Answered step by step

Verified Expert Solution

Question

1 Approved Answer

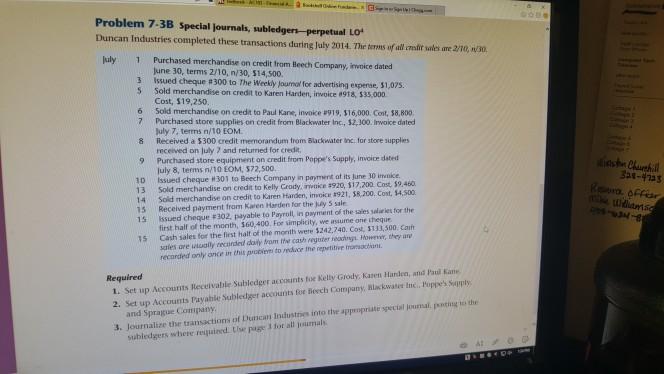

Problem 7-3B Special journals, subledgers-perpetual LO Duncan Industries completed these transactions during July 2014. The terms of all credit sales are 2/10, 30 July

Problem 7-3B Special journals, subledgers-perpetual LO Duncan Industries completed these transactions during July 2014. The terms of all credit sales are 2/10, 30 July 1 3 5 6 7 8 9 10 23454 13 14 15 15 15 Purchased merchandise on credit from Beech Company, invoice dated June 30, terms 2/10, n/30, $14,500. Issued cheque #300 to The Weekly Journal for advertising expense, $1,075. Sold merchandise on credit to Karen Harden, invoice 8918, $35,000 Cost, $19,250. Sold merchandise on credit to Paul Kane, invoice #919, $16,000. Cost, $8,800. Purchased store supplies on credit from Blackwater Inc., $2,300. Invoice dated July 7, terms n/10 EOM. Received a $300 credit memorandum from Blackwater Inc. for store supplies received on July 7 and returned for credit, Purchased store equipment on credit from Poppe's Supply, invoice dated July 8, terms n/10 EOM, $72,500. Issued cheque #301 to Beech Company in payment of its June 30 imnice. Sold merchandise on credit to Kelly Crady, inwoice $920, $17,200 Cost, $9.460 Sold merchandise on credit to Karen Harden, invoice #921, $8,200. Cost, $4,500 Received payment from Karen Harden for the July 5 sale Issued cheque #302, payable to Payroll, in payment of the sales salaries for the first half of the month, $60,400. For simplicity, we assume one theque. Cash sales for the first half of the month were $242,740. Cost, $133,500. Cam sales are usually recorded daily from the cash register readings. However, they are recorded only once in this problem to reduce the repetitive transactions. Required 1. Set up Accounts Receivable Subledger accounts for Kelly Grody, Karen Handen, and Paul Kane 2. Set up Accounts Payable Subledger accounts for Beech Company, Blackwater Inc.. Poppe's Supply and Sprague Company. 3. Journalize the transactions of Duncan Industries into the appropriate special journal pasting to the subledgers where required the page 1 for all journals. @4/00 inston Churchill 328-4725 Resura officer mike Williamso

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Date Account Debited 2020 July Date 2020 July 15 Karen Date 2020 July 5 Karen Harden 6 Paul Kane 13 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started