Question

Problem 73.2 Zero-coupon risk-free bonds are available with the following maturities and yield rates (eective, annual): Maturity(in years) yield % 1 6 2 6.5 3

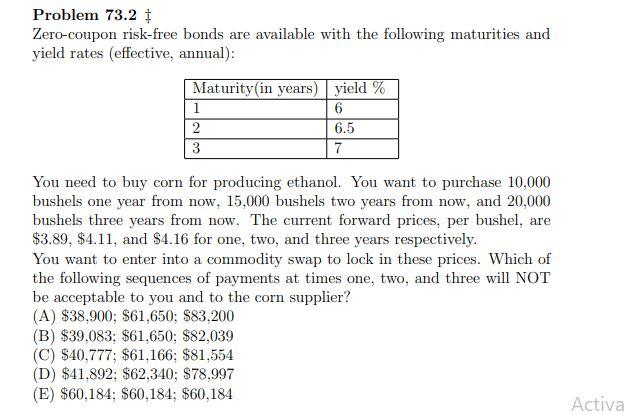

Problem 73.2 Zero-coupon risk-free bonds are available with the following maturities and yield rates (eective, annual): Maturity(in years) yield % 1 6 2 6.5 3 7 You need to buy corn for producing ethanol. You want to purchase 10,000 bushels one year from now, 15,000 bushels two years from now, and 20,000 bushels three years from now. The current forward prices, per bushel, are $3.89, $4.11, and $4.16 for one, two, and three years respectively. You want to enter into a commodity swap to lock in these prices. Which of the following sequences of payments at times one, two, and three will NOT be acceptable to you and to the corn supplier?

The Answer is B however I need an explanation and try to avoid using excel for explanation but financial/graphing calculators are encouraged

Problem 73.2 ! Zero-coupon risk-free bonds are available with the following maturities and yield rates (effective, annual): Maturity (in years) yield % 1 6 2 6.5 3 7 You need to buy corn for producing ethanol. You want to purchase 10,000 bushels one year from now. 15,000 bushels two years from now, and 20,000 bushels three years from now. The current forward prices, per bushel, are $3.89, $4.11, and $4.16 for one, two, and three years respectively. You want to enter into a commodity swap to lock in these prices. Which of the following sequences of payments at times one, two, and three will NOT be acceptable to you and to the corn supplier? (A) $38,900; $61,650; $83,200 (B) $39.083; $61.650; $82,039 (C) $40,777; $61,166; $81,554 (D) $41.892: $62,340; $78,997 (E) $60,184; $60,184; $60.184 Activa Problem 73.2 ! Zero-coupon risk-free bonds are available with the following maturities and yield rates (effective, annual): Maturity (in years) yield % 1 6 2 6.5 3 7 You need to buy corn for producing ethanol. You want to purchase 10,000 bushels one year from now. 15,000 bushels two years from now, and 20,000 bushels three years from now. The current forward prices, per bushel, are $3.89, $4.11, and $4.16 for one, two, and three years respectively. You want to enter into a commodity swap to lock in these prices. Which of the following sequences of payments at times one, two, and three will NOT be acceptable to you and to the corn supplier? (A) $38,900; $61,650; $83,200 (B) $39.083; $61.650; $82,039 (C) $40,777; $61,166; $81,554 (D) $41.892: $62,340; $78,997 (E) $60,184; $60,184; $60.184 Activa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started