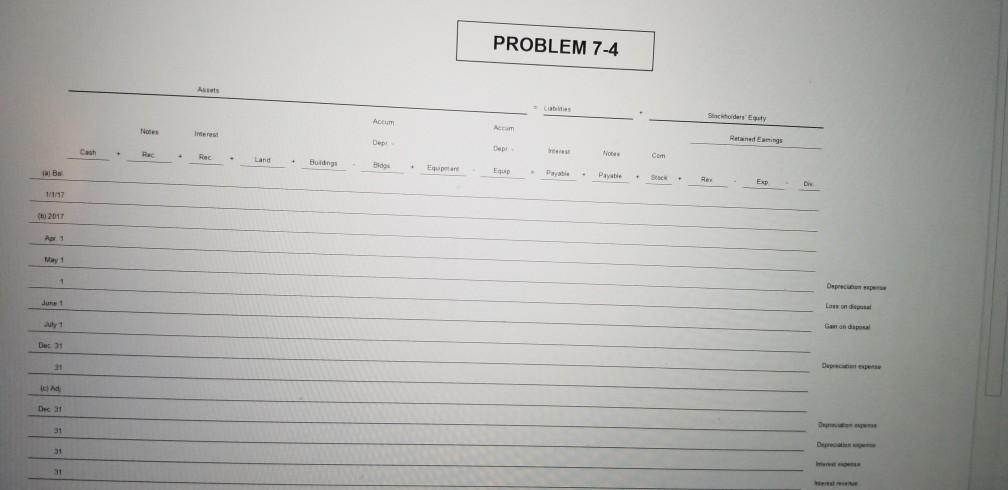

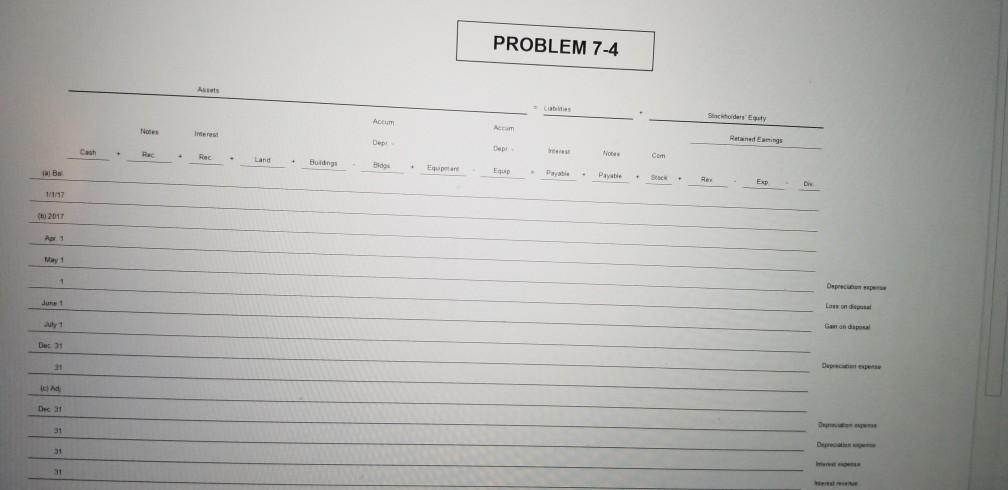

problem 7-4

P7-4

problem 7-4, use the tabular summary below to complete problem

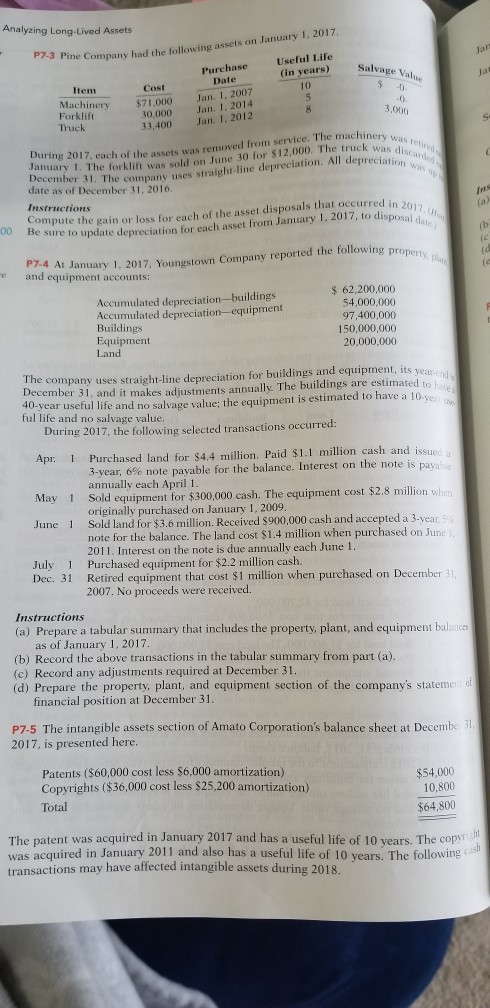

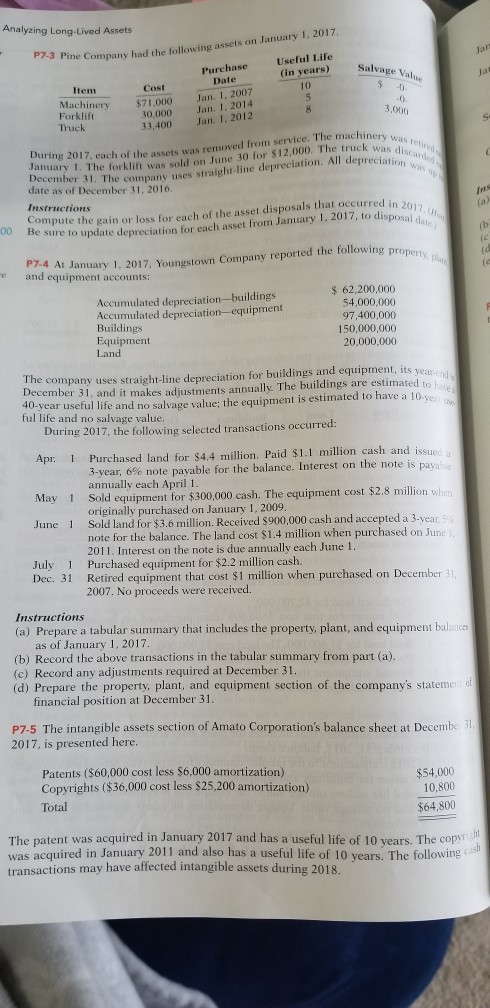

Analyzing Long-Lived Assets , 2017 Pine Company had the following assets on January 1 ful Life (in years) Purchase Date Salvage v Item Cost 10 Machinery $71000 Jan. 1, 2007 30,000 33,400 20 Forklift Truck Jan. 1,2012 service. The machinery was r ation. All depreciatio During 2017, each of the assets was removed from December 31. The company uses straight-line depre The forklift was sold on June 30 for $12,000. The trucki date as of December 31, 2016. Instructions Compute the gain or loss for each of the asset disposals that occurred in 20 isposal da 00 Be sure to upd ate depreciation for each asset from January 1, 2017, to di (b (c P7-4 At January 1, 2017, Youngstown Company reported the following property plar 62,200,000 54,000,000 97,400,000 150,000,000 20,000,000 Accumulated depreciation-buildings Accumulated depreciation-equipment Buildings Equipment Land company uses straight-line depreciation for buildings and equipment, its year December 31, and it makes adjustments annually. The buildings are estimated to 40-year useful life and no salvage value; the equipment is estimated to have a 10 ye ful life and no salvage value During 2017, the following selected transactions occurred: Apr. 1 Purchased land for $4.4 million. Paid $1.1 million cash and issued a 3-year, 6% note payable for the balance. Interest on the note is annually each April 1 May 1 Sold equipment for $300,000 cash. The equipment cost $2.8 million wh originally purchased on January 1, 2009 Sold land for $3.6 million. Received $900,000 cash and accepted a 3-year note for the balance. The land cost $1.4 million when purchased on June 2011. Interest on the note is due annually each June 1 June 1 July 1 Purchased equipment for $2.2 million cash. Dec. 31 Retired equipment that cost $1 million when purchased on December 31 2007. No proceeds were received. Instruction (a) Prepare a tabular summary that includes the property, plant, and equipment balances as of January 1, 2017 (b) Record the above transactions in the tabular summary from part (a) (c) Record any adjustments required at December 31 (d) Prepare the property, plant, and equipment section of the company's stateme financial position at December 31 P7-5 The intangible assets section of Amato Corporation's balance sheet at Decembe 2017, is presented here. Patents ($60,000 cost less $6,000 amortization) Copyrights ($36,000 cost less $25,200 amortization) Total $54,000 10,800 $64,800 The patent was acquired in January 2017 and has a useful life of 10 vears. The copv was acquired in January 2011 and also has a useful life of 10 vears. The following transactions may have affected intangible assets during 2018 PROBLEM 7-4 Stockhoiders Equty Accum Accom Retained Eamings Com Rec Rec Bldgs Equipman Equp Payatle Payable Stack Rev a) Ba (b) 2017 Apr 1 May 1 Depreciion experse Lass on disposal Gan on daposal June 1 Dapreciaion expense Dec 31 31 Dec 31 31 31 31 Interest expense