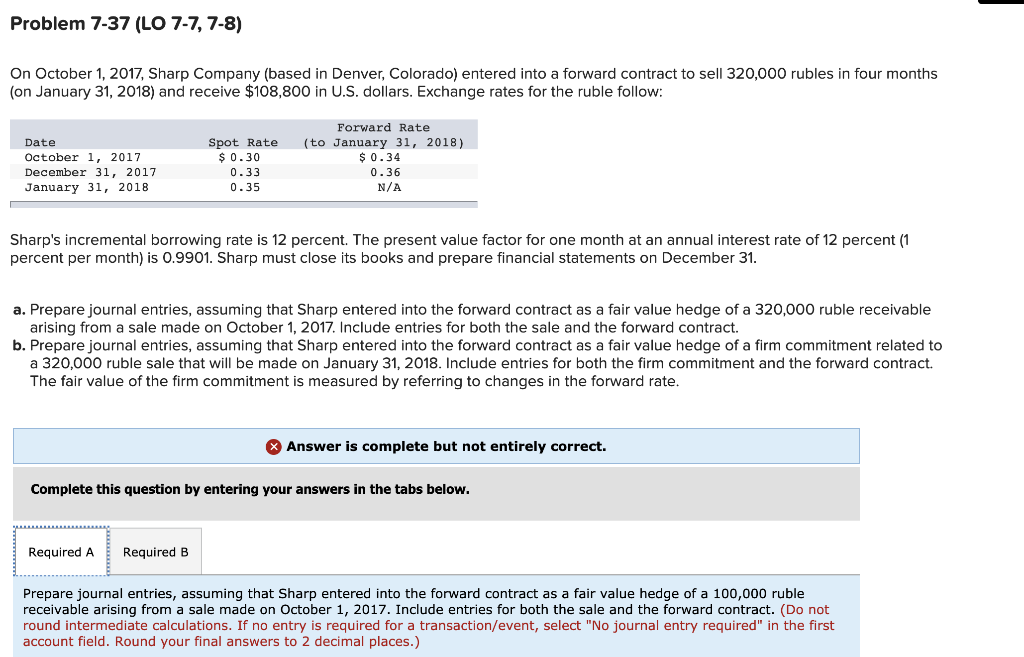

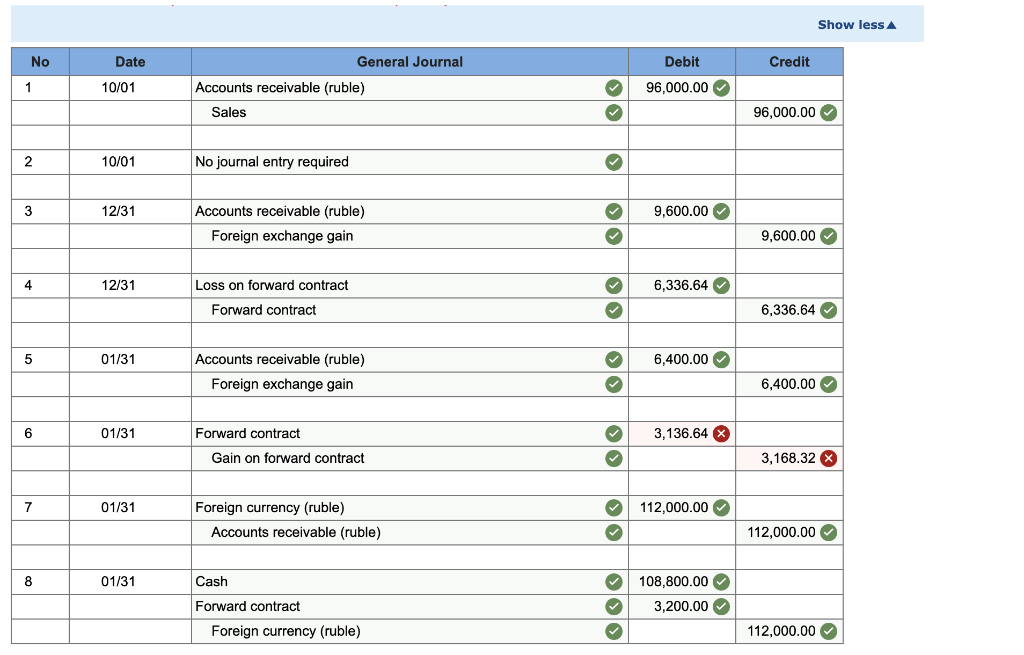

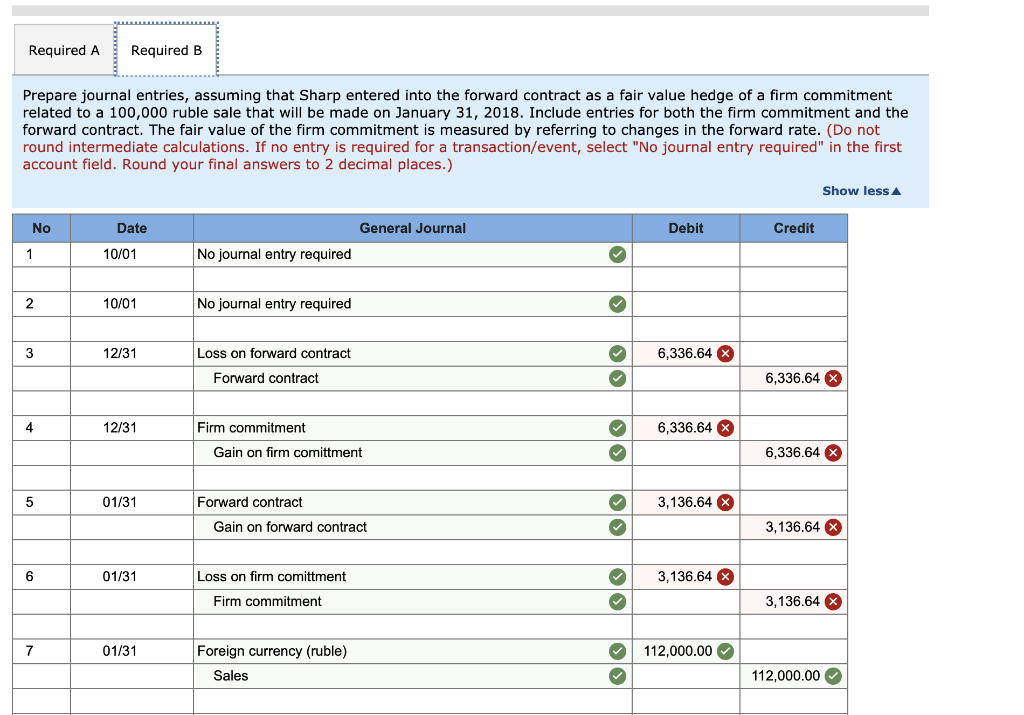

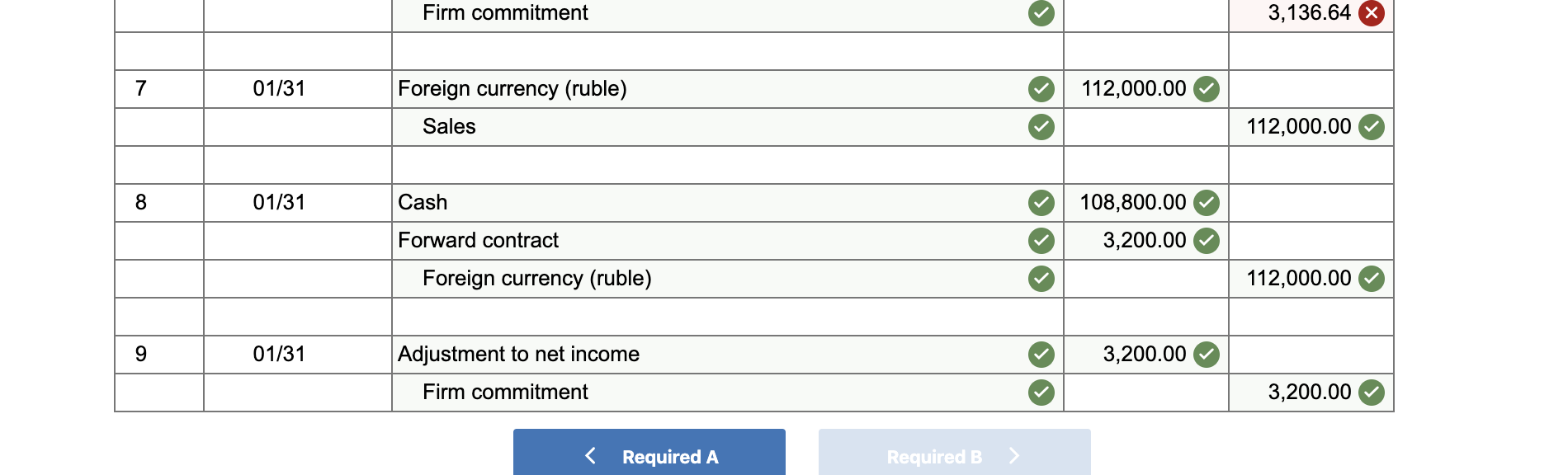

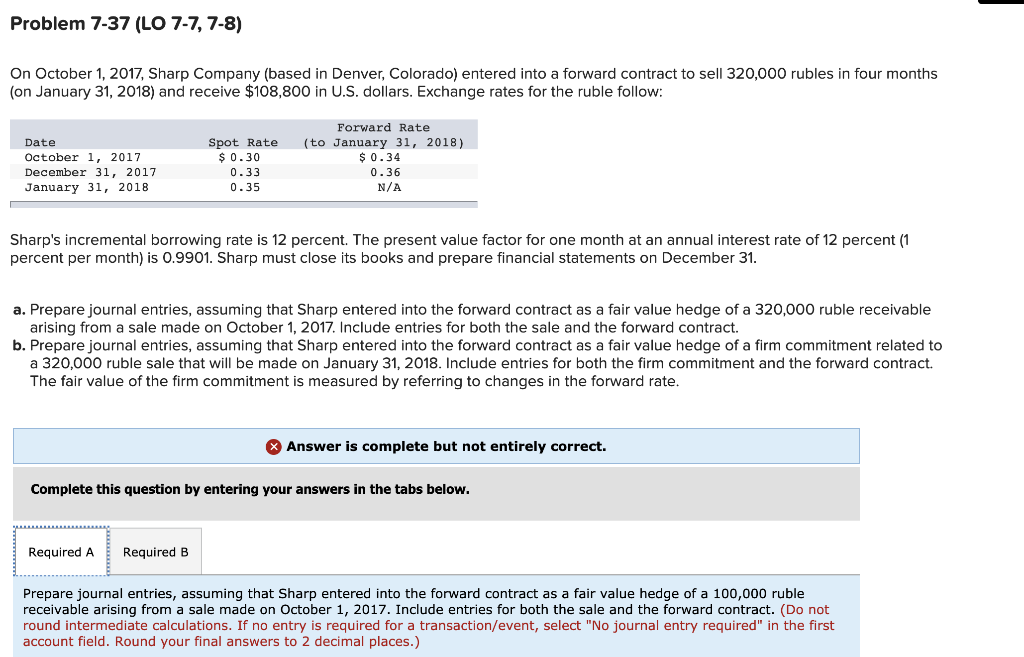

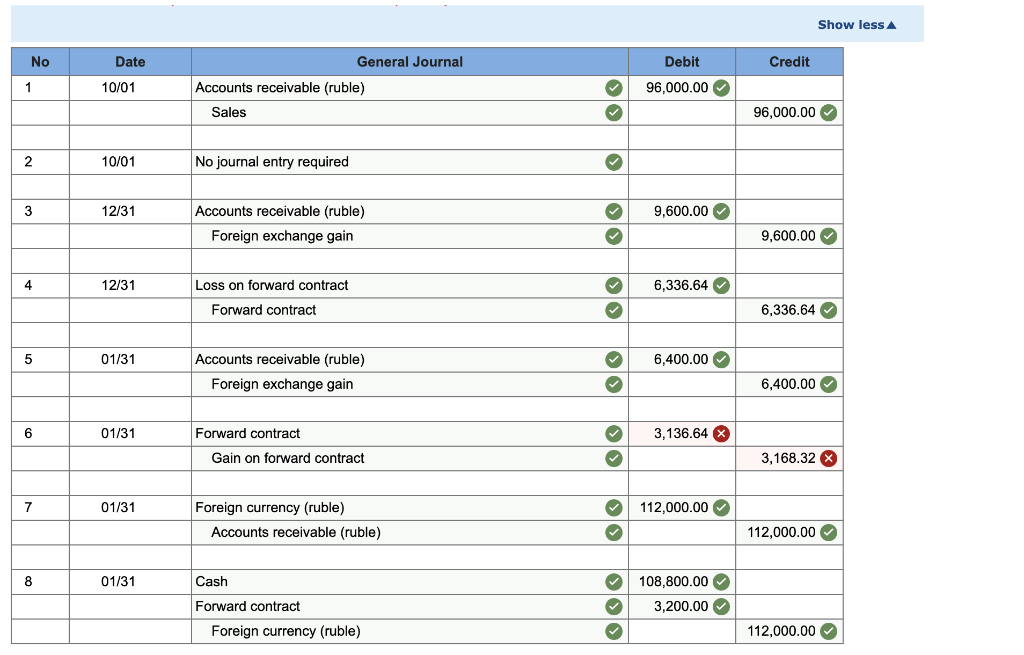

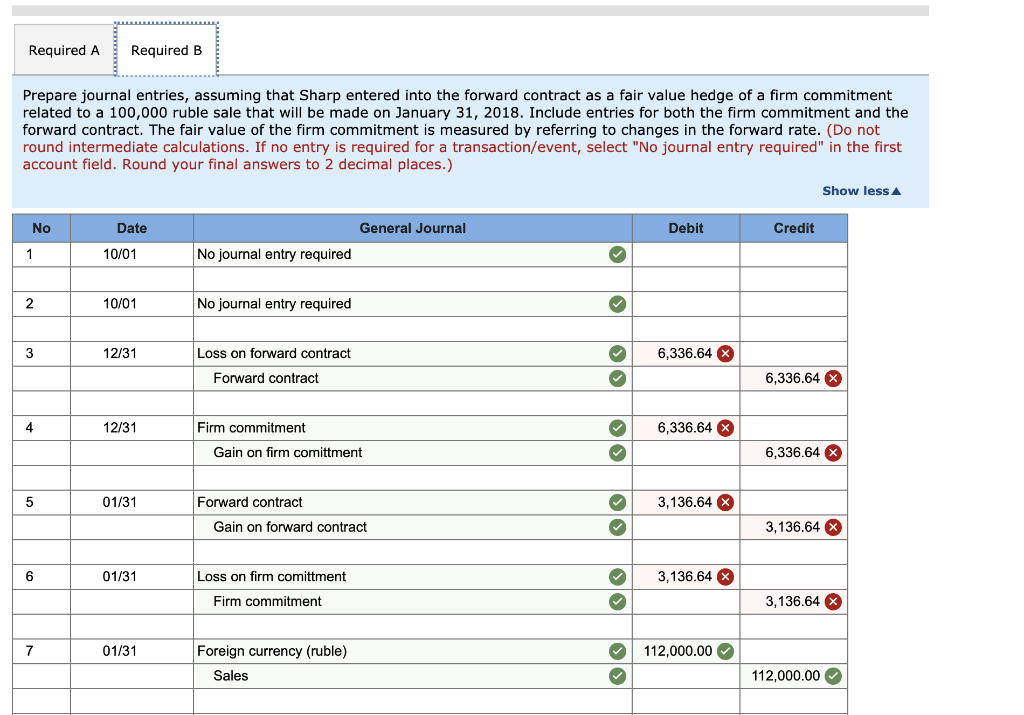

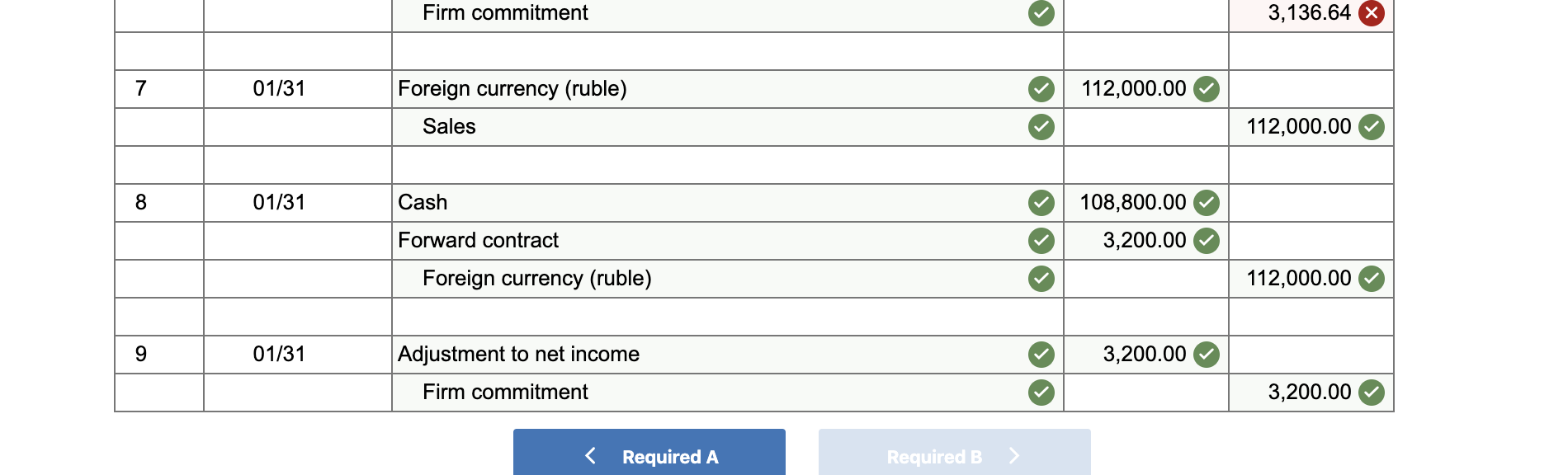

Problem 7-37 (LO 7-7, 7-8) On October 1, 2017, Sharp Company (based in Denver, Colorado) entered into a forward contract to sell 320,000 rubles in four months (on January 31, 2018) and receive $108,800 in U.S. dollars. Exchange rates for the ruble follow: Date October 1, 2017 December 31, 2017 January 31, 2018 Spot Rate $ 0.30 0.33 0.35 Forward Rate (to January 31, 2018) $ 0.34 0.36 N/A Sharp's incremental borrowing rate is 12 percent. The present value factor for one month at an annual interest rate of 12 percent (1 percent per month) is 0.9901. Sharp must close its books and prepare financial statements on December 31. a. Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a 320,000 ruble receivable arising from a sale made on October 1, 2017. Include entries for both the sale and the forward contract b. Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a firm commitment related to a 320,000 ruble sale that will be made on January 31, 2018. Include entries for both the firm commitment and the forward contract. The fair value of the firm commitment is measured by referring to changes in the forward rate. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a 100,000 ruble receivable arising from a sale made on October 1, 2017. Include entries for both the sale and the forward contract. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to 2 decimal places.) Show less No Credit Date 10/01 General Journal Accounts receivable (ruble) Sales Debit 96,000.00 96,000.00 10/01 No journal entry required 12/31 9,600.00 Accounts receivable (ruble) Foreign exchange gain 9,600.00 4 12/31 6,336.64 Loss on forward contract Forward contract 6,336.64 01/31 6,400.00 Accounts receivable (ruble) Foreign exchange gain 6,400.00 01/31 3,136.64 Forward contract Gain on forward contract 3,168.32 X 01/31 Foreign currency (ruble) 112,000.00 Accounts receivable (ruble) 112,000.00 01/31 Cash Forward contract Foreign currency (ruble) 108,800.00 3,200.00 112,000.00 Required A Required B Prepare journal entries, assuming that Sharp entered into the forward contract as a fair value hedge of a firm commitment related to a 100,000 ruble sale that will be made on January 31, 2018. Include entries for both the firm commitment and the forward contract. The fair value of the firm commitment is measured by referring to changes in the forward rate. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to 2 decimal places.) Show less A Debit Credit No 1 Date 10/01 General Journal No journal entry required 10/01 No journal entry required 12/31 6,336.64 Loss on forward contract Forward contract 6,336.64 X 12/31 Firm commitment 6,336.64 X Gain on firm comittment 6,336.64 X 01/31 3,136.64 % Forward contract Gain on forward contract 3,136.64 % 01/31 3,136.64 X Loss on firm comittment Firm commitment 3,136.64 X 01/31 112,000.00 Foreign currency (ruble) Sales 112,000.00 Firm commitment 3,136.64 $ 01/31 112,000.00 Foreign currency (ruble) Sales 112,000.00 01/31 Cash 108,800.00 3,200.00 Forward contract Foreign currency (ruble) 112,000.00 01/31 3,200.00 Adjustment to net income Firm commitment 3,200.00 Required A Required B >