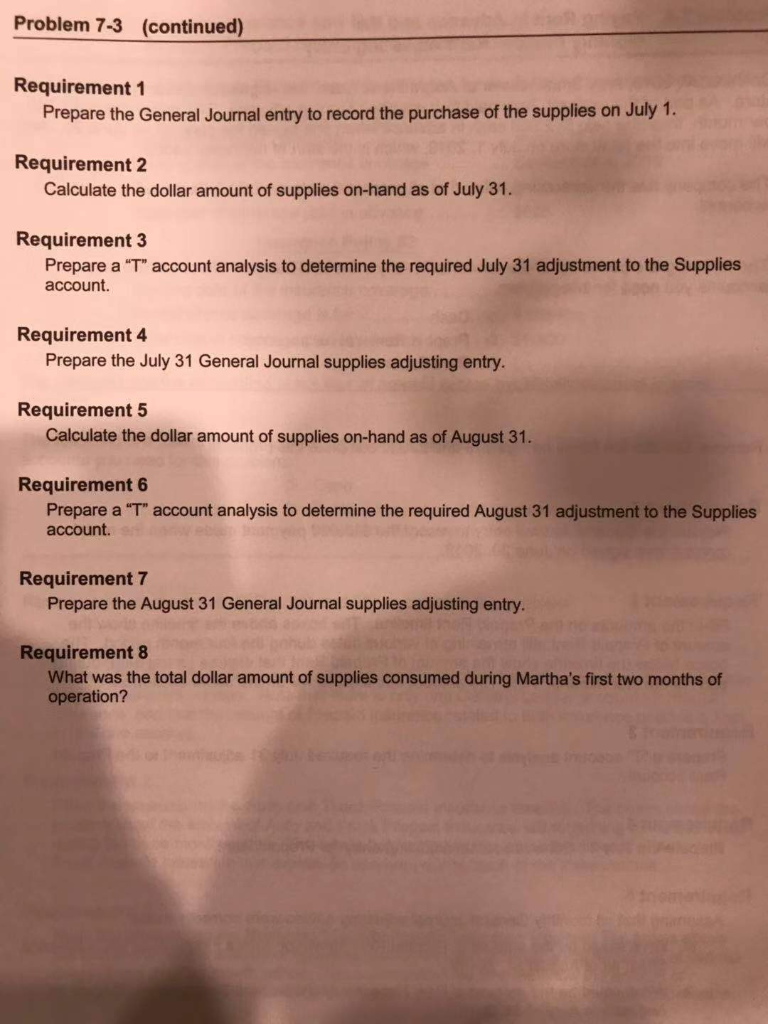

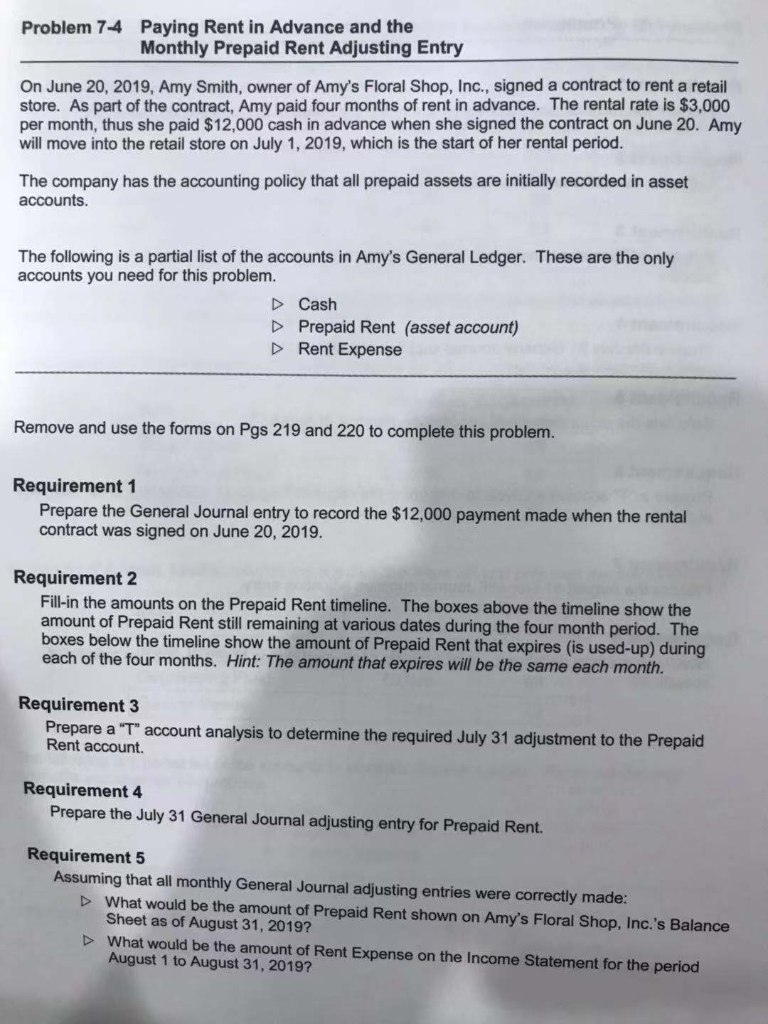

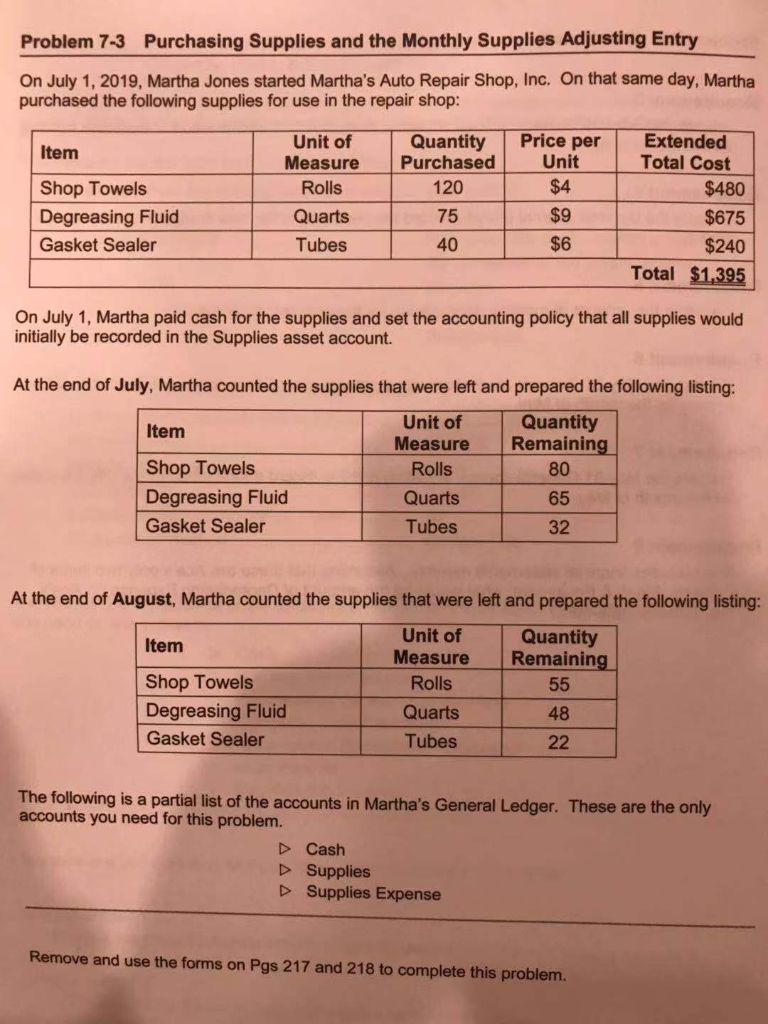

Problem 7-3 Purchasing Supplies and the Monthly Supplies Adjusting Entry On July 1, 2019, Martha Jones started Martha's Auto Repair Shop, Inc. On that same day, Martha purchased the following supplies for use in the repair shop: Unit of Mease Purchased Unit Total Cost Quantity Price per Extended $4 $9 $6 Item Shop Towels Degreasing Fluid Gasket Sealer Rolls Quarts Tubes 120 75 40 $480 $675 $240 Total $1,395 On July 1, Martha paid cash for the supplies and set the accounting policy that all supplies would initially be recorded in the Supplies asset account. At the end of July, Martha counted the supplies that were left and prepared the following listing: Quantity 80 65 32 Unit of Item Shop Towels Degreasing Fluid Gasket Sealer Measure Remaining Rolls Quarts Tubes At the end of August, Martha counted the supplies that were left and prepared the following listing: Unit of Quantity Measure Remaining Item Shop Towels Degreasing Fluid Gasket Sealer Rolls Quarts Tubes 48 The following is a partial list of the accounts in Martha's General Ledger. These are the only accounts you need for this problem. D Cash D Supplies D Supplies Expense Remove and use the forms on Pgs 217 and 218 to complete this problem. Problem 7-4 Paying Rent in Advance and the Monthly Prepaid Rent Adjusting Entry On June 20, 2019, Amy Smith, owner of Amy's Floral Shop, Inc., signed a contract to rent a retail store. As part of the contract, Amy paid four months of rent in advance. The rental rate is $3,000 per month, thus she paid $12,000 cash in advance when she signed the contract on June 20. Amy will move into the retail store on July 1, 2019, which is the start of her rental period. The company has the accounting policy that all prepaid assets are initially recorded in asset accounts. The following is a partial list of the accounts in Amy's General Ledger. These are the only accounts you need for this problem. D Cash Prepaid Rent (asset account) D Rent Expense Remove and use the forms on Pgs 219 and 220 to complete this problem Requirement 1 Prepare the General Journal entry to record the $12,000 payment made when the rental contract was signed on June 20, 2019 Requirement 2 Fill-in the amounts on the Prepaid Rent timeline. The boxes above the timeline show the amount of Prepaid Rent still remaining at various dates during the four month period. The boxes below the timeline show the amount of Prepaid Rent that expires (is used-up) during each of the four months. Hint: The amount that expires will be the same each month. Requirement 3 Prepare a T account analysis to determine the required July 31 adjustment to the Prepaid Rent account. Requirement 4 Prepare the July 31 General Journal adjusting entry for Prepaid Rent. Requirement 5 Assuming that all monthly General Journal adjusting entries were correctly made: D What would be the amount of Prepaid Rent shown on Amy's Floral Shop, Inc.'s Balance Sheet as of August 31, 2019? D What would be the amount of Rent Expense on the Income Statement for the period August 1 to August 31, 2019